Valuation Techniques for Social Cost-Benefit Analysis: - HM Treasury

Valuation Techniques for Social Cost-Benefit Analysis: - HM Treasury

Valuation Techniques for Social Cost-Benefit Analysis: - HM Treasury

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

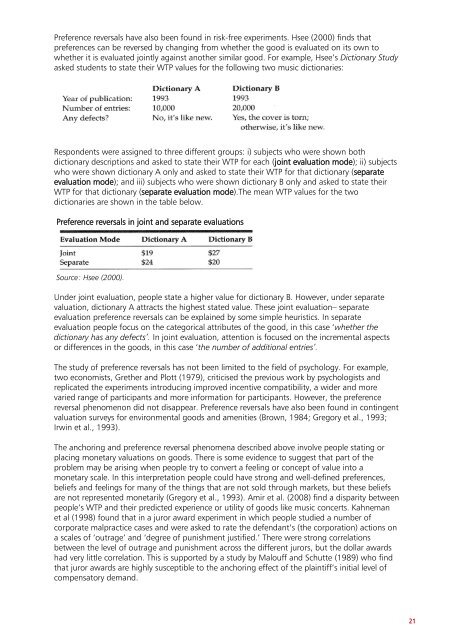

Preference reversals have also been found in risk-free experiments. Hsee (2000) finds that<br />

preferences can be reversed by changing from whether the good is evaluated on its own to<br />

whether it is evaluated jointly against another similar good. For example, Hsee‘s Dictionary Study<br />

asked students to state their WTP values <strong>for</strong> the following two music dictionaries:<br />

Respondents were assigned to three different groups: i) subjects who were shown both<br />

dictionary descriptions and asked to state their WTP <strong>for</strong> each (joint evaluation mode); ii) subjects<br />

who were shown dictionary A only and asked to state their WTP <strong>for</strong> that dictionary (separate<br />

evaluation mode); and iii) subjects who were shown dictionary B only and asked to state their<br />

WTP <strong>for</strong> that dictionary (separate evaluation mode).The mean WTP values <strong>for</strong> the two<br />

dictionaries are shown in the table below.<br />

Preference reversals in joint and separate evaluations<br />

Source: Hsee (2000).<br />

Under joint evaluation, people state a higher value <strong>for</strong> dictionary B. However, under separate<br />

valuation, dictionary A attracts the highest stated value. These joint evaluation– separate<br />

evaluation preference reversals can be explained by some simple heuristics. In separate<br />

evaluation people focus on the categorical attributes of the good, in this case ‗whether the<br />

dictionary has any defects’. In joint evaluation, attention is focused on the incremental aspects<br />

or differences in the goods, in this case ‗the number of additional entries’.<br />

The study of preference reversals has not been limited to the field of psychology. For example,<br />

two economists, Grether and Plott (1979), criticised the previous work by psychologists and<br />

replicated the experiments introducing improved incentive compatibility, a wider and more<br />

varied range of participants and more in<strong>for</strong>mation <strong>for</strong> participants. However, the preference<br />

reversal phenomenon did not disappear. Preference reversals have also been found in contingent<br />

valuation surveys <strong>for</strong> environmental goods and amenities (Brown, 1984; Gregory et al., 1993;<br />

Irwin et al., 1993).<br />

The anchoring and preference reversal phenomena described above involve people stating or<br />

placing monetary valuations on goods. There is some evidence to suggest that part of the<br />

problem may be arising when people try to convert a feeling or concept of value into a<br />

monetary scale. In this interpretation people could have strong and well-defined preferences,<br />

beliefs and feelings <strong>for</strong> many of the things that are not sold through markets, but these beliefs<br />

are not represented monetarily (Gregory et al., 1993). Amir et al. (2008) find a disparity between<br />

people‘s WTP and their predicted experience or utility of goods like music concerts. Kahneman<br />

et al (1998) found that in a juror award experiment in which people studied a number of<br />

corporate malpractice cases and were asked to rate the defendant‘s (the corporation) actions on<br />

a scales of ‗outrage‘ and ‗degree of punishment justified.‘ There were strong correlations<br />

between the level of outrage and punishment across the different jurors, but the dollar awards<br />

had very little correlation. This is supported by a study by Malouff and Schutte (1989) who find<br />

that juror awards are highly susceptible to the anchoring effect of the plaintiff‘s initial level of<br />

compensatory demand.<br />

21

![AIRTO [Professor Dr Brian Blunden] - HM Treasury](https://img.yumpu.com/15492848/1/184x260/airto-professor-dr-brian-blunden-hm-treasury.jpg?quality=85)