Investment Plan - OPERS

Investment Plan - OPERS

Investment Plan - OPERS

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

2 0 1 0 I N V E S T M E N T P L A N<br />

FUND STRATEGIES<br />

Market insight: Internal asset management provides important information across asset classes to help<br />

in decision-making processes such as:<br />

External manager hiring and oversight—improves Staff’s ability to assess external manager<br />

strengths and weaknesses.<br />

Across markets—frequently, Staff can leverage information garnered from one asset class<br />

to support decision-making in another asset class.<br />

More effective payment of pension and health care benefits, operating expenses and funding of external<br />

managers – cash to pay benefits, operating expenses or fund external managers can be raised<br />

immediately from internally managed assets whereas raising cash from external managers can take<br />

weeks or longer.<br />

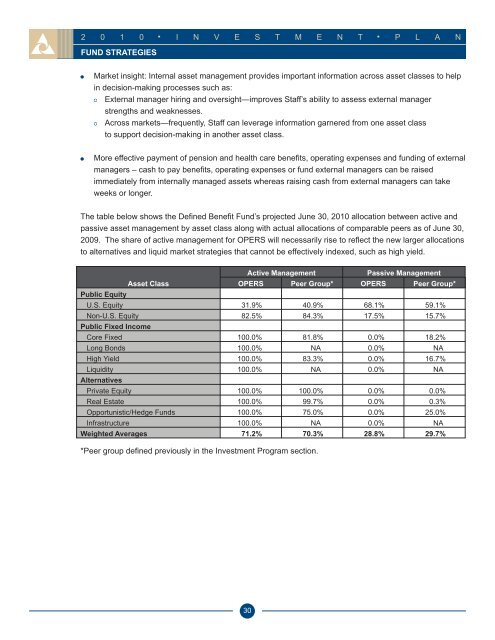

The table below shows the Defined Benefit Fund’s projected June 30, 2010 allocation between active and<br />

passive asset management by asset class along with actual allocations of comparable peers as of June 30,<br />

2009. The share of active management for <strong>OPERS</strong> will necessarily rise to reflect the new larger allocations<br />

to alternatives and liquid market strategies that cannot be effectively indexed, such as high yield.<br />

Public Equity<br />

Asset Class<br />

*Peer group defined previously in the <strong>Investment</strong> Program section.<br />

Active Management Passive Management<br />

<strong>OPERS</strong> Peer Group* <strong>OPERS</strong> Peer Group*<br />

U.S. Equity 31.9% 40.9% 68.1% 59.1%<br />

Non-U.S. Equity 82.5% 84.3% 17.5% 15.7%<br />

Public Fixed Income<br />

Core Fixed 100.0% 81.8% 0.0% 18.2%<br />

Long Bonds 100.0% NA 0.0% NA<br />

High Yield 100.0% 83.3% 0.0% 16.7%<br />

Liquidity 100.0% NA 0.0% NA<br />

Alternatives<br />

Private Equity 100.0% 100.0% 0.0% 0.0%<br />

Real Estate 100.0% 99.7% 0.0% 0.3%<br />

Opportunistic/Hedge Funds 100.0% 75.0% 0.0% 25.0%<br />

Infrastructure 100.0% NA 0.0% NA<br />

Weighted Averages 71.2% 70.3% 28.8% 29.7%<br />

30