JM FINANCIAL PRODUCTS LIMITED - Bombay Stock Exchange

JM FINANCIAL PRODUCTS LIMITED - Bombay Stock Exchange

JM FINANCIAL PRODUCTS LIMITED - Bombay Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

A. Internal Risk Factors:<br />

In Section II – Risk Factors<br />

2. Credit Risk, in the first paragraph - The gross loan portfolio of the Company was Rs. 2,222 crore as on<br />

June 30, 2012 and Rs. 2,095 crore as on March 31, 2012.<br />

4. Non-Performing Assets (“NPA”), in the paragraph - The Company had nil and 0.01% net NPAs as on<br />

March 31, 2011 and March 31, 2012 respectively and its provisioning norms fully comply with the RBI<br />

guidelines / directives.<br />

In Section III – Disclosure as per Schedule I of Securities and <strong>Exchange</strong> Board of India (Issue and Listing<br />

of Debt Securities) Regulations, 2008<br />

Names and addresses of the Directors of the Issuer:<br />

Mr. Vaddarse Prabhakar Shetty has been appointed as the Executive Chairman of the Company with effect from<br />

June 1, 2012.<br />

Mr. Darius E Udwadia has joined the Company as a director with effect from May 14, 2012. Mr. Udwadia is a<br />

non-executive and independent director and is a senior partner of Udwadia Udeshi & Argus Partners,<br />

Elphistone House, 1 st Floor, 17, Murzban Road, Mumbai – 400 001.<br />

Brief summary of the business / activities of the Issuer and its line of business:<br />

The gross lending portfolio stood at Rs. 2,222 crore as on June 30, 2012 and Rs. 2,095 crore as on March 31,<br />

2012 (Rs. 1,988 crore as on March 31, 2011).<br />

Changes in the capital structure of the Company:<br />

There have been no changes in the capital structure of the Company post the disclosure made in the Shelf<br />

Information Memorandum of the Company.<br />

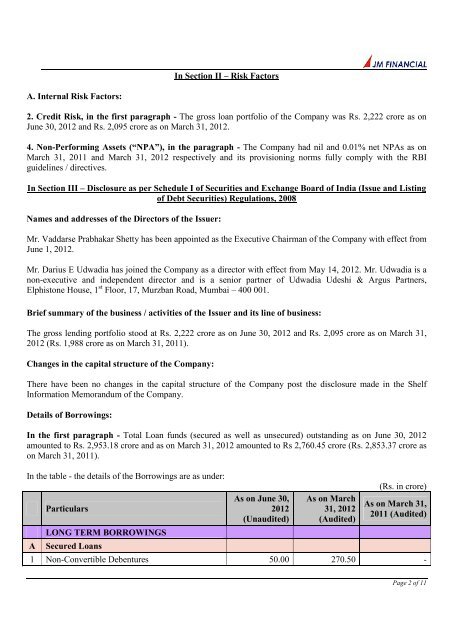

Details of Borrowings:<br />

In the first paragraph - Total Loan funds (secured as well as unsecured) outstanding as on June 30, 2012<br />

amounted to Rs. 2,953.18 crore and as on March 31, 2012 amounted to Rs 2,760.45 crore (Rs. 2,853.37 crore as<br />

on March 31, 2011).<br />

In the table - the details of the Borrowings are as under:<br />

Particulars<br />

LONG TERM BORROWINGS<br />

A Secured Loans<br />

As on June 30,<br />

2012<br />

(Unaudited)<br />

As on March<br />

31, 2012<br />

(Audited)<br />

(Rs. in crore)<br />

As on March 31,<br />

2011 (Audited)<br />

1 Non-Convertible Debentures 50.00 270.50 -<br />

Page 2 of 11