printmgr file - Templeton

printmgr file - Templeton

printmgr file - Templeton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

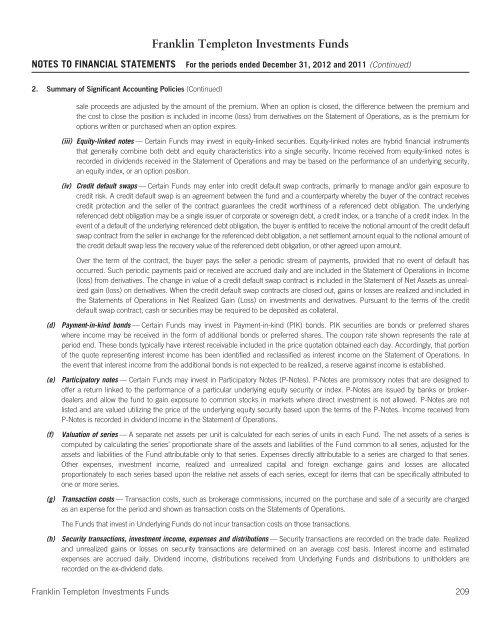

Franklin <strong>Templeton</strong> Investments Funds<br />

NOTES TO FINANCIAL STATEMENTS For the periods ended December 31, 2012 and 2011 (Continued)<br />

2. Summary of Significant Accounting Policies (Continued)<br />

sale proceeds are adjusted by the amount of the premium. When an option is closed, the difference between the premium and<br />

the cost to close the position is included in income (loss) from derivatives on the Statement of Operations, as is the premium for<br />

options written or purchased when an option expires.<br />

(iii) Equity-linked notes — Certain Funds may invest in equity-linked securities. Equity-linked notes are hybrid financial instruments<br />

that generally combine both debt and equity characteristics into a single security. Income received from equity-linked notes is<br />

recorded in dividends received in the Statement of Operations and may be based on the performance of an underlying security,<br />

an equity index, or an option position.<br />

(iv) Credit default swaps — Certain Funds may enter into credit default swap contracts, primarily to manage and/or gain exposure to<br />

credit risk. A credit default swap is an agreement between the fund and a counterparty whereby the buyer of the contract receives<br />

credit protection and the seller of the contract guarantees the credit worthiness of a referenced debt obligation. The underlying<br />

referenced debt obligation may be a single issuer of corporate or sovereign debt, a credit index, or a tranche of a credit index. In the<br />

event of a default of the underlying referenced debt obligation, the buyer is entitled to receive the notional amount of the credit default<br />

swap contract from the seller in exchange for the referenced debt obligation, a net settlement amount equal to the notional amount of<br />

the credit default swap less the recovery value of the referenced debt obligation, or other agreed upon amount.<br />

Over the term of the contract, the buyer pays the seller a periodic stream of payments, provided that no event of default has<br />

occurred. Such periodic payments paid or received are accrued daily and are included in the Statement of Operations in Income<br />

(loss) from derivatives. The change in value of a credit default swap contract is included in the Statement of Net Assets as unrealized<br />

gain (loss) on derivatives. When the credit default swap contracts are closed out, gains or losses are realized and included in<br />

the Statements of Operations in Net Realized Gain (Loss) on investments and derivatives. Pursuant to the terms of the credit<br />

default swap contract, cash or securities may be required to be deposited as collateral.<br />

(d) Payment-in-kind bonds — Certain Funds may invest in Payment-in-kind (PIK) bonds. PIK securities are bonds or preferred shares<br />

where income may be received in the form of additional bonds or preferred shares. The coupon rate shown represents the rate at<br />

period end. These bonds typically have interest receivable included in the price quotation obtained each day. Accordingly, that portion<br />

of the quote representing interest income has been identified and reclassified as interest income on the Statement of Operations. In<br />

the event that interest income from the additional bonds is not expected to be realized, a reserve against income is established.<br />

(e) Participatory notes — Certain Funds may invest in Participatory Notes (P-Notes). P-Notes are promissory notes that are designed to<br />

offer a return linked to the performance of a particular underlying equity security or index. P-Notes are issued by banks or brokerdealers<br />

and allow the fund to gain exposure to common stocks in markets where direct investment is not allowed. P-Notes are not<br />

listed and are valued utilizing the price of the underlying equity security based upon the terms of the P-Notes. Income received from<br />

P-Notes is recorded in dividend income in the Statement of Operations.<br />

(f) Valuation of series — A separate net assets per unit is calculated for each series of units in each Fund. The net assets of a series is<br />

computed by calculating the series’ proportionate share of the assets and liabilities of the Fund common to all series, adjusted for the<br />

assets and liabilities of the Fund attributable only to that series. Expenses directly attributable to a series are charged to that series.<br />

Other expenses, investment income, realized and unrealized capital and foreign exchange gains and losses are allocated<br />

proportionately to each series based upon the relative net assets of each series, except for items that can be specifically attributed to<br />

one or more series.<br />

(g) Transaction costs — Transaction costs, such as brokerage commissions, incurred on the purchase and sale of a security are charged<br />

as an expense for the period and shown as transaction costs on the Statements of Operations.<br />

The Funds that invest in Underlying Funds do not incur transaction costs on those transactions.<br />

(h) Security transactions, investment income, expenses and distributions — Security transactions are recorded on the trade date. Realized<br />

and unrealized gains or losses on security transactions are determined on an average cost basis. Interest income and estimated<br />

expenses are accrued daily. Dividend income, distributions received from Underlying Funds and distributions to unitholders are<br />

recorded on the ex-dividend date.<br />

Franklin <strong>Templeton</strong> Investments Funds 209