printmgr file - Templeton

printmgr file - Templeton

printmgr file - Templeton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Franklin <strong>Templeton</strong> Investments Funds<br />

NOTES TO FINANCIAL STATEMENTS For the periods ended December 31, 2012 and 2011 (Continued)<br />

10. Financial Risk Management (Continued)<br />

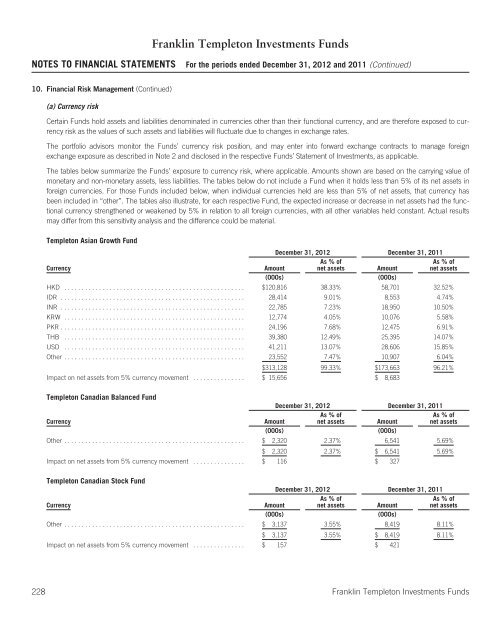

(a) Currency risk<br />

Certain Funds hold assets and liabilities denominated in currencies other than their functional currency, and are therefore exposed to currency<br />

risk as the values of such assets and liabilities will fluctuate due to changes in exchange rates.<br />

The portfolio advisors monitor the Funds’ currency risk position, and may enter into forward exchange contracts to manage foreign<br />

exchange exposure as described in Note 2 and disclosed in the respective Funds’ Statement of Investments, as applicable.<br />

The tables below summarize the Funds’ exposure to currency risk, where applicable. Amounts shown are based on the carrying value of<br />

monetary and non-monetary assets, less liabilities. The tables below do not include a Fund when it holds less than 5% of its net assets in<br />

foreign currencies. For those Funds included below, when individual currencies held are less than 5% of net assets, that currency has<br />

been included in “other”. The tables also illustrate, for each respective Fund, the expected increase or decrease in net assets had the functional<br />

currency strengthened or weakened by 5% in relation to all foreign currencies, with all other variables held constant. Actual results<br />

may differ from this sensitivity analysis and the difference could be material.<br />

<strong>Templeton</strong> Asian Growth Fund<br />

December 31, 2012 December 31, 2011<br />

As % of<br />

As % of<br />

Currency Amount net assets Amount net assets<br />

(000s) (000s)<br />

HKD .................................................... $120,816 38.33% 58,701 32.52%<br />

IDR ..................................................... 28,414 9.01% 8,553 4.74%<br />

INR ..................................................... 22,785 7.23% 18,950 10.50%<br />

KRW .................................................... 12,774 4.05% 10,076 5.58%<br />

PKR..................................................... 24,196 7.68% 12,475 6.91%<br />

THB .................................................... 39,380 12.49% 25,395 14.07%<br />

USD .................................................... 41,211 13.07% 28,606 15.85%<br />

Other .................................................... 23,552 7.47% 10,907 6.04%<br />

$313,128 99.33% $173,663 96.21%<br />

Impact on net assets from 5% currency movement ............... $ 15,656 $ 8,683<br />

<strong>Templeton</strong> Canadian Balanced Fund<br />

December 31, 2012 December 31, 2011<br />

Currency Amount<br />

As % of<br />

net assets Amount<br />

As % of<br />

net assets<br />

(000s) (000s)<br />

Other .................................................... $ 2,320 2.37% 6,541 5.69%<br />

$ 2,320 2.37% $ 6,541 5.69%<br />

Impact on net assets from 5% currency movement ............... $ 116 $ 327<br />

<strong>Templeton</strong> Canadian Stock Fund<br />

December 31, 2012 December 31, 2011<br />

As % of<br />

As % of<br />

Currency Amount net assets Amount net assets<br />

(000s) (000s)<br />

Other .................................................... $ 3,137 3.55% 8,419 8.11%<br />

$ 3,137 3.55% $ 8,419 8.11%<br />

Impact on net assets from 5% currency movement ............... $ 157 $ 421<br />

228 Franklin <strong>Templeton</strong> Investments Funds