Investment Plan - OPERS

Investment Plan - OPERS

Investment Plan - OPERS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2 0 1 0 I N V E S T M E N T P L A N<br />

INVESTMENT PROGRAM<br />

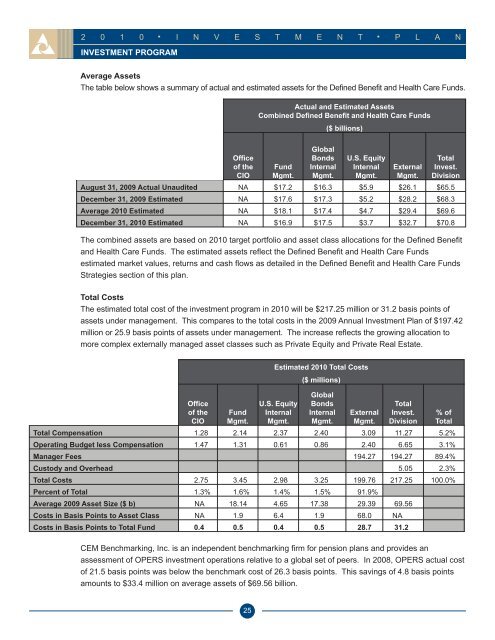

Average Assets<br />

The table below shows a summary of actual and estimated assets for the Defined Benefit and Health Care Funds.<br />

Office<br />

of the<br />

CIO<br />

The combined assets are based on 2010 target portfolio and asset class allocations for the Defined Benefit<br />

and Health Care Funds. The estimated assets reflect the Defined Benefit and Health Care Funds<br />

estimated market values, returns and cash flows as detailed in the Defined Benefit and Health Care Funds<br />

Strategies section of this plan.<br />

Total Costs<br />

The estimated total cost of the investment program in 2010 will be $217.25 million or 31.2 basis points of<br />

assets under management. This compares to the total costs in the 2009 Annual <strong>Investment</strong> <strong>Plan</strong> of $197.42<br />

million or 25.9 basis points of assets under management. The increase reflects the growing allocation to<br />

more complex externally managed asset classes such as Private Equity and Private Real Estate.<br />

CEM Benchmarking, Inc. is an independent benchmarking firm for pension plans and provides an<br />

assessment of <strong>OPERS</strong> investment operations relative to a global set of peers. In 2008, <strong>OPERS</strong> actual cost<br />

of 21.5 basis points was below the benchmark cost of 26.3 basis points. This savings of 4.8 basis points<br />

amounts to $33.4 million on average assets of $69.56 billion.<br />

25<br />

Actual and Estimated Assets<br />

Combined Defined Benefit and Health Care Funds<br />

($ billions)<br />

Fund<br />

Mgmt.<br />

Global<br />

Bonds<br />

Internal<br />

Mgmt.<br />

U.S. Equity<br />

Internal<br />

Mgmt.<br />

External<br />

Mgmt.<br />

Total<br />

Invest.<br />

Division<br />

August 31, 2009 Actual Unaudited NA $17.2 $16.3 $5.9 $26.1 $65.5<br />

December 31, 2009 Estimated NA $17.6 $17.3 $5.2 $28.2 $68.3<br />

Average 2010 Estimated NA $18.1 $17.4 $4.7 $29.4 $69.6<br />

December 31, 2010 Estimated NA $16.9 $17.5 $3.7 $32.7 $70.8<br />

Office<br />

of the<br />

CIO<br />

Fund<br />

Mgmt.<br />

Estimated 2010 Total Costs<br />

($ millions)<br />

U.S. Equity<br />

Internal<br />

Mgmt.<br />

Global<br />

Bonds<br />

Internal<br />

Mgmt.<br />

External<br />

Mgmt.<br />

Total<br />

Invest.<br />

Division<br />

Total Compensation 1.28 2.14 2.37 2.40 3.09 11.27 5.2%<br />

Operating Budget less Compensation 1.47 1.31 0.61 0.86 2.40 6.65 3.1%<br />

Manager Fees 194.27 194.27 89.4%<br />

Custody and Overhead 5.05 2.3%<br />

Total Costs 2.75 3.45 2.98 3.25 199.76 217.25 100.0%<br />

Percent of Total 1.3% 1.6% 1.4% 1.5% 91.9%<br />

Average 2009 Asset Size ($ b) NA 18.14 4.65 17.38 29.39 69.56<br />

Costs in Basis Points to Asset Class NA 1.9 6.4 1.9 68.0 NA<br />

Costs in Basis Points to Total Fund 0.4 0.5 0.4 0.5 28.7 31.2<br />

% of<br />

Total