Investment Plan - OPERS

Investment Plan - OPERS

Investment Plan - OPERS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2 0 1 0 I N V E S T M E N T P L A N<br />

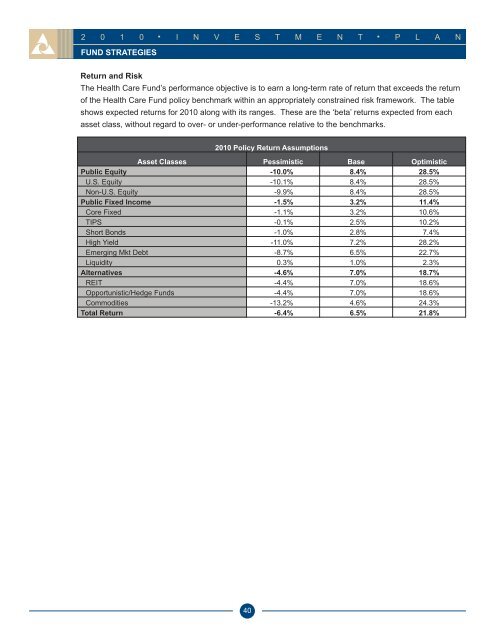

FUND STRATEGIES<br />

Return and Risk<br />

The Health Care Fund’s performance objective is to earn a long-term rate of return that exceeds the return<br />

of the Health Care Fund policy benchmark within an appropriately constrained risk framework. The table<br />

shows expected returns for 2010 along with its ranges. These are the ‘beta’ returns expected from each<br />

asset class, without regard to over- or under-performance relative to the benchmarks.<br />

2010 Policy Return Assumptions<br />

Asset Classes Pessimistic Base Optimistic<br />

Public Equity -10.0% 8.4% 28.5%<br />

U.S. Equity -10.1% 8.4% 28.5%<br />

Non-U.S. Equity -9.9% 8.4% 28.5%<br />

Public Fixed Income -1.5% 3.2% 11.4%<br />

Core Fixed -1.1% 3.2% 10.6%<br />

TIPS -0.1% 2.5% 10.2%<br />

Short Bonds -1.0% 2.8% 7.4%<br />

High Yield -11.0% 7.2% 28.2%<br />

Emerging Mkt Debt -8.7% 6.5% 22.7%<br />

Liquidity 0.3% 1.0% 2.3%<br />

Alternatives -4.6% 7.0% 18.7%<br />

REIT -4.4% 7.0% 18.6%<br />

Opportunistic/Hedge Funds -4.4% 7.0% 18.6%<br />

Commodities -13.2% 4.6% 24.3%<br />

Total Return -6.4% 6.5% 21.8%<br />

40