JM FINANCIAL PRODUCTS LIMITED - Bombay Stock Exchange

JM FINANCIAL PRODUCTS LIMITED - Bombay Stock Exchange

JM FINANCIAL PRODUCTS LIMITED - Bombay Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

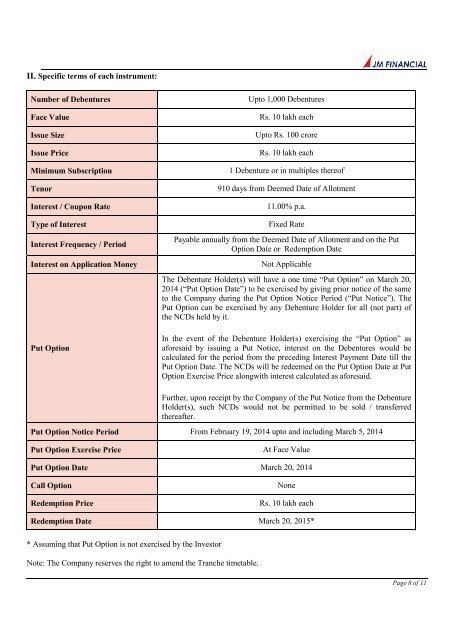

II. Specific terms of each instrument:<br />

Number of Debentures Upto 1,000 Debentures<br />

Face Value Rs. 10 lakh each<br />

Issue Size Upto Rs. 100 crore<br />

Issue Price Rs. 10 lakh each<br />

Minimum Subscription 1 Debenture or in multiples thereof<br />

Tenor 910 days from Deemed Date of Allotment<br />

Interest / Coupon Rate 11.00% p.a.<br />

Type of Interest Fixed Rate<br />

Interest Frequency / Period<br />

Payable annually from the Deemed Date of Allotment and on the Put<br />

Option Date or Redemption Date<br />

Interest on Application Money Not Applicable<br />

Put Option<br />

The Debenture Holder(s) will have a one time “Put Option” on March 20,<br />

2014 (“Put Option Date”) to be exercised by giving prior notice of the same<br />

to the Company during the Put Option Notice Period (“Put Notice”). The<br />

Put Option can be exercised by any Debenture Holder for all (not part) of<br />

the NCDs held by it.<br />

In the event of the Debenture Holder(s) exercising the “Put Option” as<br />

aforesaid by issuing a Put Notice, interest on the Debentures would be<br />

calculated for the period from the preceding Interest Payment Date till the<br />

Put Option Date. The NCDs will be redeemed on the Put Option Date at Put<br />

Option Exercise Price alongwith interest calculated as aforesaid.<br />

Further, upon receipt by the Company of the Put Notice from the Debenture<br />

Holder(s), such NCDs would not be permitted to be sold / transferred<br />

thereafter.<br />

Put Option Notice Period From February 19, 2014 upto and including March 5, 2014<br />

Put Option Exercise Price At Face Value<br />

Put Option Date March 20, 2014<br />

Call Option None<br />

Redemption Price Rs. 10 lakh each<br />

Redemption Date March 20, 2015*<br />

* Assuming that Put Option is not exercised by the Investor<br />

Note: The Company reserves the right to amend the Tranche timetable.<br />

Page 8 of 11