Niclas Holst Sonne - Danmarks Skatteadvokater

Niclas Holst Sonne - Danmarks Skatteadvokater

Niclas Holst Sonne - Danmarks Skatteadvokater

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

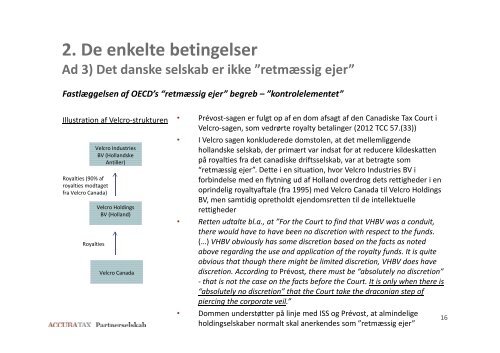

2. De enkelte betingelserAd 3) Det danske selskab er ikke ”retmæssig ejer”Fastlæggelsen af OECD’s “retmæssig ejer” begreb – ”kontrolelementet”Illustration af Velcro-strukturenRoyalties (90% afroyalties modtagetfra Velcro Canada)RoyaltiesVelcro IndustriesBV (HollandskeAntiller)Velcro HoldingsBV (Holland)Velcro Canada• Prévost-sagen er fulgt op af en dom afsagt af den Canadiske Tax Court iVelcro-sagen, som vedrørte royalty betalinger (2012 TCC 57.(33))• I Velcro sagen konkluderede domstolen, at det mellemliggendehollandske selskab, der primært var indsat for at reducere kildeskattenpå royalties fra det canadiske driftsselskab, var at betragte som“retmæssig ejer”. Dette i en situation, hvor Velcro Industries BV iforbindelse med en flytning ud af Holland overdrog dets rettigheder i enoprindelig royaltyaftale (fra 1995) med Velcro Canada til Velcro HoldingsBV, men samtidig opretholdt ejendomsretten til de intellektuellerettigheder• Retten udtalte bl.a., at ”For the Court to find that VHBV was a conduit,there would have to have been no discretion with respect to the funds.(…) VHBV obviously has some discretion based on the facts as notedabove regarding the use and application of the royalty funds. It is quiteobvious that though there might be limited discretion, VHBV does havediscretion. According to Prévost, there must be “absolutely no discretion”- that is not the case on the facts before the Court. It is only when there is“absolutely no discretion” that the Court take the draconian step ofpiercing the corporate veil.”• Dommen understøtter på linje med ISS og Prévost, at almindeligeholdingselskaber normalt skal anerkendes som ”retmæssig ejer”16