Annual Report - Miba

Annual Report - Miba

Annual Report - Miba

- TAGS

- annual

- miba

- www.miba.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The national (Austrian) tax rate of 33.25 % results from the allocation of the 34 % tax rate<br />

which was valid until December 31, 2004 and the 25 % tax rate which is valid from<br />

January 1, 2005 onwards.<br />

11. Intangible assets<br />

A detailed classification and the changes in intangible assets are provided in Appendix 1<br />

to the Notes.<br />

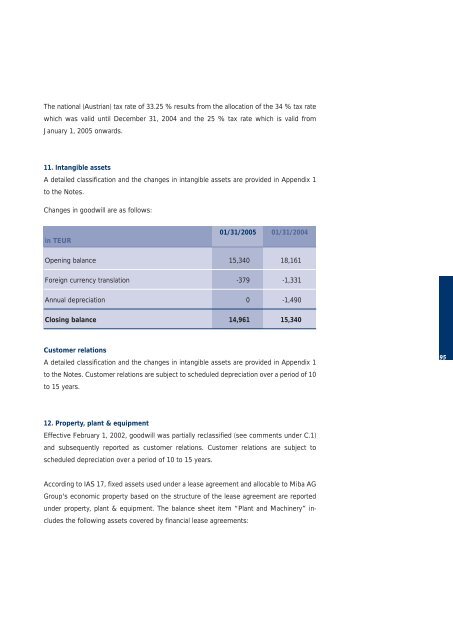

Changes in goodwill are as follows:<br />

in TEUR<br />

01/31/2005 01/31/2004<br />

Opening balance 15,340 18,161<br />

Foreign currency translation -379 -1,331<br />

<strong>Annual</strong> depreciation 0 -1,490<br />

Closing balance 14,961 15,340<br />

Customer relations<br />

A detailed classification and the changes in intangible assets are provided in Appendix 1<br />

to the Notes. Customer relations are subject to scheduled depreciation over a period of 10<br />

to 15 years.<br />

12. Property, plant & equipment<br />

Effective February 1, 2002, goodwill was partially reclassified (see comments under C.1)<br />

and subsequently reported as customer relations. Customer relations are subject to<br />

scheduled depreciation over a period of 10 to 15 years.<br />

According to IAS 17, fixed assets used under a lease agreement and allocable to <strong>Miba</strong> AG<br />

Group's economic property based on the structure of the lease agreement are reported<br />

under property, plant & equipment. The balance sheet item “Plant and Machinery” includes<br />

the following assets covered by financial lease agreements:<br />

95