Annual Report - Miba

Annual Report - Miba

Annual Report - Miba

- TAGS

- annual

- miba

- www.miba.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

94<br />

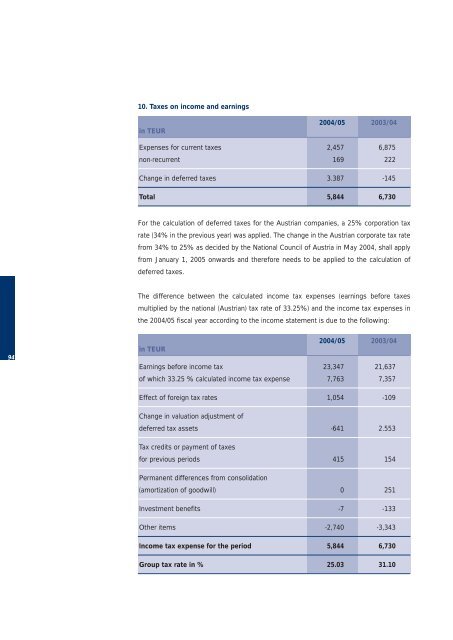

10. Taxes on income and earnings<br />

in TEUR<br />

For the calculation of deferred taxes for the Austrian companies, a 25% corporation tax<br />

rate (34% in the previous year) was applied. The change in the Austrian corporate tax rate<br />

from 34% to 25% as decided by the National Council of Austria in May 2004, shall apply<br />

from January 1, 2005 onwards and therefore needs to be applied to the calculation of<br />

deferred taxes.<br />

The difference between the calculated income tax expenses (earnings before taxes<br />

multiplied by the national (Austrian) tax rate of 33.25%) and the income tax expenses in<br />

the 2004/05 fiscal year according to the income statement is due to the following:<br />

in TEUR<br />

2004/05 2003/04<br />

Earnings before income tax 23,347 21,637<br />

of which 33.25 % calculated income tax expense 7,763 7,357<br />

Effect of foreign tax rates 1,054 -109<br />

Change in valuation adjustment of<br />

deferred tax assets -641 2.553<br />

Tax credits or payment of taxes<br />

2004/05 2003/04<br />

Expenses for current taxes 2,457 6,875<br />

non-recurrent 169 222<br />

Change in deferred taxes 3.387 -145<br />

Total 5,844 6,730<br />

for previous periods 415 154<br />

Permanent differences from consolidation<br />

(amortization of goodwill) 0 251<br />

Investment benefits -7 -133<br />

Other items -2,740 -3,343<br />

Income tax expense for the period 5,844 6,730<br />

Group tax rate in % 25.03 31.10