BRITISH TOURIST AUTHORITY TRADING AS VISITBRITAIN ...

BRITISH TOURIST AUTHORITY TRADING AS VISITBRITAIN ...

BRITISH TOURIST AUTHORITY TRADING AS VISITBRITAIN ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

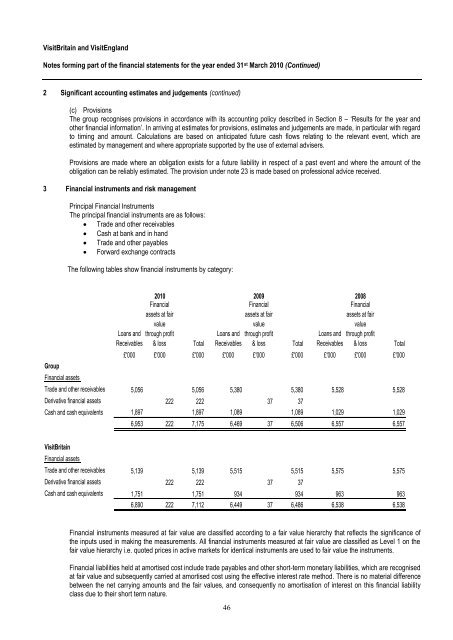

VisitBritain and VisitEngland<br />

Notes forming part of the financial statements for the year ended 31 st March 2010 (Continued)<br />

2 Significant accounting estimates and judgements (continued)<br />

(c) Provisions<br />

The group recognises provisions in accordance with its accounting policy described in Section 8 – ‘Results for the year and<br />

other financial information’. In arriving at estimates for provisions, estimates and judgements are made, in particular with regard<br />

to timing and amount. Calculations are based on anticipated future cash flows relating to the relevant event, which are<br />

estimated by management and where appropriate supported by the use of external advisers.<br />

Provisions are made where an obligation exists for a future liability in respect of a past event and where the amount of the<br />

obligation can be reliably estimated. The provision under note 23 is made based on professional advice received.<br />

3 Financial instruments and risk management<br />

Principal Financial Instruments<br />

The principal financial instruments are as follows:<br />

Trade and other receivables<br />

Cash at bank and in hand<br />

Trade and other payables<br />

Forward exchange contracts<br />

The following tables show financial instruments by category:<br />

2010 2009 2008<br />

Loans and<br />

Financial<br />

assets at fair<br />

value<br />

through profit<br />

Receivables & loss Total<br />

Loans and<br />

Financial<br />

assets at fair<br />

value<br />

through profit<br />

Receivables & loss Total<br />

46<br />

Loans and<br />

Financial<br />

assets at fair<br />

value<br />

through profit<br />

Receivables & loss Total<br />

£'000 £'000 £'000 £'000 £'000 £'000 £'000 £'000 £'000<br />

Group<br />

Financial assets<br />

Trade and other receivables 5,056 5,056 5,380 5,380 5,528 5,528<br />

Derivative financial assets 222 222 37 37<br />

Cash and cash equivalents 1,897 1,897 1,089 1,089 1,029 1,029<br />

6,953 222 7,175 6,469 37 6,506 6,557 6,557<br />

VisitBritain<br />

Financial assets<br />

Trade and other receivables 5,139 5,139 5,515 5,515 5,575 5,575<br />

Derivative financial assets 222 222 37 37<br />

Cash and cash equivalents 1,751 1,751 934 934 963 963<br />

6,890 222 7,112 6,449 37 6,486 6,538 6,538<br />

Financial instruments measured at fair value are classified according to a fair value hierarchy that reflects the significance of<br />

the inputs used in making the measurements. All financial instruments measured at fair value are classified as Level 1 on the<br />

fair value hierarchy i.e. quoted prices in active markets for identical instruments are used to fair value the instruments.<br />

Financial liabilities held at amortised cost include trade payables and other short-term monetary liabilities, which are recognised<br />

at fair value and subsequently carried at amortised cost using the effective interest rate method. There is no material difference<br />

between the net carrying amounts and the fair values, and consequently no amortisation of interest on this financial liability<br />

class due to their short term nature.