SYDNEY PORTS CORPORATION ANNUAL REPORT 12

SYDNEY PORTS CORPORATION ANNUAL REPORT 12

SYDNEY PORTS CORPORATION ANNUAL REPORT 12

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

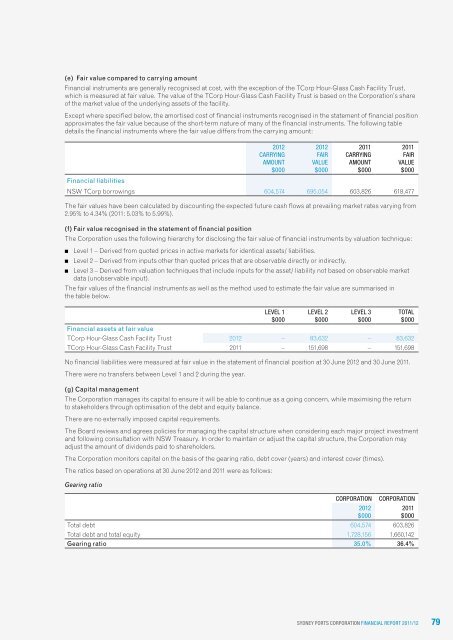

(e) Fair value compared to carrying amount<br />

Financial instruments are generally recognised at cost, with the exception of the TCorp Hour-Glass Cash Facility Trust,<br />

which is measured at fair value. The value of the TCorp Hour-Glass Cash Facility Trust is based on the Corporation’s share<br />

of the market value of the underlying assets of the facility.<br />

Except where specified below, the amortised cost of financial instruments recognised in the statement of financial position<br />

approximates the fair value because of the short-term nature of many of the financial instruments. The following table<br />

details the financial instruments where the fair value differs from the carrying amount:<br />

20<strong>12</strong><br />

Carrying<br />

amoUnt<br />

$000<br />

20<strong>12</strong><br />

fair<br />

valUe<br />

$000<br />

2011<br />

Carrying<br />

amoUnt<br />

$000<br />

2011<br />

fair<br />

valUe<br />

$000<br />

Financial liabilities<br />

NSW TCorp borrowings 604,574 695,054 603,826 618,477<br />

The fair values have been calculated by discounting the expected future cash flows at prevailing market rates varying from<br />

2.95% to 4.34% (2011: 5.03% to 5.99%).<br />

(f) Fair value recognised in the statement of financial position<br />

The Corporation uses the following hierarchy for disclosing the fair value of financial instruments by valuation technique:<br />

■■ Level 1 – Derived from quoted prices in active markets for identical assets/ liabilities.<br />

■■ Level 2 – Derived from inputs other than quoted prices that are observable directly or indirectly.<br />

■■ Level 3 – Derived from valuation techniques that include inputs for the asset/ liability not based on observable market<br />

data (unobservable input).<br />

The fair values of the financial instruments as well as the method used to estimate the fair value are summarised in<br />

the table below.<br />

level 1<br />

$000<br />

level 2<br />

$000<br />

level 3<br />

$000<br />

Financial assets at fair value<br />

TCorp Hour-Glass Cash Facility Trust 20<strong>12</strong> – 83,632 – 83,632<br />

TCorp Hour-Glass Cash Facility Trust 2011 – 151,698 – 151,698<br />

No financial liabilities were measured at fair value in the statement of financial position at 30 June 20<strong>12</strong> and 30 June 2011.<br />

There were no transfers between Level 1 and 2 during the year.<br />

(g) Capital management<br />

The Corporation manages its capital to ensure it will be able to continue as a going concern, while maximising the return<br />

to stakeholders through optimisation of the debt and equity balance.<br />

There are no externally imposed capital requirements.<br />

The Board reviews and agrees policies for managing the capital structure when considering each major project investment<br />

and following consultation with NSW Treasury. In order to maintain or adjust the capital structure, the Corporation may<br />

adjust the amount of dividends paid to shareholders.<br />

The Corporation monitors capital on the basis of the gearing ratio, debt cover (years) and interest cover (times).<br />

The ratios based on operations at 30 June 20<strong>12</strong> and 2011 were as follows:<br />

Gearing ratio<br />

total<br />

$000<br />

CorPoration CorPoration<br />

Total debt 604,574 603,826<br />

Total debt and total equity 1,728,156 1,660,142<br />

Gearing ratio 35.0% 36.4%<br />

20<strong>12</strong><br />

$000<br />

2011<br />

$000<br />

Sydney PortS CorPoration finanCial rePort 2011/<strong>12</strong> 79