printmgr file - Templeton

printmgr file - Templeton

printmgr file - Templeton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

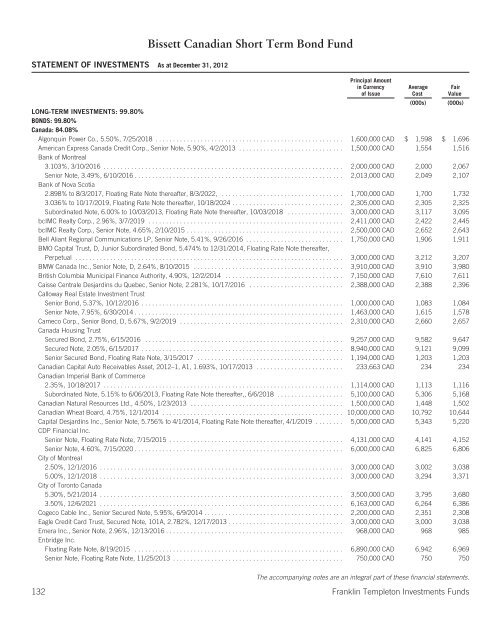

STATEMENT OF INVESTMENTS As at December 31, 2012<br />

Bissett Canadian Short Term Bond Fund<br />

Principal Amount<br />

in Currency<br />

of Issue<br />

(000s) (000s)<br />

LONG-TERM INVESTMENTS: 99.80%<br />

BONDS: 99.80%<br />

Canada: 84.08%<br />

Algonquin Power Co., 5.50%, 7/25/2018 ...................................................... 1,600,000 CAD $ 1,598 $ 1,696<br />

American Express Canada Credit Corp., Senior Note, 5.90%, 4/2/2013 ..............................<br />

Bank of Montreal<br />

1,500,000 CAD 1,554 1,516<br />

3.103%, 3/10/2016 ..................................................................... 2,000,000 CAD 2,000 2,067<br />

Senior Note, 3.49%, 6/10/2016 ............................................................<br />

Bank of Nova Scotia<br />

2,013,000 CAD 2,049 2,107<br />

2.898% to 8/3/2017, Floating Rate Note thereafter, 8/3/2022, ................................... 1,700,000 CAD 1,700 1,732<br />

3.036% to 10/17/2019, Floating Rate Note thereafter, 10/18/2024 ................................ 2,305,000 CAD 2,305 2,325<br />

Subordinated Note, 6.00% to 10/03/2013, Floating Rate Note thereafter, 10/03/2018 ................ 3,000,000 CAD 3,117 3,095<br />

bcIMC Realty Corp., 2.96%, 3/7/2019 ........................................................ 2,411,000 CAD 2,422 2,445<br />

bcIMC Realty Corp., Senior Note, 4.65%, 2/10/2015 ............................................. 2,500,000 CAD 2,652 2,643<br />

Bell Aliant Regional Communications LP, Senior Note, 5.41%, 9/26/2016 ............................<br />

BMO Capital Trust, D, Junior Subordinated Bond, 5.474% to 12/31/2014, Floating Rate Note thereafter,<br />

1,750,000 CAD 1,906 1,911<br />

Perpetual ............................................................................. 3,000,000 CAD 3,212 3,207<br />

BMW Canada Inc., Senior Note, D, 2.64%, 8/10/2015 ........................................... 3,910,000 CAD 3,910 3,980<br />

British Columbia Municipal Finance Authority, 4.90%, 12/2/2014 .................................. 7,150,000 CAD 7,610 7,611<br />

Caisse Centrale Desjardins du Quebec, Senior Note, 2.281%, 10/17/2016 ...........................<br />

Calloway Real Estate Investment Trust<br />

2,388,000 CAD 2,388 2,396<br />

Senior Bond, 5.37%, 10/12/2016 .......................................................... 1,000,000 CAD 1,083 1,084<br />

Senior Note, 7.95%, 6/30/2014 ............................................................ 1,463,000 CAD 1,615 1,578<br />

Cameco Corp., Senior Bond, D, 5.67%, 9/2/2019 ...............................................<br />

Canada Housing Trust<br />

2,310,000 CAD 2,660 2,657<br />

Secured Bond, 2.75%, 6/15/2016 ......................................................... 9,257,000 CAD 9,582 9,647<br />

Secured Note, 2.05%, 6/15/2017 .......................................................... 8,940,000 CAD 9,121 9,099<br />

Senior Secured Bond, Floating Rate Note, 3/15/2017 .......................................... 1,194,000 CAD 1,203 1,203<br />

Canadian Capital Auto Receivables Asset, 2012–1, A1, 1.693%, 10/17/2013 .........................<br />

Canadian Imperial Bank of Commerce<br />

233,663 CAD 234 234<br />

2.35%, 10/18/2017 ..................................................................... 1,114,000 CAD 1,113 1,116<br />

Subordinated Note, 5.15% to 6/06/2013, Floating Rate Note thereafter,, 6/6/2018 ................... 5,100,000 CAD 5,306 5,168<br />

Canadian Natural Resources Ltd., 4.50%, 1/23/2013 ............................................ 1,500,000 CAD 1,448 1,502<br />

Canadian Wheat Board, 4.75%, 12/1/2014 .................................................... 10,000,000 CAD 10,792 10,644<br />

Capital Desjardins Inc., Senior Note, 5.756% to 4/1/2014, Floating Rate Note thereafter, 4/1/2019 ........<br />

CDP Financial Inc.<br />

5,000,000 CAD 5,343 5,220<br />

Senior Note, Floating Rate Note, 7/15/2015 .................................................. 4,131,000 CAD 4,141 4,152<br />

Senior Note, 4.60%, 7/15/2020 ............................................................<br />

City of Montreal<br />

6,000,000 CAD 6,825 6,806<br />

2.50%, 12/1/2016 ...................................................................... 3,000,000 CAD 3,002 3,038<br />

5.00%, 12/1/2018 ......................................................................<br />

City of Toronto Canada<br />

3,000,000 CAD 3,294 3,371<br />

5.30%, 5/21/2014 ...................................................................... 3,500,000 CAD 3,795 3,680<br />

3.50%, 12/6/2021 ...................................................................... 6,163,000 CAD 6,264 6,386<br />

Cogeco Cable Inc., Senior Secured Note, 5.95%, 6/9/2014 ........................................ 2,200,000 CAD 2,351 2,308<br />

Eagle Credit Card Trust, Secured Note, 101A, 2.782%, 12/17/2013 ................................. 3,000,000 CAD 3,000 3,038<br />

Emera Inc., Senior Note, 2.96%, 12/13/2016 ...................................................<br />

Enbridge Inc.<br />

968,000 CAD 968 985<br />

Floating Rate Note, 8/19/2015 ............................................................ 6,890,000 CAD 6,942 6,969<br />

Senior Note, Floating Rate Note, 11/25/2013 ................................................. 750,000 CAD 750 750<br />

Average<br />

Cost<br />

Fair<br />

Value<br />

The accompanying notes are an integral part of these financial statements.<br />

132 Franklin <strong>Templeton</strong> Investments Funds