Indian-Fertilizer-Scenario - Department of Fertilizers

Indian-Fertilizer-Scenario - Department of Fertilizers

Indian-Fertilizer-Scenario - Department of Fertilizers

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

130 indian fertilizer scenario 2010<br />

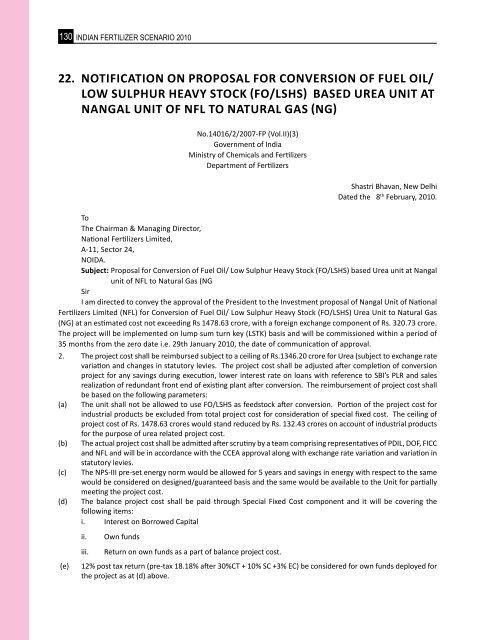

22. notiFiCAtion on PRoPosAL FoR ConVeRsion oF FUeL oiL/<br />

loW SUlPHUr HeaVY SToCK (Fo/lSHS) baSeD Urea UNiT aT<br />

NaNgal UNiT oF NFl To NaTUral gaS (Ng)<br />

No.14016/2/2007-FP (Vol.II)(3)<br />

Government <strong>of</strong> India<br />

Ministry <strong>of</strong> Chemicals and <strong>Fertilizer</strong>s<br />

<strong>Department</strong> <strong>of</strong> <strong>Fertilizer</strong>s<br />

Shastri bhavan, New Delhi<br />

Dated the 8 th February, 2010.<br />

to<br />

The Chairman & Managing Director,<br />

National <strong>Fertilizer</strong>s limited,<br />

a-11, Sector 24,<br />

NOIDa.<br />

Subject: Proposal for Conversion <strong>of</strong> Fuel Oil/ low Sulphur Heavy Stock (FO/lSHS) based Urea unit at Nangal<br />

unit <strong>of</strong> NFl to Natural Gas (NG<br />

sir<br />

I am directed to convey the approval <strong>of</strong> the President to the Investment proposal <strong>of</strong> Nangal Unit <strong>of</strong> National<br />

<strong>Fertilizer</strong>s limited (NFl) for Conversion <strong>of</strong> Fuel Oil/ low Sulphur Heavy Stock (FO/lSHS) Urea Unit to Natural Gas<br />

(NG) at an estimated cost not exceeding Rs 1478.63 crore, with a foreign exchange component <strong>of</strong> Rs. 320.73 crore.<br />

The project will be implemented on lump sum turn key (lSTK) basis and will be commissioned within a period <strong>of</strong><br />

35 months from the zero date i.e. 29th January 2010, the date <strong>of</strong> communication <strong>of</strong> approval.<br />

2. The project cost shall be reimbursed subject to a ceiling <strong>of</strong> Rs.1346.20 crore for Urea (subject to exchange rate<br />

variation and changes in statutory levies. The project cost shall be adjusted after completion <strong>of</strong> conversion<br />

project for any savings during execution, lower interest rate on loans with reference to SbI’s PlR and sales<br />

realization <strong>of</strong> redundant front end <strong>of</strong> existing plant after conversion. The reimbursement <strong>of</strong> project cost shall<br />

be based on the following parameters:<br />

(a) The unit shall not be allowed to use FO/lSHS as feedstock after conversion. Portion <strong>of</strong> the project cost for<br />

industrial products be excluded from total project cost for consideration <strong>of</strong> special fixed cost. The ceiling <strong>of</strong><br />

project cost <strong>of</strong> Rs. 1478.63 crores would stand reduced by Rs. 132.43 crores on account <strong>of</strong> industrial products<br />

for the purpose <strong>of</strong> urea related project cost.<br />

(b) The actual project cost shall be admitted after scrutiny by a team comprising representatives <strong>of</strong> PDIl, DOF, FICC<br />

and NFl and will be in accordance with the CCea approval along with exchange rate variation and variation in<br />

statutory levies.<br />

(c) The NPS-III pre-set energy norm would be allowed for 5 years and savings in energy with respect to the same<br />

would be considered on designed/guaranteed basis and the same would be available to the Unit for partially<br />

meeting the project cost.<br />

(d) The balance project cost shall be paid through Special Fixed Cost component and it will be covering the<br />

following items:<br />

i. Interest on borrowed Capital<br />

ii. Own funds<br />

iii. Return on own funds as a part <strong>of</strong> balance project cost.<br />

(e) 12% post tax return (pre-tax 18.18% after 30%CT + 10% SC +3% eC) be considered for own funds deployed for<br />

the project as at (d) above.