BRITISH TOURIST AUTHORITY TRADING AS VISITBRITAIN ...

BRITISH TOURIST AUTHORITY TRADING AS VISITBRITAIN ...

BRITISH TOURIST AUTHORITY TRADING AS VISITBRITAIN ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

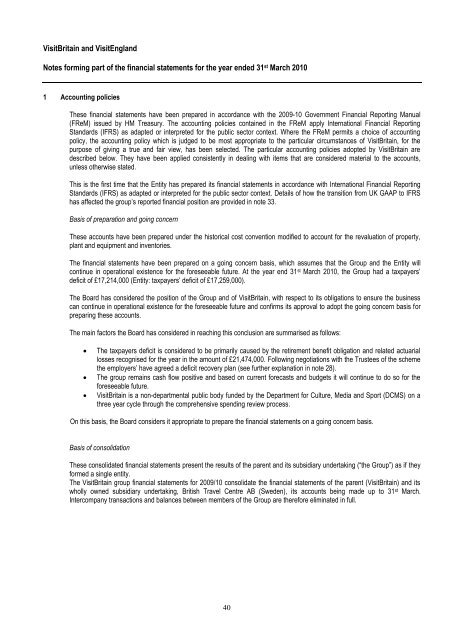

VisitBritain and VisitEngland<br />

Notes forming part of the financial statements for the year ended 31 st March 2010<br />

1 Accounting policies<br />

These financial statements have been prepared in accordance with the 2009-10 Government Financial Reporting Manual<br />

(FReM) issued by HM Treasury. The accounting policies contained in the FReM apply International Financial Reporting<br />

Standards (IFRS) as adapted or interpreted for the public sector context. Where the FReM permits a choice of accounting<br />

policy, the accounting policy which is judged to be most appropriate to the particular circumstances of VisitBritain, for the<br />

purpose of giving a true and fair view, has been selected. The particular accounting policies adopted by VisitBritain are<br />

described below. They have been applied consistently in dealing with items that are considered material to the accounts,<br />

unless otherwise stated.<br />

This is the first time that the Entity has prepared its financial statements in accordance with International Financial Reporting<br />

Standards (IFRS) as adapted or interpreted for the public sector context. Details of how the transition from UK GAAP to IFRS<br />

has affected the group’s reported financial position are provided in note 33.<br />

Basis of preparation and going concern<br />

These accounts have been prepared under the historical cost convention modified to account for the revaluation of property,<br />

plant and equipment and inventories.<br />

The financial statements have been prepared on a going concern basis, which assumes that the Group and the Entity will<br />

continue in operational existence for the foreseeable future. At the year end 31 st March 2010, the Group had a taxpayers’<br />

deficit of £17,214,000 (Entity: taxpayers’ deficit of £17,259,000).<br />

The Board has considered the position of the Group and of VisitBritain, with respect to its obligations to ensure the business<br />

can continue in operational existence for the foreseeable future and confirms its approval to adopt the going concern basis for<br />

preparing these accounts.<br />

The main factors the Board has considered in reaching this conclusion are summarised as follows:<br />

The taxpayers deficit is considered to be primarily caused by the retirement benefit obligation and related actuarial<br />

losses recognised for the year in the amount of £21,474,000. Following negotiations with the Trustees of the scheme<br />

the employers’ have agreed a deficit recovery plan (see further explanation in note 28).<br />

The group remains cash flow positive and based on current forecasts and budgets it will continue to do so for the<br />

foreseeable future.<br />

VisitBritain is a non-departmental public body funded by the Department for Culture, Media and Sport (DCMS) on a<br />

three year cycle through the comprehensive spending review process.<br />

On this basis, the Board considers it appropriate to prepare the financial statements on a going concern basis.<br />

Basis of consolidation<br />

These consolidated financial statements present the results of the parent and its subsidiary undertaking (“the Group”) as if they<br />

formed a single entity.<br />

The VisitBritain group financial statements for 2009/10 consolidate the financial statements of the parent (VisitBritain) and its<br />

wholly owned subsidiary undertaking, British Travel Centre AB (Sweden), its accounts being made up to 31 st March.<br />

Intercompany transactions and balances between members of the Group are therefore eliminated in full.<br />

40