Effects of Wholesale Lending to SACCOs in Uganda - Rural Finance ...

Effects of Wholesale Lending to SACCOs in Uganda - Rural Finance ...

Effects of Wholesale Lending to SACCOs in Uganda - Rural Finance ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

We cannot, however, rush <strong>to</strong> argue that absolute growth is always a sign <strong>of</strong> strength and<br />

viability. In some <strong>in</strong>stances, stability may <strong>in</strong>dicate <strong>in</strong>stitutional strength.<br />

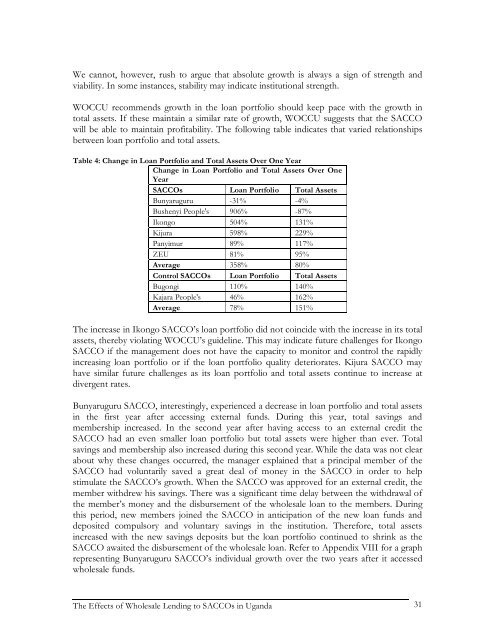

WOCCU recommends growth <strong>in</strong> the loan portfolio should keep pace with the growth <strong>in</strong><br />

<strong>to</strong>tal assets. If these ma<strong>in</strong>ta<strong>in</strong> a similar rate <strong>of</strong> growth, WOCCU suggests that the SACCO<br />

will be able <strong>to</strong> ma<strong>in</strong>ta<strong>in</strong> pr<strong>of</strong>itability. The follow<strong>in</strong>g table <strong>in</strong>dicates that varied relationships<br />

between loan portfolio and <strong>to</strong>tal assets.<br />

Table 4: Change <strong>in</strong> Loan Portfolio and Total Assets Over One Year<br />

Change <strong>in</strong> Loan Portfolio and Total Assets Over One<br />

Year<br />

<strong>SACCOs</strong> Loan Portfolio Total Assets<br />

Bunyaruguru -31% -4%<br />

Bushenyi People's 906% -87%<br />

Ikongo 504% 131%<br />

Kijura 598% 229%<br />

Panyimur 89% 117%<br />

ZEU 81% 95%<br />

Average 358% 80%<br />

Control <strong>SACCOs</strong> Loan Portfolio Total Assets<br />

Bugongi 110% 140%<br />

Kajara People's 46% 162%<br />

Average 78% 151%<br />

The <strong>in</strong>crease <strong>in</strong> Ikongo SACCO’s loan portfolio did not co<strong>in</strong>cide with the <strong>in</strong>crease <strong>in</strong> its <strong>to</strong>tal<br />

assets, thereby violat<strong>in</strong>g WOCCU’s guidel<strong>in</strong>e. This may <strong>in</strong>dicate future challenges for Ikongo<br />

SACCO if the management does not have the capacity <strong>to</strong> moni<strong>to</strong>r and control the rapidly<br />

<strong>in</strong>creas<strong>in</strong>g loan portfolio or if the loan portfolio quality deteriorates. Kijura SACCO may<br />

have similar future challenges as its loan portfolio and <strong>to</strong>tal assets cont<strong>in</strong>ue <strong>to</strong> <strong>in</strong>crease at<br />

divergent rates.<br />

Bunyaruguru SACCO, <strong>in</strong>terest<strong>in</strong>gly, experienced a decrease <strong>in</strong> loan portfolio and <strong>to</strong>tal assets<br />

<strong>in</strong> the first year after access<strong>in</strong>g external funds. Dur<strong>in</strong>g this year, <strong>to</strong>tal sav<strong>in</strong>gs and<br />

membership <strong>in</strong>creased. In the second year after hav<strong>in</strong>g access <strong>to</strong> an external credit the<br />

SACCO had an even smaller loan portfolio but <strong>to</strong>tal assets were higher than ever. Total<br />

sav<strong>in</strong>gs and membership also <strong>in</strong>creased dur<strong>in</strong>g this second year. While the data was not clear<br />

about why these changes occurred, the manager expla<strong>in</strong>ed that a pr<strong>in</strong>cipal member <strong>of</strong> the<br />

SACCO had voluntarily saved a great deal <strong>of</strong> money <strong>in</strong> the SACCO <strong>in</strong> order <strong>to</strong> help<br />

stimulate the SACCO’s growth. When the SACCO was approved for an external credit, the<br />

member withdrew his sav<strong>in</strong>gs. There was a significant time delay between the withdrawal <strong>of</strong><br />

the member’s money and the disbursement <strong>of</strong> the wholesale loan <strong>to</strong> the members. Dur<strong>in</strong>g<br />

this period, new members jo<strong>in</strong>ed the SACCO <strong>in</strong> anticipation <strong>of</strong> the new loan funds and<br />

deposited compulsory and voluntary sav<strong>in</strong>gs <strong>in</strong> the <strong>in</strong>stitution. Therefore, <strong>to</strong>tal assets<br />

<strong>in</strong>creased with the new sav<strong>in</strong>gs deposits but the loan portfolio cont<strong>in</strong>ued <strong>to</strong> shr<strong>in</strong>k as the<br />

SACCO awaited the disbursement <strong>of</strong> the wholesale loan. Refer <strong>to</strong> Appendix VIII for a graph<br />

represent<strong>in</strong>g Bunyaruguru SACCO’s <strong>in</strong>dividual growth over the two years after it accessed<br />

wholesale funds.<br />

The <strong>Effects</strong> <strong>of</strong> <strong>Wholesale</strong> <strong>Lend<strong>in</strong>g</strong> <strong>to</strong> <strong>SACCOs</strong> <strong>in</strong> <strong>Uganda</strong><br />

31