Annual Report - Miba

Annual Report - Miba

Annual Report - Miba

- TAGS

- annual

- miba

- www.miba.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

62<br />

Income from Investments<br />

Income from investments amounting to EUR 14,000,000.00 (TEUR 12,442.6 in the<br />

previous year) relates solely to profit distributions and profit assumptions from affiliated<br />

companies respectively. During the fiscal year 2004/05, as in previous years, profit<br />

assumption was recognized upon occurrence due to the controlling influence of the parent<br />

company.<br />

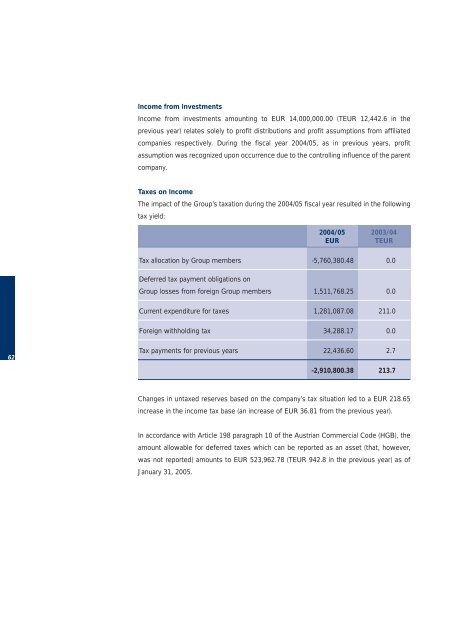

Taxes on Income<br />

The impact of the Group’s taxation during the 2004/05 fiscal year resulted in the following<br />

tax yield:<br />

2004/05 2003/04<br />

EUR TEUR<br />

Tax allocation by Group members -5,760,380.48 0.0<br />

Deferred tax payment obligations on<br />

Group losses from foreign Group members 1,511,768.25 0.0<br />

Current expenditure for taxes 1,281,087.08 211.0<br />

Foreign withholding tax 34,288.17 0.0<br />

Tax payments for previous years 22,436.60 2.7<br />

-2,910,800.38 213.7<br />

Changes in untaxed reserves based on the company’s tax situation led to a EUR 218.65<br />

increase in the income tax base (an increase of EUR 36.81 from the previous year).<br />

In accordance with Article 198 paragraph 10 of the Austrian Commercial Code (HGB), the<br />

amount allowable for deferred taxes which can be reported as an asset (that, however,<br />

was not reported) amounts to EUR 523,962.78 (TEUR 942.8 in the previous year) as of<br />

January 31, 2005.