Annual Report - Miba

Annual Report - Miba

Annual Report - Miba

- TAGS

- annual

- miba

- www.miba.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

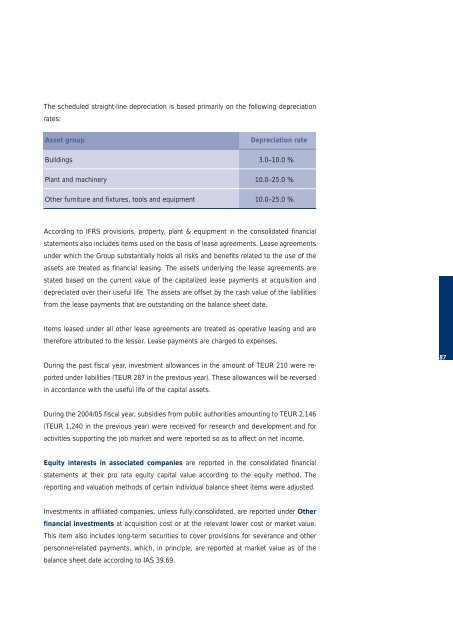

The scheduled straight-line depreciation is based primarily on the following depreciation<br />

rates:<br />

Asset group Depreciation rate<br />

Buildings 3.0–10.0 %<br />

Plant and machinery 10.0–25.0 %<br />

Other furniture and fixtures, tools and equipment 10.0–25.0 %<br />

According to IFRS provisions, property, plant & equipment in the consolidated financial<br />

statements also includes items used on the basis of lease agreements. Lease agreements<br />

under which the Group substantially holds all risks and benefits related to the use of the<br />

assets are treated as financial leasing. The assets underlying the lease agreements are<br />

stated based on the current value of the capitalized lease payments at acquisition and<br />

depreciated over their useful life. The assets are offset by the cash value of the liabilities<br />

from the lease payments that are outstanding on the balance sheet date.<br />

Items leased under all other lease agreements are treated as operative leasing and are<br />

therefore attributed to the lessor. Lease payments are charged to expenses.<br />

During the past fiscal year, investment allowances in the amount of TEUR 210 were reported<br />

under liabilities (TEUR 287 in the previous year). These allowances will be reversed<br />

in accordance with the useful life of the capital assets.<br />

During the 2004/05 fiscal year, subsidies from public authorities amounting to TEUR 2,146<br />

(TEUR 1,240 in the previous year) were received for research and development and for<br />

activities supporting the job market and were reported so as to affect on net income.<br />

Equity interests in associated companies are reported in the consolidated financial<br />

statements at their pro rata equity capital value according to the equity method. The<br />

reporting and valuation methods of certain individual balance sheet items were adjusted.<br />

Investments in affiliated companies, unless fully consolidated, are reported under Other<br />

financial investments at acquisition cost or at the relevant lower cost or market value.<br />

This item also includes long-term securities to cover provisions for severance and other<br />

personnel-related payments, which, in principle, are reported at market value as of the<br />

balance sheet date according to IAS 39.69.<br />

87