Abridged English version of the SCHUFA Credit Compass 2008

Abridged English version of the SCHUFA Credit Compass 2008

Abridged English version of the SCHUFA Credit Compass 2008

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

i<br />

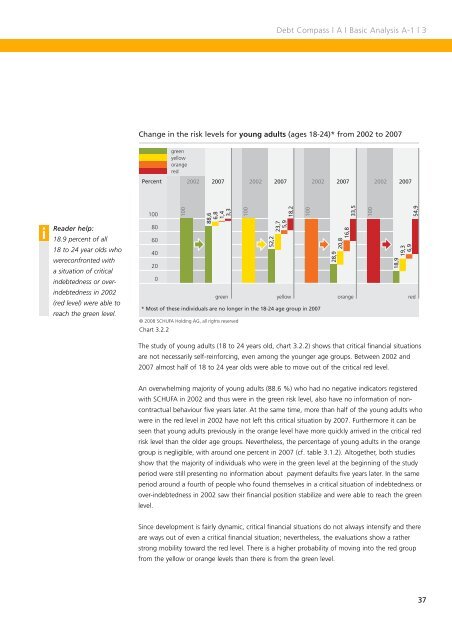

Reader help:<br />

18.9 percent <strong>of</strong> all<br />

18 to 24 year olds who<br />

wereconfronted with<br />

a situation <strong>of</strong> critical<br />

indebtedness or overindebtedness<br />

in 2002<br />

(red level) were able to<br />

reach <strong>the</strong> green level.<br />

Debt <strong>Compass</strong> | A | Basic Analysis A-1 | 3<br />

Change in <strong>the</strong> risk levels for young adults (ages 18-24)* from 2002 to 2007<br />

Percent<br />

green<br />

yellow<br />

orange<br />

red<br />

© <strong>2008</strong> <strong>SCHUFA</strong> Holding AG, all rights reserved<br />

Chart 3.2.2<br />

green yellow orange red<br />

* Most <strong>of</strong> <strong>the</strong>se individuals are no longer in <strong>the</strong> 18-24 age group in 2007<br />

The study <strong>of</strong> young adults (18 to 24 years old, chart 3.2.2) shows that critical financial situations<br />

are not necessarily self-reinforcing, even among <strong>the</strong> younger age groups. Between 2002 and<br />

2007 almost half <strong>of</strong> 18 to 24 year olds were able to move out <strong>of</strong> <strong>the</strong> critical red level.<br />

An overwhelming majority <strong>of</strong> young adults (88.6 %) who had no negative indicators registered<br />

with <strong>SCHUFA</strong> in 2002 and thus were in <strong>the</strong> green risk level, also have no information <strong>of</strong> noncontractual<br />

behaviour five years later. At <strong>the</strong> same time, more than half <strong>of</strong> <strong>the</strong> young adults who<br />

were in <strong>the</strong> red level in 2002 have not left this critical situation by 2007. Fur<strong>the</strong>rmore it can be<br />

seen that young adults previously in <strong>the</strong> orange level have more quickly arrived in <strong>the</strong> critical red<br />

risk level than <strong>the</strong> older age groups. Never<strong>the</strong>less, <strong>the</strong> percentage <strong>of</strong> young adults in <strong>the</strong> orange<br />

group is negligible, with around one percent in 2007 (cf. table 3.1.2). Altoge<strong>the</strong>r, both studies<br />

show that <strong>the</strong> majority <strong>of</strong> individuals who were in <strong>the</strong> green level at <strong>the</strong> beginning <strong>of</strong> <strong>the</strong> study<br />

period were still presenting no information about payment defaults five years later. In <strong>the</strong> same<br />

period around a fourth <strong>of</strong> people who found <strong>the</strong>mselves in a critical situation <strong>of</strong> indebtedness or<br />

over-indebtedness in 2002 saw <strong>the</strong>ir financial position stabilize and were able to reach <strong>the</strong> green<br />

level.<br />

Since development is fairly dynamic, critical financial situations do not always intensify and <strong>the</strong>re<br />

are ways out <strong>of</strong> even a critical financial situation; never<strong>the</strong>less, <strong>the</strong> evaluations show a ra<strong>the</strong>r<br />

strong mobility toward <strong>the</strong> red level. There is a higher probability <strong>of</strong> moving into <strong>the</strong> red group<br />

from <strong>the</strong> yellow or orange levels than <strong>the</strong>re is from <strong>the</strong> green level.<br />

37