Funding

Funding

Funding

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

8<br />

Organization<br />

The Foundation is governed by the Board of<br />

Trustees. It comprises 14 eminent persons drawn<br />

from the domains of academia, politics, and industry<br />

(see page 94), of whom seven are appointed by<br />

the Federal Government and seven by the State of<br />

Lower Saxony. Their period of office is five years<br />

and they can be reappointed for one further term.<br />

The Trustees are completely independent and<br />

responsible only to the Foundation’s statutes.<br />

The Board usually convenes about three times a<br />

year to discuss and formulate strategy and to decide<br />

on applications. The Trustees are responsible for<br />

the annual budget and the annual accounts, as<br />

well as the publication of the Foundation’s annual<br />

report and appointment of the Secretary General.<br />

Dr. Wilhelm Krull has been Secretary General of<br />

the Foundation since 1996, and is as such responsible<br />

for its management.<br />

Currently the Volkswagen Foundation’s office has<br />

a staff of about 90, mainly spread over three divisions:<br />

There is one division dealing with research<br />

funding, the other divisions care for finance and ad -<br />

ministration and manage the Foundation’s assets.<br />

The office staff prepare the proposals for the<br />

Board of Trustees and execute the Board’s decisions.<br />

This involves the conceptualization and<br />

implementation of funding initiatives, processing<br />

applications, informing and advising the applicants,<br />

and monitoring the funded projects from<br />

start to finish. In addition, the grants have to be<br />

administered and checked to see that they have<br />

been used correctly and efficiently for the immediate<br />

purpose for which they were allocated.<br />

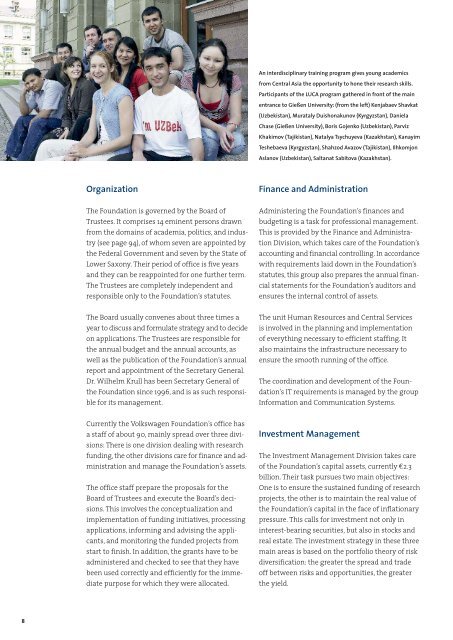

An interdisciplinary training program gives young academics<br />

from Central Asia the opportunity to hone their research skills.<br />

Participants of the LUCA program gathered in front of the main<br />

entrance to Gießen University: (from the left) Kenjabaev Shavkat<br />

(Uzbekistan), Murataly Duishonakunov (Kyrgyzstan), Daniela<br />

Chase (Gießen University), Boris Gojenko (Uzbekistan), Parviz<br />

Khakimov (Tajikistan), Natalya Tsychuyeva (Kazakhstan), Kanayim<br />

Teshebaeva (Kyrgyzstan), Shahzod Avazov (Tajikistan), Ilhkomjon<br />

Aslanov (Uzbekistan), Saltanat Sabitova (Kazakhstan).<br />

Finance and Administration<br />

Administering the Foundation’s finances and<br />

budgeting is a task for professional management.<br />

This is provided by the Finance and Administration<br />

Division, which takes care of the Foundation’s<br />

accounting and financial controlling. In accordance<br />

with requirements laid down in the Foundation’s<br />

statutes, this group also prepares the annual finan -<br />

cial statements for the Foundation’s auditors and<br />

ensures the internal control of assets.<br />

The unit Human Resources and Central Services<br />

is involved in the planning and implementation<br />

of everything necessary to efficient staffing. It<br />

also maintains the infrastructure necessary to<br />

ensure the smooth running of the office.<br />

The coordination and development of the Foun -<br />

dation’s IT requirements is managed by the group<br />

Information and Communication Systems.<br />

Investment Management<br />

The Investment Management Division takes care<br />

of the Foundation’s capital assets, currently €2.3<br />

billion. Their task pursues two main objectives:<br />

One is to ensure the sustained funding of research<br />

projects, the other is to maintain the real value of<br />

the Foundation’s capital in the face of inflationary<br />

pressure. This calls for investment not only in<br />

interest-bearing securities, but also in stocks and<br />

real estate. The investment strategy in these three<br />

main areas is based on the portfolio theory of risk<br />

diversification: the greater the spread and trade<br />

off between risks and opportunities, the greater<br />

the yield.