BRITISH TOURIST AUTHORITY TRADING AS VISITBRITAIN ...

BRITISH TOURIST AUTHORITY TRADING AS VISITBRITAIN ...

BRITISH TOURIST AUTHORITY TRADING AS VISITBRITAIN ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

VisitBritain and VisitEngland<br />

Notes forming part of the financial statements for the year ended 31 st March 2010 (Continued)<br />

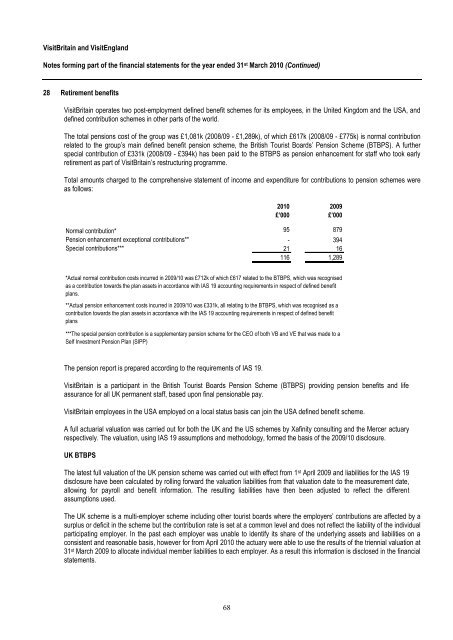

28 Retirement benefits<br />

VisitBritain operates two post-employment defined benefit schemes for its employees, in the United Kingdom and the USA, and<br />

defined contribution schemes in other parts of the world.<br />

The total pensions cost of the group was £1,081k (2008/09 - £1,289k), of which £617k (2008/09 - £775k) is normal contribution<br />

related to the group’s main defined benefit pension scheme, the British Tourist Boards’ Pension Scheme (BTBPS). A further<br />

special contribution of £331k (2008/09 - £394k) has been paid to the BTBPS as pension enhancement for staff who took early<br />

retirement as part of VisitBritain’s restructuring programme.<br />

Total amounts charged to the comprehensive statement of income and expenditure for contributions to pension schemes were<br />

as follows:<br />

68<br />

2010 2009<br />

£’000 £’000<br />

Normal contribution* 95 879<br />

Pension enhancement exceptional contributions** - 394<br />

Special contributions*** 21 16<br />

116 1,289<br />

*Actual normal contribution costs incurred in 2009/10 was £712k of which £617 related to the BTBPS, which was recognised<br />

as a contribution towards the plan assets in accordance with I<strong>AS</strong> 19 accounting requirements in respect of defined benefit<br />

plans.<br />

**Actual pension enhancement costs incurred in 2009/10 was £331k, all relating to the BTBPS, which was recognised as a<br />

contribution towards the plan assets in accordance with the I<strong>AS</strong> 19 accounting requirements in respect of defined benefit<br />

plans<br />

***The special pension contribution is a supplementary pension scheme for the CEO of both VB and VE that was made to a<br />

Self Investment Pension Plan (SIPP)<br />

The pension report is prepared according to the requirements of I<strong>AS</strong> 19.<br />

VisitBritain is a participant in the British Tourist Boards Pension Scheme (BTBPS) providing pension benefits and life<br />

assurance for all UK permanent staff, based upon final pensionable pay.<br />

VisitBritain employees in the USA employed on a local status basis can join the USA defined benefit scheme.<br />

A full actuarial valuation was carried out for both the UK and the US schemes by Xafinity consulting and the Mercer actuary<br />

respectively. The valuation, using I<strong>AS</strong> 19 assumptions and methodology, formed the basis of the 2009/10 disclosure.<br />

UK BTBPS<br />

The latest full valuation of the UK pension scheme was carried out with effect from 1 st April 2009 and liabilities for the I<strong>AS</strong> 19<br />

disclosure have been calculated by rolling forward the valuation liabilities from that valuation date to the measurement date,<br />

allowing for payroll and benefit information. The resulting liabilities have then been adjusted to reflect the different<br />

assumptions used.<br />

The UK scheme is a multi-employer scheme including other tourist boards where the employers’ contributions are affected by a<br />

surplus or deficit in the scheme but the contribution rate is set at a common level and does not reflect the liability of the individual<br />

participating employer. In the past each employer was unable to identify its share of the underlying assets and liabilities on a<br />

consistent and reasonable basis, however for from April 2010 the actuary were able to use the results of the triennial valuation at<br />

31 st March 2009 to allocate individual member liabilities to each employer. As a result this information is disclosed in the financial<br />

statements.