printmgr file - Templeton

printmgr file - Templeton

printmgr file - Templeton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

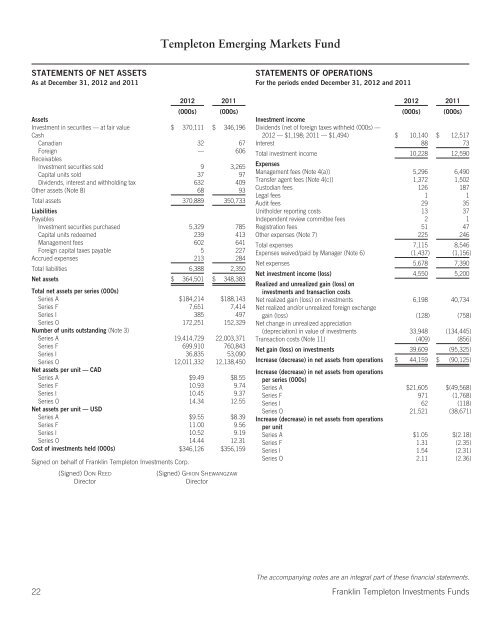

STATEMENTS OF NET ASSETS<br />

As at December 31, 2012 and 2011<br />

2012 2011<br />

(000s) (000s)<br />

Assets<br />

Investment in securities — at fair value<br />

Cash<br />

$ 370,111 $ 346,196<br />

Canadian 32 67<br />

Foreign<br />

Receivables<br />

— 606<br />

Investment securities sold 9 3,265<br />

Capital units sold 37 97<br />

Dividends, interest and withholding tax 632 409<br />

Other assets (Note 8) 68 93<br />

Total assets<br />

Liabilities<br />

Payables<br />

370,889 350,733<br />

Investment securities purchased 5,329 785<br />

Capital units redeemed 239 413<br />

Management fees 602 641<br />

Foreign capital taxes payable 5 227<br />

Accrued expenses 213 284<br />

Total liabilities 6,388 2,350<br />

Net assets $ 364,501 $ 348,383<br />

Total net assets per series (000s)<br />

Series A $184,214 $188,143<br />

Series F 7,651 7,414<br />

Series I 385 497<br />

Series O 172,251 152,329<br />

Number of units outstanding (Note 3)<br />

Series A 19,414,729 22,003,371<br />

Series F 699,910 760,843<br />

Series I 36,835 53,090<br />

Series O 12,011,332 12,138,450<br />

Net assets per unit — CAD<br />

Series A $9.49 $8.55<br />

Series F 10.93 9.74<br />

Series I 10.45 9.37<br />

Series O 14.34 12.55<br />

Net assets per unit — USD<br />

Series A $9.55 $8.39<br />

Series F 11.00 9.56<br />

Series I 10.52 9.19<br />

Series O 14.44 12.31<br />

Cost of investments held (000s) $346,126 $356,159<br />

Signed on behalf of Franklin <strong>Templeton</strong> Investments Corp.<br />

(Signed) DON REED<br />

Director<br />

<strong>Templeton</strong> Emerging Markets Fund<br />

(Signed) GHION SHEWANGZAW<br />

Director<br />

STATEMENTS OF OPERATIONS<br />

For the periods ended December 31, 2012 and 2011<br />

2012 2011<br />

(000s) (000s)<br />

Investment income<br />

Dividends (net of foreign taxes withheld (000s) —<br />

2012 — $1,198; 2011 — $1,494) $ 10,140 $ 12,517<br />

Interest 88 73<br />

Total investment income<br />

Expenses<br />

10,228 12,590<br />

Management fees (Note 4(a)) 5,296 6,490<br />

Transfer agent fees (Note 4(c)) 1,372 1,502<br />

Custodian fees 126 187<br />

Legal fees 1 1<br />

Audit fees 29 35<br />

Unitholder reporting costs 13 37<br />

Independent review committee fees 2 1<br />

Registration fees 51 47<br />

Other expenses (Note 7) 225 246<br />

Total expenses 7,115 8,546<br />

Expenses waived/paid by Manager (Note 6) (1,437) (1,156)<br />

Net expenses 5,678 7,390<br />

Net investment income (loss) 4,550 5,200<br />

Realized and unrealized gain (loss) on<br />

investments and transaction costs<br />

Net realized gain (loss) on investments<br />

Net realized and/or unrealized foreign exchange<br />

6,198 40,734<br />

gain (loss)<br />

Net change in unrealized appreciation<br />

(128) (758)<br />

(depreciation) in value of investments 33,948 (134,445)<br />

Transaction costs (Note 11) (409) (856)<br />

Net gain (loss) on investments 39,609 (95,325)<br />

Increase (decrease) in net assets from operations $ 44,159 $ (90,125)<br />

Increase (decrease) in net assets from operations<br />

per series (000s)<br />

Series A $21,605 $(49,568)<br />

Series F 971 (1,768)<br />

Series I 62 (118)<br />

Series O 21,521 (38,671)<br />

Increase (decrease) in net assets from operations<br />

per unit<br />

Series A $1.05 $(2.18)<br />

Series F 1.31 (2.35)<br />

Series I 1.54 (2.31)<br />

Series O 2.11 (2.36)<br />

The accompanying notes are an integral part of these financial statements.<br />

22 Franklin <strong>Templeton</strong> Investments Funds