Annual Report - Miba

Annual Report - Miba

Annual Report - Miba

- TAGS

- annual

- miba

- www.miba.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

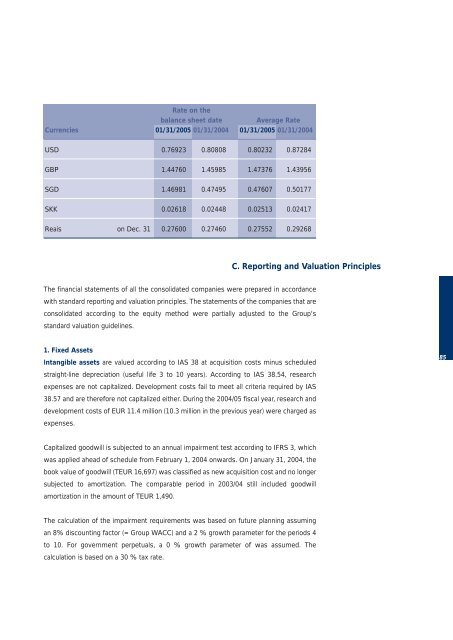

Rate on the<br />

balance sheet date Average Rate<br />

Currencies 01/31/2005 01/31/2004 01/31/2005 01/31/2004<br />

USD 0.76923 0.80808 0.80232 0.87284<br />

GBP 1.44760 1.45985 1.47376 1.43956<br />

SGD 1.46981 0.47495 0.47607 0.50177<br />

SKK 0.02618 0.02448 0.02513 0.02417<br />

Reais on Dec. 31 0.27600 0.27460 0.27552 0.29268<br />

C. <strong>Report</strong>ing and Valuation Principles<br />

The financial statements of all the consolidated companies were prepared in accordance<br />

with standard reporting and valuation principles. The statements of the companies that are<br />

consolidated according to the equity method were partially adjusted to the Group's<br />

standard valuation guidelines.<br />

1. Fixed Assets<br />

Intangible assets are valued according to IAS 38 at acquisition costs minus scheduled<br />

straight-line depreciation (useful life 3 to 10 years). According to IAS 38.54, research<br />

expenses are not capitalized. Development costs fail to meet all criteria required by IAS<br />

38.57 and are therefore not capitalized either. During the 2004/05 fiscal year, research and<br />

development costs of EUR 11.4 million (10.3 million in the previous year) were charged as<br />

expenses.<br />

Capitalized goodwill is subjected to an annual impairment test according to IFRS 3, which<br />

was applied ahead of schedule from February 1, 2004 onwards. On January 31, 2004, the<br />

book value of goodwill (TEUR 16,697) was classified as new acquisition cost and no longer<br />

subjected to amortization. The comparable period in 2003/04 still included goodwill<br />

amortization in the amount of TEUR 1,490.<br />

The calculation of the impairment requirements was based on future planning assuming<br />

an 8% discounting factor (= Group WACC) and a 2 % growth parameter for the periods 4<br />

to 10. For government perpetuals, a 0 % growth parameter of was assumed. The<br />

calculation is based on a 30 % tax rate.<br />

85