http://legacy.library.ucsf.edu/tid/deg12a00/pdf

http://legacy.library.ucsf.edu/tid/deg12a00/pdf

http://legacy.library.ucsf.edu/tid/deg12a00/pdf

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

. ~-. ~ _:~ _ t<br />

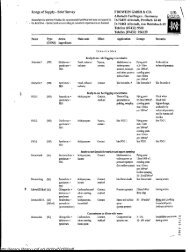

Consollidated~ Statements of Changesin Fiinancial Position<br />

t'tini0 Mortis loaoryorated and Consctldned SubsiAiarin<br />

Jorthayems. ended Dcoember 31 . 1972 and 1971<br />

1972 1971<br />

Additions to Working Capital:<br />

Operations:<br />

Net earnings . _ . . . .. . . . .. . . . .. . . .. . . . .. . . .. . . . . . . . . . .. . .<br />

S I24,466 ;000 $101,498,000 :<br />

Add (d<strong>edu</strong>ct) items not requiring current use of working capital :<br />

Depreciation . .. . . .. . . . .. . . . . .. . . . . .. . . . .. . . . . .. . . . . .. . . . . . .. . . .. . . . . .. . . . . .. . . . .. . . . . .. . . . . .. . . . .. . . . . .. . . . .. . . . . . .. . . . ... 26,576a000 21,500,000<br />

Amortization . .. . . . . .. . . . .. .. . . . .. . . . .. . . .. . . . . .. 1,563,000 1,421,000<br />

Deferred income taxes . . . . . .. . . . .. . . . .. . . . . .. . . . . . .. . . . . .. . . .. . .. 4,890,000 9,559,000<br />

Provision for reserve applicable to international operations . . . . . . . . . . .. . . . . .. 1,723,000<br />

Equity in net earnings of unconsolidated subsidiaries and alfiliates . .. . . . . .. . . . . .. (11,478,000)', (9,928,000 )<br />

Dividends received from unconsolidated subsidiaries _ . . . .. . . . . .. . . . . .. .__ . . . . . .. . . . . . .. . . . . -. 4.692,000 2,875,000<br />

From operations__ .. . . . . .. . . .. . . .. . . . .. .. . . . .. 150,709;000 128,648,000<br />

Financing' :<br />

Long-term debt :<br />

Issued . . . . . .. . . . . .. . . . .. . . . . .. . . .. .. . . . . . .._ . .. . . . __ . . . . . . . . .. .. . . .. . . . . . . .. _ 184,108,000 47,868,000<br />

Prepaymentsandretirements . . . . .. . . .. (38,892,000) (9,766,000)<br />

From long-term debt . ._ . . . . .. . . . .. . . . . ._ . .. .. 145,216a000 38,102,000<br />

Stockholders' equity :<br />

Shares issued under stock options 4,434,000 3,720,000<br />

Sharesofpreferredstockpurchasedforueasury .. . . . . . .. . . . ._ . . .. (4,188,000) (2;021,000)<br />

From equity transactions . . .. . .. 2464000 1,699 .000<br />

From financing . . . .. . . . . .. . . . .. 145.462,000 39,801,000<br />

Other :<br />

Disposal of~property ; plant and equipmeno<br />

Net unrealized exchange gainsadded to reserv e<br />

. . . .. . . .. 1,433,000 8,442,000<br />

applicable to international operations . .. . . .. . . . . .. . . . . .. . . . .. . . . . .. . . . .. . . . . .. . . .. . . . . . .. . . . . .. . . . . .. . . .. 3,755,000 2,928,000<br />

Additions to working capital . . . . . . .. . . . . .. . . ... .. . . .. . . . .. . . ._ . . . . . . . . . .. . . . .. . . . . _ . . . . . . . .. 301,359;000 179,819,000<br />

Uses of Working Capital:<br />

Dividends . . . . .. . . . . .. . . . .. . . . .. . . . . .. . . . . .. . . . .. . . . . .. . . . . . .. . . . .. . . . .. . . . . . . . . . . .. . . . . ._ .. . . . . . . . . . .._ . .. . . . ._ . . . .. . . . . . .. . .. 34,572,000 31,832,000<br />

Expansion and modernization of'property ; planrand equipment . .. . . . .. . . . . . . . . .. . .. 120,034,000 68,001,000<br />

Investments in and advances to unconsolidatedsubsidiaries and affiliates . . . . . .. . . . . . .. . .. 5,276,000 4,013,000<br />

Investments in consolidated subsidiaries, net of working capital acquiredf' :<br />

Mission Viejo Company . . . . .. . . . .. . . . . .. . . .. . . . . . .. . . . . .. . . . . .. . . . . . .. . . . .. . . . .. . . . . .. . . . . .. . . . . .. . . . .. . . . . .. . . . . . .. . .. 22,524,000<br />

Other subsidiaries . . . .. . . . . .. . . . . . .. . . . . .. . . .. . . . . . .. . . . . .. . . . . . .. . . . .. . . . . .. . . . .. . . . . . .. . . . .. . . . .. . . . . .. . . . . .. . . . .. .. . . .. . .. 6,873,000 2,255,000<br />

29,397;000 2,255,000<br />

Other, net . . . . .. . . . . .. . . . .. . . . .. . . . . . .. . . . . .. . . . . .. . . .. . . . . . .. . . . . .. . . . . . .. . . .. . . . . . .. . . . .. . . . . .. . . .. .. . . . .. . . . . . . . . . .__ .. . . . . .. . .. 4,880,000 3,809,00 0<br />

Working capital used _ . .. . . . . .. . . . . .. . . . . .. . . . .. . . . _ .. . . . .. . . . . .. . . . . _ . . . .. . . . . .. . . . .. . . . . .. . . . . . .. . .. 194,159,000 109,910,000<br />

Inerease in working capital _ . . . . .. . . .. . . . . .. . . . . . .. . . . . .. . . . .. . . . .. . . . . .. . . . . .. . . . .. . . . . .. . . . . . .. . .. $107,200,000 $ 69,909,00 0<br />

Changes in components of working ca pitai':<br />

Cash and cash equivalents .. . . . .. . . . . .. . . ... . . . . .. . . . . .. . . . . .. . . . . . .. . . . .. . . . . .. . . . .. . . . . . .. . . . .. . . . .. . . . . .. . . . . . .. . . .<br />

Receivables . . .. . . . .. . . ... . . . . .. . . . . .. . . . .. . . . . .. . . . . . .. . . . . .. . . . .. . . . . .. . . . . .. . . . . .. . . . .. . . . .. . . . . . .. . . . .. . . . .. . . . . . .. . . . . .. . . .<br />

Inventories . . . . .. . . . .. . . . .. . . . ... . . . . .. . . . .. . . . . .. . . . . . .. . . . . .. . . . .. . . . .. . . . . . .. . . . .. . . . . .. . . . .. . . . . . .. . . . . .. . . .. .. . . .. . . . . . .. . . .<br />

Notes payable . . . . .. . . . . . .. . . . . .. . . . . .. . . . .. . . . . . .. . . . . .. . . . . .. . . . .. . . . . .. . . . .. . . . . .. . . . . .. . . . . . . . . . .. . . . .. . . . . .. .. . . .. . . .<br />

Accounts payable and accrued liabilities . . . . .. . . . . .. . . . . .. . . . . .. . . . .. . . . .. .. . . . .. . . . .. . . . . . .. . . . .. . . . . .. . . .<br />

Other; net . .. . . . ... . . . .. . . .. . . . . . .. . . . . .. . . . . . .. . . .. . . . . . .. . . . . .. . . . . .. . . . ... . . . .. . . . .. . . . . .. . . . .. . . . .. . . . .. . . . . . .. . . . .. . . . . .. . .<br />

Other significant financing transactions, not affecting working capital,<br />

S 6,128,000 ($ 3,699,000)<br />

26,487,000 929,00 0<br />

130,901,000 101,816,00 0<br />

3,500,000 (14,200,000)<br />

(45,785a000) (19,960,000)<br />

(14,03 i,000) 5,023,00 0<br />

$107,200,000 $ 69,909,000<br />

were conversions of $26,351„000 and $56,066,000'of debentures into common stock in 1972 and 1971, respectively :<br />

Represented by :<br />

Net noncurrent assets of companies acquired, prineipally land and offtrac t<br />

improvements . .. . . . . .. . . . . . .. . . . . .. . . . .. . . . . .. . . . . . .. . . . .. . . . . ... . . : .. . . . ... . . . .. . . . . .. . . . .. . . . . .. . . . . .. . . . .. .. . . .. . . . . ..<br />

Cost in excess of net assets acquired . . . . .. . . . . .. . . . . .. . . . . .. . . . ... . . . .. . . ... . . . ... . . . . .. . . . . .. . . ... . . . . ... . . . ..<br />

Less, Amount invested in Mission Viejo Company in~1970 . . . .. . . . . .. . . . . .. . . . .. . . . . .... . . ..<br />

See notes totinancial sutements .<br />

<strong>http</strong>://<strong>legacy</strong>.<strong>library</strong>.<strong>ucsf</strong>.<strong>edu</strong>/<strong>tid</strong>/<strong>deg12a00</strong>/<strong>pdf</strong><br />

$ 21,004,00 0<br />

28 ;479,00 0<br />

.49,483,000<br />

$ 362,000 ,<br />

1,893,000<br />

2,255 ;000<br />

20,086,000<br />

S 29,397,000 $ 2,255,000