himani.singh@icicidir ect.com Nicholas Piramal (NICPIR) Lucrative ...

himani.singh@icicidir ect.com Nicholas Piramal (NICPIR) Lucrative ...

himani.singh@icicidir ect.com Nicholas Piramal (NICPIR) Lucrative ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NPIL lost a huge turnover due to formulations portfolio disturbance events.<br />

Three major factors impacted domestic formulations business. Sales of<br />

Phensedyl, a leading brand of the <strong>com</strong>pany, were adversely aff<strong>ect</strong>ed during<br />

FY06 due to a controversy. As Phensedyl contains codeine derived from a<br />

narcotics origin, the Narcotics Control Bureau (NCB) initiated investigation into<br />

the sale of the product. In July 2005, the NCB initiated wide spread<br />

investigations of stockists and chemists across the country. This resulted in<br />

disruption of retail stocking and off-take of the brand. NPIL contested the<br />

action of NCB in the courts and was successful in establishing that Phensedyl<br />

is not a narcotic drug under the NDPS Act. Valdecoxib was globally advised to<br />

be withdrawn, including from India. NPIL had 2 nd ranking in Valdecoxib<br />

through Vah and Valto brands. Following this, the <strong>com</strong>pany discontinued the<br />

brands in July 05, which resulted in annual sales loss of Rs 11.40 crore in FY06.<br />

The third reason for sales loss was business restructuring. The <strong>com</strong>pany<br />

divested Carex division to a distributor. This division had two main product<br />

groups, Hospital products (annual sales: Rs 9.30 crore) and Inhalation<br />

Anesthetics (annual sales: Rs 6.10 crore). Hospital products were generating<br />

paper-thin margin and were not fitting into the business of the <strong>com</strong>pany. For<br />

Inhalation Anesthetics, NPIL has global model to sell through distributors.<br />

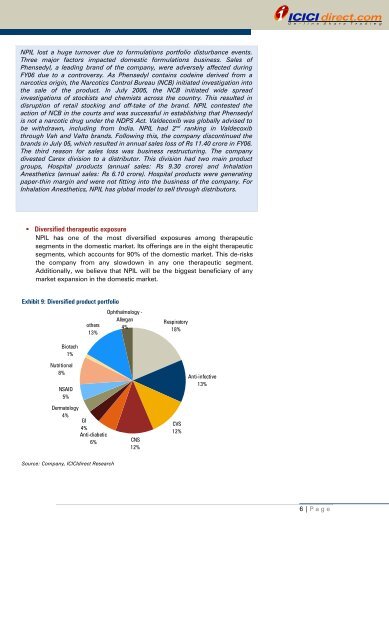

Diversified therapeutic exposure<br />

NPIL has one of the most diversified exposures among therapeutic<br />

segments in the domestic market. Its offerings are in the eight therapeutic<br />

segments, which accounts for 90% of the domestic market. This de-risks<br />

the <strong>com</strong>pany from any slowdown in any one therapeutic segment.<br />

Additionally, we believe that NPIL will be the biggest beneficiary of any<br />

market expansion in the domestic market.<br />

Exhibit 9: Diversified product portfolio<br />

Biotech<br />

1%<br />

Nutritional<br />

8%<br />

NSAID<br />

5%<br />

Dermatology<br />

4%<br />

others<br />

13%<br />

GI<br />

4%<br />

Anti-diabetic<br />

6%<br />

Source: Company, ICICIdir<strong>ect</strong> Research<br />

Ophthalmology -<br />

Allergan<br />

4%<br />

CNS<br />

12%<br />

Respiratory<br />

18%<br />

CVS<br />

12%<br />

Anti-inf<strong>ect</strong>ive<br />

13%<br />

6 | P age