BRITISH TOURIST AUTHORITY TRADING AS VISITBRITAIN ...

BRITISH TOURIST AUTHORITY TRADING AS VISITBRITAIN ...

BRITISH TOURIST AUTHORITY TRADING AS VISITBRITAIN ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

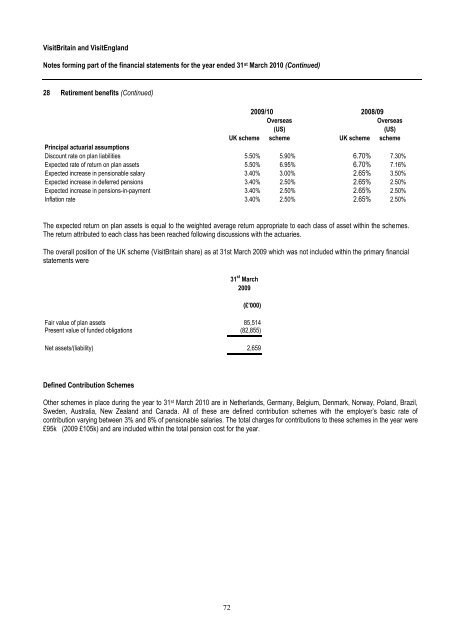

VisitBritain and VisitEngland<br />

Notes forming part of the financial statements for the year ended 31 st March 2010 (Continued)<br />

28 Retirement benefits (Continued)<br />

72<br />

UK scheme<br />

2009/10 2008/09<br />

Overseas<br />

(US)<br />

scheme UK scheme<br />

Overseas<br />

(US)<br />

scheme<br />

Principal actuarial assumptions<br />

Discount rate on plan liabilities 5.50% 5.90% 6.70% 7.30%<br />

Expected rate of return on plan assets 5.50% 6.95% 6.70% 7.16%<br />

Expected increase in pensionable salary 3.40% 3.00% 2.65% 3.50%<br />

Expected increase in deferred pensions 3.40% 2.50% 2.65% 2.50%<br />

Expected increase in pensions-in-payment 3.40% 2.50% 2.65% 2.50%<br />

Inflation rate 3.40% 2.50% 2.65% 2.50%<br />

The expected return on plan assets is equal to the weighted average return appropriate to each class of asset within the schemes.<br />

The return attributed to each class has been reached following discussions with the actuaries.<br />

The overall position of the UK scheme (VisitBritain share) as at 31st March 2009 which was not included within the primary financial<br />

statements were<br />

31 st March<br />

2009<br />

(£’000)<br />

Fair value of plan assets 85,514<br />

Present value of funded obligations (82,855)<br />

Net assets/(liability) 2,659<br />

Defined Contribution Schemes<br />

Other schemes in place during the year to 31 st March 2010 are in Netherlands, Germany, Belgium, Denmark, Norway, Poland, Brazil,<br />

Sweden, Australia, New Zealand and Canada. All of these are defined contribution schemes with the employer’s basic rate of<br />

contribution varying between 3% and 8% of pensionable salaries. The total charges for contributions to these schemes in the year were<br />

£95k (2009 £105k) and are included within the total pension cost for the year.