printmgr file - Templeton

printmgr file - Templeton

printmgr file - Templeton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

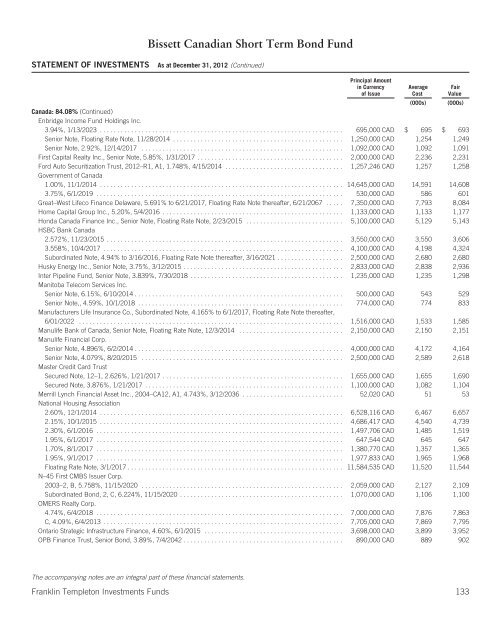

Bissett Canadian Short Term Bond Fund<br />

STATEMENT OF INVESTMENTS As at December 31, 2012 (Continued)<br />

Principal Amount<br />

in Currency<br />

of Issue<br />

(000s) (000s)<br />

Canada: 84.08% (Continued)<br />

Enbridge Income Fund Holdings Inc.<br />

3.94%, 1/13/2023 ...................................................................... 695,000 CAD $ 695 $ 693<br />

Senior Note, Floating Rate Note, 11/28/2014 ................................................. 1,250,000 CAD 1,254 1,249<br />

Senior Note, 2.92%, 12/14/2017 .......................................................... 1,092,000 CAD 1,092 1,091<br />

First Capital Realty Inc., Senior Note, 5.85%, 1/31/2017 .......................................... 2,000,000 CAD 2,236 2,231<br />

Ford Auto Securitization Trust, 2012–R1, A1, 1.748%, 4/15/2014 ..................................<br />

Government of Canada<br />

1,257,246 CAD 1,257 1,258<br />

1.00%, 11/1/2014 ...................................................................... 14,645,000 CAD 14,591 14,608<br />

3.75%, 6/1/2019 ....................................................................... 530,000 CAD 586 601<br />

Great–West Lifeco Finance Delaware, 5.691% to 6/21/2017, Floating Rate Note thereafter, 6/21/2067 ..... 7,350,000 CAD 7,793 8,084<br />

Home Capital Group Inc., 5.20%, 5/4/2016 .................................................... 1,133,000 CAD 1,133 1,177<br />

Honda Canada Finance Inc., Senior Note, Floating Rate Note, 2/23/2015 ............................<br />

HSBC Bank Canada<br />

5,100,000 CAD 5,129 5,143<br />

2.572%, 11/23/2015 .................................................................... 3,550,000 CAD 3,550 3,606<br />

3.558%, 10/4/2017 ..................................................................... 4,100,000 CAD 4,198 4,324<br />

Subordinated Note, 4.94% to 3/16/2016, Floating Rate Note thereafter, 3/16/2021 ................... 2,500,000 CAD 2,680 2,680<br />

Husky Energy Inc., Senior Note, 3.75%, 3/12/2015 .............................................. 2,833,000 CAD 2,838 2,936<br />

Inter Pipeline Fund, Senior Note, 3.839%, 7/30/2018 ............................................<br />

Manitoba Telecom Services Inc.<br />

1,235,000 CAD 1,235 1,298<br />

Senior Note, 6.15%, 6/10/2014 ............................................................ 500,000 CAD 543 529<br />

Senior Note,, 4.59%, 10/1/2018 ...........................................................<br />

Manufacturers Life Insurance Co., Subordinated Note, 4.165% to 6/1/2017, Floating Rate Note thereafter,<br />

774,000 CAD 774 833<br />

6/01/2022 ............................................................................ 1,516,000 CAD 1,533 1,585<br />

Manulife Bank of Canada, Senior Note, Floating Rate Note, 12/3/2014 ..............................<br />

Manulife Financial Corp.<br />

2,150,000 CAD 2,150 2,151<br />

Senior Note, 4.896%, 6/2/2014 ............................................................ 4,000,000 CAD 4,172 4,164<br />

Senior Note, 4.079%, 8/20/2015 ..........................................................<br />

Master Credit Card Trust<br />

2,500,000 CAD 2,589 2,618<br />

Secured Note, 12–1, 2.626%, 1/21/2017 .................................................... 1,655,000 CAD 1,655 1,690<br />

Secured Note, 3.876%, 1/21/2017 ......................................................... 1,100,000 CAD 1,082 1,104<br />

Merrill Lynch Financial Asset Inc., 2004–CA12, A1, 4.743%, 3/12/2036 .............................<br />

National Housing Association<br />

52,020 CAD 51 53<br />

2.60%, 12/1/2014 ...................................................................... 6,528,116 CAD 6,467 6,657<br />

2.15%, 10/1/2015 ...................................................................... 4,686,417 CAD 4,540 4,739<br />

2.30%, 6/1/2016 ....................................................................... 1,497,706 CAD 1,485 1,519<br />

1.95%, 6/1/2017 ....................................................................... 647,544 CAD 645 647<br />

1.70%, 8/1/2017 ....................................................................... 1,380,770 CAD 1,357 1,365<br />

1.95%, 9/1/2017 ....................................................................... 1,977,833 CAD 1,965 1,968<br />

Floating Rate Note, 3/1/2017 ..............................................................<br />

N–45 First CMBS Issuer Corp.<br />

11,584,535 CAD 11,520 11,544<br />

2003–2, B, 5.758%, 11/15/2020 .......................................................... 2,059,000 CAD 2,127 2,109<br />

Subordinated Bond, 2, C, 6.224%, 11/15/2020 ...............................................<br />

OMERS Realty Corp.<br />

1,070,000 CAD 1,106 1,100<br />

4.74%, 6/4/2018 ....................................................................... 7,000,000 CAD 7,876 7,863<br />

C, 4.09%, 6/4/2013 ..................................................................... 7,705,000 CAD 7,869 7,795<br />

Ontario Strategic Infrastructure Finance, 4.60%, 6/1/2015 ........................................ 3,698,000 CAD 3,899 3,952<br />

OPB Finance Trust, Senior Bond, 3.89%, 7/4/2042 .............................................. 890,000 CAD 889 902<br />

The accompanying notes are an integral part of these financial statements.<br />

Franklin <strong>Templeton</strong> Investments Funds 133<br />

Average<br />

Cost<br />

Fair<br />

Value