himani.singh@icicidir ect.com Nicholas Piramal (NICPIR) Lucrative ...

himani.singh@icicidir ect.com Nicholas Piramal (NICPIR) Lucrative ...

himani.singh@icicidir ect.com Nicholas Piramal (NICPIR) Lucrative ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

COMPANY BACKGROUND<br />

<strong>Nicholas</strong> <strong>Piramal</strong> (India) Ltd (NPIL) is one of the<br />

country’s largest pharmaceutical <strong>com</strong>panies. The<br />

<strong>com</strong>pany is currently ranked 4th in the Indian market<br />

with a diverse product portfolio spanning nine<br />

therapeutic areas. The <strong>com</strong>pany has R&D capabilities in<br />

custom chemical synthesis, process innovation, NDDS<br />

and basic research. It has world-class US FDAapproved<br />

formulations and API facilities. NPIL has a<br />

long track record of successful collaboration with<br />

innovator <strong>com</strong>panies. Since 2003, the <strong>com</strong>pany has<br />

made significant investments to be<strong>com</strong>e a global<br />

contract manufacturing organization (CMO) for large<br />

and medium-sized innovator <strong>com</strong>panies. NPIL has a<br />

track record of buying depressed assets (See Exhibit 2)<br />

and turning them around. It bought loss making Avecia<br />

in 2005 and Pfizer’s Morpeth facility in 2006. NPIL<br />

provides CMO from assets in India (Pithampur in<br />

Madhya Pradesh and Digwal near Hyderabad) and<br />

abroad. The Avecia and Morpeth facilities in UK also<br />

provide CMO. The acquisition of Morpeth plant from<br />

Pfizer helped the <strong>com</strong>pany to secure an order worth<br />

US$350 million spread over 5 years.<br />

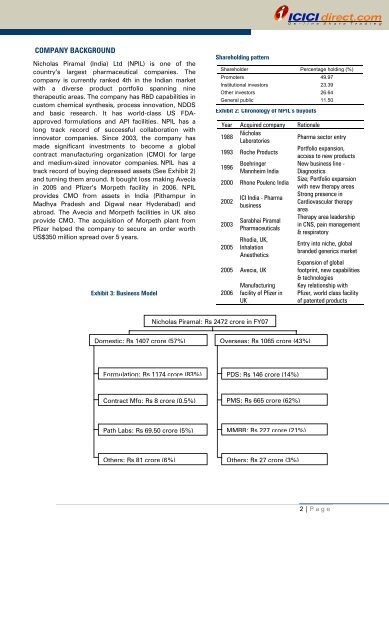

Exhibit 3: Business Model<br />

Shareholding pattern<br />

Shareholder Percentage holding (%)<br />

Promoters 49.97<br />

Institutional investors 23.39<br />

Other investors 26.64<br />

General public 11.50<br />

Exhibit 2: Chronology of NPIL’s buyouts<br />

<strong>Nicholas</strong> <strong>Piramal</strong>: Rs 2472 crore in FY07<br />

Domestic: Rs 1407 crore (57%) Overseas: Rs 1065 crore (43%)<br />

Formulation: Rs 1174 crore (83%)<br />

Contract Mfg: Rs 8 crore (0.5%)<br />

Path Labs: Rs 69.50 crore (5%)<br />

Others: Rs 81 crore (6%)<br />

Year Acquired <strong>com</strong>pany Rationale<br />

1988 <strong>Nicholas</strong><br />

Laboratories<br />

Pharma s<strong>ect</strong>or entry<br />

1993 Roche Products<br />

Portfolio expansion,<br />

access to new products<br />

1996 Boehringer<br />

Mannheim India<br />

New business line -<br />

Diagnostics<br />

2000 Rhone Poulenc India<br />

Size; Portfolio expansion<br />

with new therapy areas<br />

2002<br />

ICI India - Pharma<br />

business<br />

Strong presence in<br />

Cardiovascular therapy<br />

area<br />

2003<br />

Sarabhai <strong>Piramal</strong><br />

Pharmaceuticals<br />

Therapy area leadership<br />

in CNS, pain management<br />

& respiratory<br />

2005<br />

Rhodia, UK,<br />

Inhalation<br />

Anesthetics<br />

Entry into niche, global<br />

branded generics market<br />

Expansion of global<br />

2005 Avecia, UK<br />

footprint, new capabilities<br />

& technologies<br />

Manufacturing Key relationship with<br />

2006 facility of Pfizer in Pfizer, world class facility<br />

UK<br />

of patented products<br />

PDS: Rs 146 crore (14%)<br />

PMS: Rs 665 crore (62%)<br />

MMBB: Rs 227 crore (21%)<br />

Others: Rs 27 crore (3%)<br />

2 | P age