Investment Plan - OPERS

Investment Plan - OPERS

Investment Plan - OPERS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2 0 1 0 I N V E S T M E N T P L A N<br />

FUND STRATEGIES<br />

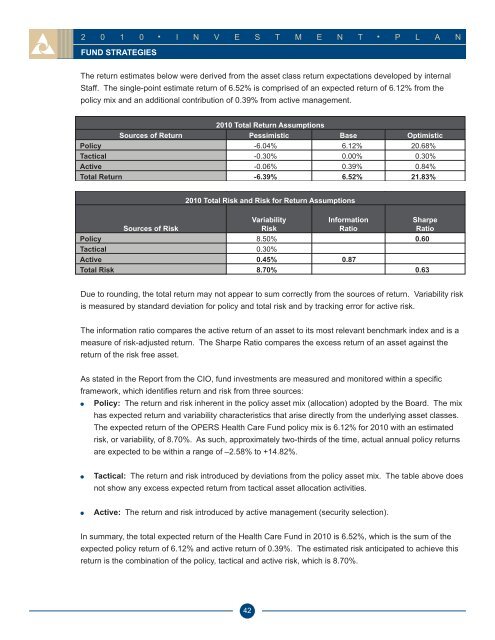

The return estimates below were derived from the asset class return expectations developed by internal<br />

Staff. The single-point estimate return of 6.52% is comprised of an expected return of 6.12% from the<br />

policy mix and an additional contribution of 0.39% from active management.<br />

2010 Total Return Assumptions<br />

Sources of Return Pessimistic Base Optimistic<br />

Policy -6.04% 6.12% 20.68%<br />

Tactical -0.30% 0.00% 0.30%<br />

Active -0.06% 0.39% 0.84%<br />

Total Return -6.39% 6.52% 21.83%<br />

Sources of Risk<br />

2010 Total Risk and Risk for Return Assumptions<br />

Due to rounding, the total return may not appear to sum correctly from the sources of return. Variability risk<br />

is measured by standard deviation for policy and total risk and by tracking error for active risk.<br />

The information ratio compares the active return of an asset to its most relevant benchmark index and is a<br />

measure of risk-adjusted return. The Sharpe Ratio compares the excess return of an asset against the<br />

return of the risk free asset.<br />

As stated in the Report from the CIO, fund investments are measured and monitored within a specific<br />

framework, which identifies return and risk from three sources:<br />

Policy: The return and risk inherent in the policy asset mix (allocation) adopted by the Board. The mix<br />

has expected return and variability characteristics that arise directly from the underlying asset classes.<br />

The expected return of the <strong>OPERS</strong> Health Care Fund policy mix is 6.12% for 2010 with an estimated<br />

risk, or variability, of 8.70%. As such, approximately two-thirds of the time, actual annual policy returns<br />

are expected to be within a range of –2.58% to +14.82%.<br />

Tactical: The return and risk introduced by deviations from the policy asset mix. The table above does<br />

not show any excess expected return from tactical asset allocation activities.<br />

Active: The return and risk introduced by active management (security selection).<br />

In summary, the total expected return of the Health Care Fund in 2010 is 6.52%, which is the sum of the<br />

expected policy return of 6.12% and active return of 0.39%. The estimated risk anticipated to achieve this<br />

return is the combination of the policy, tactical and active risk, which is 8.70%.<br />

42<br />

Variability<br />

Risk<br />

Information<br />

Ratio<br />

Sharpe<br />

Ratio<br />

Policy 8.50% 0.60<br />

Tactical 0.30%<br />

Active 0.45% 0.87<br />

Total Risk 8.70% 0.63