Investment Plan - OPERS

Investment Plan - OPERS

Investment Plan - OPERS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2 0 1 0 I N V E S T M E N T P L A N<br />

FUND STRATEGIES<br />

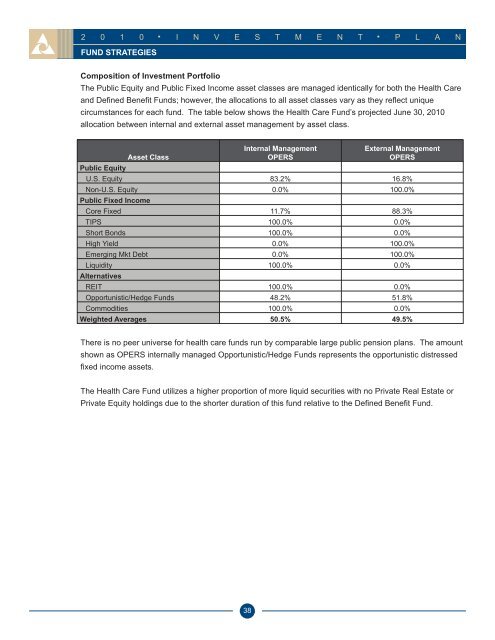

Composition of <strong>Investment</strong> Portfolio<br />

The Public Equity and Public Fixed Income asset classes are managed identically for both the Health Care<br />

and Defined Benefit Funds; however, the allocations to all asset classes vary as they reflect unique<br />

circumstances for each fund. The table below shows the Health Care Fund’s projected June 30, 2010<br />

allocation between internal and external asset management by asset class.<br />

Internal Management<br />

External Management<br />

Asset Class<br />

<strong>OPERS</strong><br />

<strong>OPERS</strong><br />

Public Equity<br />

U.S. Equity 83.2% 16.8%<br />

Non-U.S. Equity<br />

Public Fixed Income<br />

0.0% 100.0%<br />

Core Fixed 11.7% 88.3%<br />

TIPS 100.0% 0.0%<br />

Short Bonds 100.0% 0.0%<br />

High Yield 0.0% 100.0%<br />

Emerging Mkt Debt 0.0% 100.0%<br />

Liquidity<br />

Alternatives<br />

100.0% 0.0%<br />

REIT 100.0% 0.0%<br />

Opportunistic/Hedge Funds 48.2% 51.8%<br />

Commodities 100.0% 0.0%<br />

Weighted Averages 50.5% 49.5%<br />

There is no peer universe for health care funds run by comparable large public pension plans. The amount<br />

shown as <strong>OPERS</strong> internally managed Opportunistic/Hedge Funds represents the opportunistic distressed<br />

fixed income assets.<br />

The Health Care Fund utilizes a higher proportion of more liquid securities with no Private Real Estate or<br />

Private Equity holdings due to the shorter duration of this fund relative to the Defined Benefit Fund.<br />

38