ETF-Magazin mit Artikel zum Thema Sicherheit von - Börse Frankfurt

ETF-Magazin mit Artikel zum Thema Sicherheit von - Börse Frankfurt

ETF-Magazin mit Artikel zum Thema Sicherheit von - Börse Frankfurt

Erfolgreiche ePaper selbst erstellen

Machen Sie aus Ihren PDF Publikationen ein blätterbares Flipbook mit unserer einzigartigen Google optimierten e-Paper Software.

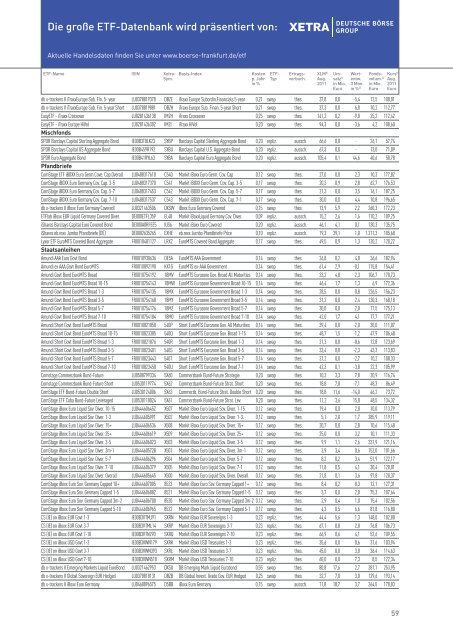

Die große <strong>ETF</strong>-Datenbank wird präsentiert <strong>von</strong>:<br />

Aktuelle Handelsdaten fi nden Sie unter www.boerse-frankfurt.de/etf<br />

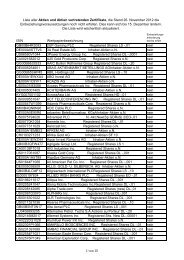

<strong>ETF</strong>-Name ISIN Xetra- Basis-Index Kosten <strong>ETF</strong>- Ertrags- XLM 2) Um- Wert- Fonds- Kurs 5)<br />

Sym. p. Jahr Typ verbuch. Aug. satz 1) entw. volum. 4) Aug.<br />

in % 2011 in Mio. 3 Mon. in Mio. 2011<br />

Euro in % 3) Euro Euro<br />

db x-trackers II iTraxxEurope Sub. Fin. 5- year LU0378819378 DBZE iTraxx Europe Subordin.Financials 5-year 0,21 swap thes. 37,8 0,0 -5,4 12,5 100,01<br />

db x-trackers II iTraxxEurope Sub. Fin. 5-year Short LU0378819881 DBZH iTraxx Europe Sub. Finan. 5-year Short 0,21 swap thes. 37,3 0,0 6,0 10,2 112,77<br />

Easy<strong>ETF</strong> - iTraxx Crossover LU0281436138 IM2H iTraxx Crossover 0,25 swap thes. 141,2 0,2 -9,0 25,2 112,42<br />

Easy<strong>ETF</strong> - iTraxx Europe HiVol LU0281436302 IM2I iTraxx HiVol 0,20 swap thes. 94,3 0,0 -3,6 4,2 108,60<br />

Mischfonds<br />

SPDR Barclays Capital Sterling Aggregate Bond IE00B3T8LK23 SYBP Barclays Capital Sterling Aggregate Bond 0,20 repliz. aussch. 66,6 0,0 - 26,1 57,74<br />

SPDR Barclays Capital US Aggregate Bond IE00B459R192 SYBU Barclays Capital U.S. Aggregate Bond 0,20 repliz. aussch. 67,3 0,0 - 13,0 71,09<br />

SPDR Euro Aggregate Bond IE00B41RYL63 SYBA Barclays Capital Euro Aggregate Bond 0,20 repliz. aussch. 105,4 0,1 44,6 40,6 50,78<br />

Pfandbriefe<br />

ComStage <strong>ETF</strong> iBOXX Euro Germ.Cove. Cap.Overall LU0488317610 C540 Markit iBoxx Euro Germ. Cov. Cap 0,12 swap thes. 27,0 0,0 2,3 10,3 177,82<br />

ComStage iBOXX Euro Germany Cov. Cap. 3-5 LU0488317370 C541 Markit iBOXX Euro Germ. Cov. Cap. 3-5 0,17 swap thes. 20,3 0,9 2,8 62,7 176,53<br />

ComStage iBOXX Euro Germany Cov. Cap. 5-7 LU0488317453 C542 Markit iBOXX Euro Germ. Cov. Cap. 5-7 0,17 swap thes. 21,3 0,0 3,5 16,1 187,25<br />

ComStage iBOXX Euro Germany Cov. Cap. 7-10 LU0488317537 C543 Markit iBOXX Euro Germ. Cov. Cap. 7-1 0,17 swap thes. 30,0 0,0 4,4 10,8 196,65<br />

db x-trackers II iBoxx Euro Germany CoveredI LU0321463506 DXSW iBoxx Euro Germany Covered 0,15 swap thes. 13,9 5,9 2,2 260,3 172,23<br />

<strong>ETF</strong>lab iBoxx EUR Liquid Germany Covered Diver. DE000<strong>ETF</strong>L359 EL48 Markit iBoxxLiquid Germany Cov. Diver. 0,09 repliz. aussch. 15,2 2,6 1,6 110,2 109,25<br />

iShares Barclays Capital Euro Covered Bond DE000A0RFEE5 IUS6 Markit iBoxx Euro Covered 0,20 repliz. aussch. 46,1 4,1 0,1 130,3 135,75<br />

iShares eb.rexx Jumbo Pfandbriefe (DE) DE0002635265 EXHE eb.rexx Jumbo Pfandbriefe Price 0,10 repliz. aussch. 19,3 39,1 1,0 1.211,3 105,68<br />

Lyxor <strong>ETF</strong> EuroMTS Covered Bond Aggregate FR0010481127 LRX2 EuroMTS Covered Bond Aggregate 0,17 swap thes. 49,5 0,9 1,3 120,2 120,22<br />

Staatsanleihen<br />

Amundi AAA Euro Govt Bond FR0010930636 DE5A EuroMTS AAA Government 0,14 swap thes. 26,8 0,2 4,8 36,6 182,94<br />

Amundi ex AAA Govt Bond EuroMTS FR0010892190 KX1G EuroMTS ex-AAA Government 0,14 swap thes. 61,4 2,9 -0,1 115,8 154,41<br />

Amundi Govt Bond EuroMTS Broad FR0010754192 18MV EuroMTS Eurozone Gov. Broad All Maturities 0,14 swap thes. 33,2 4,8 2,3 106,7 170,73<br />

Amundi Govt Bond EuroMTS Broad 10-15 FR0010754143 18MW EuroMTS Eurozone Government Broad 10-15 0,14 swap thes. 46,4 1,7 1,3 6,9 172,36<br />

Amundi Govt Bond EuroMTS Broad 1-3 FR0010754135 18MX EuroMTS Eurozone Government Broad 1-3 0,14 swap thes. 28,5 0,0 0,8 226,5 156,23<br />

Amundi Govt Bond EuroMTS Broad 3-5 FR0010754168 18MY EuroMTS Eurozone Government Broad 3-5 0,14 swap thes. 31,2 0,0 2,4 130,3 168,18<br />

Amundi Govt Bond EuroMTS Broad 5-7 FR0010754176 18MZ EuroMTS Eurozone Government Broad 5-7 0,14 swap thes. 30,0 0,0 2,8 17,5 175,13<br />

Amundi Govt Bond EuroMTS Broad 7-10 FR0010754184 18M0 EuroMTS Eurozone Government Broad 7-10 0,14 swap thes. 42,0 1,7 4,1 17,7 177,21<br />

Amundi Short Govt Bond EuroMTS Broad FR0010821850 540P Short EuroMTS Eurozone Gov. All Maturities 0,14 swap thes. 39,4 0,0 -2,0 30,0 111,07<br />

Amundi Short Govt Bond EuroMTS Broad 10-15 FR0010823385 540Q Short EuroMTS Eurozone Gov. Broad 1-15 0,14 swap thes. 48,7 1,5 -1,2 47,9 106,48<br />

Amundi Short Govt Bond EuroMTS Broad 1-3 FR0010821876 540R Short EuroMTS Eurozone Gov. Broad 1-3 0,14 swap thes. 31,3 0,0 -0,6 12,8 123,69<br />

Amundi Short Govt Bond EuroMTS Broad 3-5 FR0010823401 540S Short EuroMTS Eurozone Gov. Broad 3-5 0,14 swap thes. 33,4 0,0 -2,3 43,3 113,83<br />

Amundi Short Govt Bond EuroMTS Broad 5-7 FR0010823443 540T Short EuroMTS Eurozone Gov. Broad 5-7 0,14 swap thes. 31,2 0,0 -2,7 10,2 108,33<br />

Amundi Short Govt Bond EuroMTS Broad 7-10 FR0010823450 540U Short EuroMTS Eurozone Gov. Broad 7-1 0,14 swap thes. 42,3 0,1 -3,8 22,3 105,99<br />

Comstage Commerzbank Bund-Future LU0508799334 5X60 Commerzbank Bund-Future Strategie 0,20 swap thes. 10,3 3,3 7,8 20,9 116,74<br />

Comstage Commerzbank Bund-Future Short LU0530119774 5X62 Commerzbank Bund-Future Strat. Short 0,20 swap thes. 18,8 7,8 -7,1 48,3 86,49<br />

ComStage <strong>ETF</strong> Bund-Future Double Short LU0530124006 5X63 Commerzb. Bund-Future Strat. Double Short 0,20 swap thes. 18,8 11,6 -14,0 46,2 73,72<br />

ComStage <strong>ETF</strong> Coba Bund-Future Leveraged LU0530118024 5X61 Commerzbank Bund-Future Strat. Lev. 0,20 swap thes. 11,2 3,6 15,8 48,5 134,32<br />

ComStage iBoxx Euro Liquid Sov. Diver. 10-15 LU0444606452 X507 Markit iBoxx Euro Liquid Sov. Diver. 1-15 0,12 swap thes. 19,4 0,0 2,8 10,0 113,79<br />

ComStage iBoxx Euro Liquid Sov. Diver. 1-3 LU0444605991 X502 Markit iBoxx Euro Liquid Sov. Diver. 1-3. 0,12 swap thes. 5,1 2,0 1,7 285,9 119,11<br />

ComStage iBoxx Euro Liquid Sov. Diver. 15+ LU0444606536 X508 Markit iBoxx Euro Liquid Sov. Diver. 15+ 0,12 swap thes. 20,7 0,0 2,8 10,6 115,48<br />

ComStage iBoxx Euro Liquid Sov. Diver. 25+ LU0444606619 X509 Markit iBoxx Euro Liquid Sov. Diver. 25+ 0,12 swap thes. 25,0 0,0 3,2 10,1 111,33<br />

ComStage iBoxx Euro Liquid Sov. Diver. 3-5 LU0444606023 X503 Markit iBoxx Euro Liquid Sov. Diver. 3-5 0,12 swap thes. 9,9 1,1 2,6 331,9 121,16<br />

ComStage iBoxx Euro Liquid Sov. Diver. 3m-1 LU0444605728 X501 Markit iBoxx Euro Liquid Sov. Diver. 3m-1 0,12 swap thes. 3,9 3,4 0,6 152,0 101,66<br />

ComStage iBoxx Euro Liquid Sov. Diver. 5-7 LU0444606296 X504 Markit iBoxx Euro Liquid Sov. Diver. 5-7 0,12 swap thes. 8,2 0,2 3,4 51,9 122,17<br />

ComStage iBoxx Euro Liquid Sov. Diver. 7-10 LU0444606379 X505 Markit iBoxx Euro Liquid Sov. Diver. 7-1 0,12 swap thes. 11,8 0,5 4,1 30,4 120,01<br />

ComStage iBoxx Euro Liquid Sov. Diver. Overall LU0444605645 X500 Markit iBoxx Euro Liquid Sov. Diver. Overall 0,12 swap thes. 21,8 0,1 3,6 97,8 120,37<br />

ComStage iBoxx Euro Sov. Germany Capped 10+ LU0444607005 8523 Markit iBoxx Euro Sov. Germany Capped 1+ 0,12 swap thes. 8,4 0,2 8,3 12,1 127,31<br />

ComStage iBoxx Euro Sov. Germany Capped 1-5 LU0444606882 8521 Markit iBoxx Euro Sov. Germany Capped 1-5 0,12 swap thes. 3,7 0,0 2,8 75,3 107,64<br />

ComStage iBoxx Euro Sov. Germany Capped 3m-2 LU0444606700 8520 Markit iBoxx Euro Sov. Germany Capped 3m-2 0,12 swap thes. 2,9 0,4 1,0 15,4 102,56<br />

ComStage iBoxx Euro Sov. Germany Capped 5-10 LU0444606965 8522 Markit iBoxx Euro Sov. Germany Capped 5-1 0,12 swap thes. 4,3 0,5 6,6 81,8 116,80<br />

CS (IE) on iBoxx EUR Govt 1-3 IE00B3VTMJ91 SXRN Markit iBoxx EUR Sovereigns 1-3 0,23 repliz. thes. 44,4 5,6 1,3 148,0 102,80<br />

CS (IE) on iBoxx EUR Govt 3-7 IE00B3VTML14 SXRP Markit iBoxx EUR Sovereigns 3-7 0,23 repliz. thes. 67,1 0,8 2,8 76,8 106,73<br />

CS (IE) on iBoxx EUR Govt 7-10 IE00B3VTN290 SXRQ Markit iBoxx EUR Sovereigns 7-10 0,23 repliz. thes. 66,9 0,6 4,1 52,6 109,55<br />

CS (IE) on iBoxx USD Govt 1-3 IE00B3VWN179 SXRK Markit iBoxx USD Treasuries 1-3 0,23 repliz. thes. 35,6 0,0 0,6 31,6 103,94<br />

CS (IE) on iBoxx USD Govt 3-7 IE00B3VWN393 SXRL Markit iBoxx USD Treasuries 3-7 0,23 repliz. thes. 45,0 0,0 3,8 36,4 114,63<br />

CS (IE) on iBoxx USD Govt 7-10 IE00B3VWN518 SXRM Markit iBoxx USD Treasuries 7-10 0,23 repliz. thes. 60,0 0,0 7,3 8,5 122,34<br />

db x-trackers II Emerging Markets Liquid EuroBond LU0321462953 DXSU DB Emerging Mark.Liquid Eurobond 0,55 swap thes. 80,8 17,6 2,7 381,1 253,95<br />

db x-trackers II Global Sovereign EUR Hedged LU0378818131 DBZB DB Global Invest. Grade Gov. EUR Hedged 0,25 swap thes. 32,7 7,0 3,0 129,6 193,14<br />

db x-trackers II iBoxx Euro Germany LU0468896575 D5BB iBoxx Euro Germany 0,15 swap aussch. 11,8 18,7 3,7 264,5 178,83<br />

59