T2K_12-16_OnlinEdition

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

DECEMBER 20<strong>16</strong><br />

GENERAL MANAGER<br />

Megan Cullingford-Hicks<br />

SALES MANAGER<br />

Jerry Critser<br />

ADMINISTRATIVE STAFF<br />

Tammy Borrelli<br />

Charlene Abernathy<br />

CREATIVE DIRECTOR<br />

Chad Singleton<br />

EDITOR<br />

Sean O’Connell<br />

ADVERTISING ACCOUNT EXECUTIVES<br />

Meg Larcinese<br />

1.678.325.1025<br />

megl@targetmediapartners.com<br />

John Hicks<br />

1.770.418.9789<br />

johnh@targetmediapartners.com<br />

Greg McClendon<br />

1.678.325.1023<br />

gregmc@targetmediapartners.com<br />

Roger Fair<br />

1.256.676.3688<br />

rogerf@targetmediapartners.com<br />

Brett Scott<br />

1.757.777.5113<br />

Brett.Scott@TargetMediaPartners.com<br />

COLUMNS<br />

Bulletin Board...........................14<br />

Highway Angel..........................20<br />

Bottomline...............................24<br />

Advertiser’s Index.....................32<br />

COPYRIGHT: Copyright 20<strong>16</strong> Wilshire Classifieds,<br />

LLC. Publisher as sumes no responsibility for<br />

unsolicited material. Reproduction in whole or in<br />

part without written permis sion is prohibited. All<br />

advertisements, and/or editorials are accepted and<br />

published by Publisher on the representation that<br />

the advertiser, its advertising agency, and/or the<br />

supplier of the contents are authorized to publish<br />

the entire contents and subject matter thereof.<br />

The advertiser, its advertising agency and/or the<br />

supplier of the contents will defend, indemnify and<br />

hold Publisher harmless from and against any loss,<br />

expense or other liability, resulting from any claims<br />

or suits for libel, violation of privacy, plagiarism,<br />

copyright or trademark infringement and any other<br />

claims or suits that may rise out of publication<br />

of such contents. Press releases are expressly<br />

covered within the definition of contents.<br />

TRUCKING 20<strong>16</strong> • (256) 835-7610<br />

4 TRUCKING 20<strong>16</strong>

October Preliminary Net Class 8<br />

Orders Negatively Impacted By<br />

OEM “Clean Up”<br />

Transportation Analyst FTR reported<br />

November 3 that preliminary Class 8 net orders<br />

for October reached 13,800 units, virtually<br />

even with the previous month. The total was<br />

46 percent down from October 2015, said<br />

ACT Research President and Senior Analyst<br />

Kenny Vieth. “September is typically a weak<br />

order month,” Vieth said. “Normally, we would<br />

expect to see about a 30 percent (increase for<br />

October over September).”<br />

2015,” FTR stated.<br />

Don Ake, vice president of Commercial<br />

Vehicles at FTR, said “The adjusted number of<br />

21,300 was fueled by the big fleets placing their<br />

requirement orders for the first half of 2017.<br />

This indicates the freight markets are stabilizing<br />

and the fleets are confident enough to replace<br />

older trucks.<br />

“FTR expects medium-sized and smaller fleets<br />

to wait until after the election to place most of<br />

their initial 2017 orders. Once that uncertainty<br />

has been lifted, it should help the equipment<br />

markets and the general economy. Monthly<br />

orders will likely hover around the 20,000 unit<br />

mark in November and December.”<br />

The reported net order number for the<br />

month, FTR stated, was negatively impacted<br />

by a “significant cleanup of long-term, excess,<br />

orders by one OEM.” FTR did not name the<br />

manufacturer whose cleanup reduced the net<br />

total, and Vieth said he also could not comment<br />

on the information.<br />

“With this backlog adjustment factored<br />

out, net orders would have been closer to<br />

approximately 21,300 units, much above<br />

industry expectations and would have been the<br />

best monthly order activity since December<br />

Riverside Transportation is<br />

breaking into the west coast with<br />

its Refrigerated Division<br />

This fleet will operate up and down the<br />

I-5 corridor, with various trips to Las Vegas,<br />

Phoenix, and Salt Lake City.<br />

Those who join the fleet, and who live<br />

along the I-5 corridor, can enjoy weekly home<br />

time and consistent miles and pay. Riverside<br />

Transportation is seeking company drivers with<br />

<strong>12</strong> months<br />

of over<br />

the road<br />

experience.<br />

Company<br />

drivers will<br />

enjoy a<br />

competitive<br />

pay package, benefits, 401K, paid vacation and<br />

paid holidays.<br />

Riverside Transportation, a family-owned,<br />

14 www.TruckDriverMagazines.com TRUCKING 20<strong>16</strong>

has been in business for more than 20 years.<br />

When you’re a part of the Riverside team,<br />

you’re a part of the family. We provide our<br />

drivers with new equipment. All trucks are<br />

equipped with APUs, inverters, and refrigerators.<br />

At RTI, we know our drivers are our biggest<br />

assets.<br />

Are you ready to join our team? Give us a<br />

call today at 1-866-670-5717.<br />

Melton Truck Lines, Inc. Partners<br />

with FASTPORT To Mentor and<br />

Hire Military Veterans<br />

Melton Truck Lines, Inc., a premier<br />

air-ride flatbed carrier announced a partnership<br />

with FASTPORT through the Hiring Our<br />

Heroes Trucking Track program in a joint<br />

mission to educate Veterans about the variety of<br />

career paths trucking offers and provide them<br />

with employment opportunities with<br />

the industry.<br />

“Melton Truck Lines believes that it is<br />

our duty to provide America’s Veterans and<br />

transitioning service members with access to<br />

great careers in an industry where they fit in<br />

so well,” said Bob Peterson, Melton Chairman<br />

and CEO. “We have found that the military<br />

culture and our company culture are linked<br />

with connection points that include the value<br />

of teamwork, discipline, dedication, and an<br />

adventurous spirit. With those shared values,<br />

Veterans are set up for incredible success with<br />

Melton, and we are excited to help them find<br />

their career with us.”<br />

By partnering with FASTPORT, Melton is<br />

continuing in its strong support of the United<br />

States Armed Forces. Currently, over 30% of<br />

Melton employees are Veterans or members<br />

of the Guard and Reserve. Melton recently<br />

honored Armed Forces members at the Great<br />

American Trucking Show when they signed a<br />

Statement of Support for the Guard and Reserve.<br />

In addition to its wrapped truck that brings<br />

awareness and recognition to the Melton’s<br />

military community, all Melton veterans enjoy<br />

special decals<br />

for their<br />

trucks. The<br />

company<br />

has a<br />

longstanding<br />

history of recruiting Veterans and helping with<br />

the transition back to civilian life and is the only<br />

transportation company based in Oklahoma<br />

with an on the job training program that is<br />

certified by the State of Oklahoma Accrediting<br />

Agency to be approved for Veteran’s Benefit.<br />

“Melton Truck Lines has an outstanding<br />

track record for supporting our nation’s heroes,<br />

and we look forward to helping this militaryfriendly<br />

company continue to grow and improve<br />

that effort,” said Brad Bentley, FASTPORT<br />

President. “The company has truly earned the<br />

title of 20<strong>16</strong>’s Best Fleets to Drive For, and<br />

we are proud to be able to offer the military<br />

community a direct channel into Melton’s<br />

excellent careers and culture.”<br />

Headquartered in Tulsa, OK, Melton<br />

Truck Lines Inc. is an award-winning leader<br />

in the air-ride flatbed industry and services<br />

the United States, Canada, and Mexico. In<br />

business for almost 65 years, Melton has<br />

offices and terminals in Tulsa, Laredo, El Paso,<br />

Birmingham and Masury. For more information,<br />

please visit www.meltontruck.com.<br />

<strong>16</strong> www.TruckDriverMagazines.com TRUCKING 20<strong>16</strong>

North Carolina Truck Driver<br />

Named Highway Angel For Assisting<br />

Accident Victim<br />

Carl Debehnke, of Newport, North<br />

Carolina, a professional truck driver for<br />

Best Dedicated, LLC of Kernersville, North<br />

Carolina, has been named a<br />

Highway Angel by the Truckload<br />

Carriers Association.<br />

He is being recognized for<br />

assisting an elderly man after he<br />

was involved in a rollover accident.<br />

On August 3, 20<strong>16</strong>, around 3:30<br />

p.m., Carl Debehnke was driving<br />

westbound on Interstate 74 near<br />

Greensburg, Indiana.<br />

In the distance, he saw an<br />

eastbound van cross the<br />

median and flip over,<br />

coming to rest on its roof.<br />

Debehnke slowed his<br />

truck and came to a stop,<br />

quickly running over to<br />

the van to see if anyone<br />

was hurt. Inside, he saw an<br />

elderly man lying on his<br />

stomach, still strapped in<br />

his seatbelt.<br />

Needed to assess the<br />

man’s injuries, Debehnke went to the<br />

passenger side of the van and crawled<br />

through the sliding door. With broken glass<br />

everywhere, Debehnke had to move the<br />

shards to access the man still strapped in by<br />

the seatbelt.<br />

Debehnke checked the man’s vitals and<br />

loosened the seatbelt, as much as he could,<br />

to help relieve pressure from the<br />

man’s shoulder.<br />

“I kept talking to him to keep<br />

him awake and alert until help<br />

arrived.” Debehnke said.<br />

When assistance arrived at<br />

the scene, Debehnke gave them<br />

a thorough account of what<br />

happened.<br />

The Decatur County Sherriff’s<br />

Department called the professional<br />

Carl Debehnke<br />

truck driver’s company and<br />

complimented them on how<br />

well Debehnke had handled<br />

the situation. Debehnke<br />

was able to find out from<br />

the elderly man’s family<br />

that he was going to make<br />

a full recovery.<br />

Debehnke has been<br />

driving for 28 years and is<br />

no stranger to helping at<br />

accidents.<br />

“I have stopped at lots of accidents over<br />

the years. I learned first aid in the military<br />

so I try to help when I can,” he said.<br />

For his willingness to help, TCA has<br />

presented Debehnke with a certificate,<br />

20 www.TruckDriverMagazines.com TRUCKING 20<strong>16</strong>

patch, lapel pin and truck decal. Best<br />

Dedicated, LLC also received a certificate<br />

acknowledging Debehnke as a Highway<br />

Angel.<br />

EpicVue sponsors TCA’s Highway Angel<br />

program. Since the program’s inception<br />

in August 1997, hundreds of drivers have<br />

been recognized as Highway Angels for the<br />

unusual kindness, courtesy, and courage they<br />

have shown others while on the job.<br />

22 www.TruckDriverMagazines.com TRUCKING 20<strong>16</strong>

The<br />

Bottom Line<br />

By Shasta D. May<br />

YEAR-END<br />

TAX PLANNING<br />

December is here already, another year<br />

is coming to an end, but we still have time<br />

for some last-minute tax planning. Here<br />

are a few tax reducing strategies that can be<br />

accomplished before the end of December<br />

and information for the upcoming tax season.<br />

If You Can Itemize<br />

Prepay Deductible Expenses<br />

If you itemize deductions, accelerating<br />

some deductible expenses into this year to<br />

produce higher 20<strong>16</strong> write-offs makes sense<br />

if you expect to be in the same or lower tax<br />

bracket next year.<br />

One of the easiest deductible expenses<br />

to prepay is the interest included in house<br />

payments due on January 1. Accelerating<br />

that payment into this year will give you 13<br />

months’ worth of deductible interest in 20<strong>16</strong>.<br />

If you prepay this year, you can continue the<br />

practice for next year and beyond.<br />

Another option is prepaying state and<br />

local income and property taxes that are<br />

usually due the beginning of next year.<br />

If You Are<br />

Self-Employed<br />

Prepay Deductible Expenses<br />

If you have business expenses that<br />

you can pay in December that you would<br />

normally pay in January, you can increase<br />

your business deductions and lower your<br />

taxable business income. Consider any<br />

expenses you know you’re going to incur<br />

in the next 60 days for possible payment to<br />

maximize write-off before the end of the<br />

year, such as, tires, repairs, maintenance,<br />

insurance, etc.<br />

Another way to minimize your tax burden<br />

is to minimize your penalties for failure<br />

to pay sufficient estimated tax payments.<br />

Often, individuals in businesses get into tax<br />

trouble because they do not make estimated<br />

tax payments, and being self-employed you<br />

have self-employment tax of 15 percent.<br />

Important: You have the January 15th, 4th<br />

quarter estimated tax payment to pay in<br />

any tax liability for 20<strong>16</strong> and avoid an<br />

underpayment penalty.<br />

20<strong>16</strong> Standard<br />

Deductions<br />

For 20<strong>16</strong>, the standard deduction is<br />

$<strong>12</strong>,600 for married couples filing joint,<br />

$6,300 for single filers, and $9,300 for head<br />

of households.<br />

Important -<br />

Company Drivers<br />

If you file an itemized tax return, you<br />

can deduct employee business expenses<br />

you incur but are not reimbursed for. You<br />

can deduct any expenses that are necessary<br />

or required in the performance of your<br />

job and/or operation of the truck but are<br />

24 www.TruckDriverMagazines.com TRUCKING 20<strong>16</strong>

not reimbursed by your employer, such as,<br />

uniforms, work boots, gloves, logbooks,<br />

maps, cell phone, CB, tools, etc. These<br />

deductions are only available if you itemize<br />

and are not available if you take the standard<br />

deduction. Remember, you are also entitled<br />

to the per diem allowance for overnights to<br />

cover the cost of meals and incidentals while<br />

on the road. Remember, this deduction is<br />

only available if you are not reimbursed for<br />

meals and you itemize.<br />

To determine if you will benefit from<br />

itemizing, the total of all your individual<br />

deductions must be greater than the Standard<br />

Deduction.<br />

Example: If you are a single company<br />

driver and your only deduction is the+ per<br />

diem for overnights, your deduction for<br />

overnights must total more than the standard<br />

deduction.<br />

Let’s say your overnights for the year total<br />

250<br />

250 overnights multiplied by the current<br />

20<strong>16</strong> per diem rate ($63) = $15,750<br />

The allowable per diem deduction is 80%<br />

of the total, therefore 80% of $15,750 =<br />

$<strong>12</strong>,600<br />

The Standard Deduction for a single<br />

company driver is $6,300 - However with<br />

250 overnights you would qualify to itemize<br />

with $<strong>12</strong>,600 in deductions. By itemizing<br />

you will have $6,300 more in deductions<br />

(double the standard deduction) than if you<br />

had used the Standard Deduction and to that<br />

you may add other itemized deductions in<br />

addition to the ones mentioned above, if they<br />

are purchased in the same tax year.<br />

It is always important for individuals and<br />

small businesses to plan ahead for taxes.<br />

Many of you do not have the luxury of using<br />

an accountant throughout the year. As a<br />

result, numerous truckers are responsible<br />

for keeping their own records, determining<br />

their tax liability and potentially missing<br />

out on ongoing tax planning that could save<br />

money. If at all possible, use a trucking<br />

tax professional for year-end tax return<br />

preparation.<br />

Bottom Line<br />

This article has been presented by MBA<br />

Tax & Bookkeeping Service, a company proud<br />

to provide Corporate/LLC filings, income tax,<br />

bookkeeping and IRS problem resolution<br />

services to truckers in all states. If you would<br />

like additional information or have questions,<br />

calls are always welcome. Contact us at<br />

888-407-<strong>16</strong>69 or visit our website at www.<br />

mbataxhelp.com.<br />

This article is provided for informational<br />

purposes only and is not intended as legal or<br />

tax advice. Each individual business situation<br />

is different and the information contained<br />

herein is meant for general information<br />

purposes only. Specific tax and legal<br />

recommendations can only be made after an<br />

individual has consulted his or her qualified<br />

tax or legal professional.<br />

The<br />

26 www.TruckDriverMagazines.com TRUCKING 20<strong>16</strong>

30 www.TruckDriverMagazines.com TRUCKING 20<strong>16</strong>

ADVERTISERS INDEX<br />

Alabama Motor Express.......................30<br />

Beacon Transport.................................36<br />

Big M Transportation...........................30<br />

CalArk..............................................9, 34<br />

Celadon ..............................................6-7<br />

Central Hauling......................................8<br />

Harris Quality......................................32<br />

Hurricane Express................................<strong>12</strong><br />

JK Hackl......................................... 13, 35<br />

Johnsrud Transport...............................22<br />

Koch Trucking..................................... 27<br />

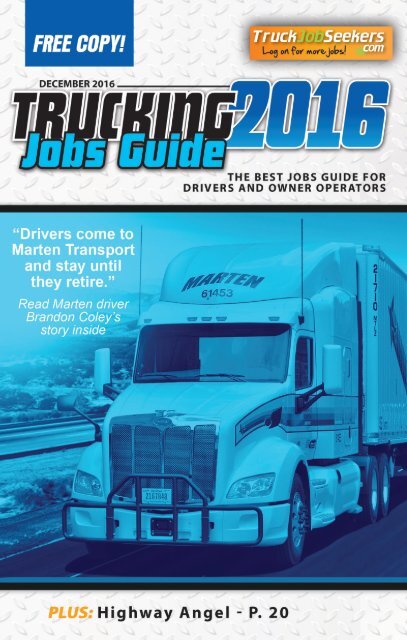

Marten Transport.... Cover, 2-3, 5, 31, 33<br />

Melton Truck Lines.........................28-29<br />

Mercer Transportation......................... 17<br />

Minstar................................................. 25<br />

Petro/TA...............................................10<br />

Redneck Trailer Supplies..................... 23<br />

RTI....................................................... 11<br />

Trans Am.............................................. 15<br />

UPS...................................................... 21<br />

K & B Transportation.....................18-19<br />

32 www.TruckDriverMagazines.com TRUCKING 20<strong>16</strong>