printmgr file - Templeton

printmgr file - Templeton

printmgr file - Templeton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

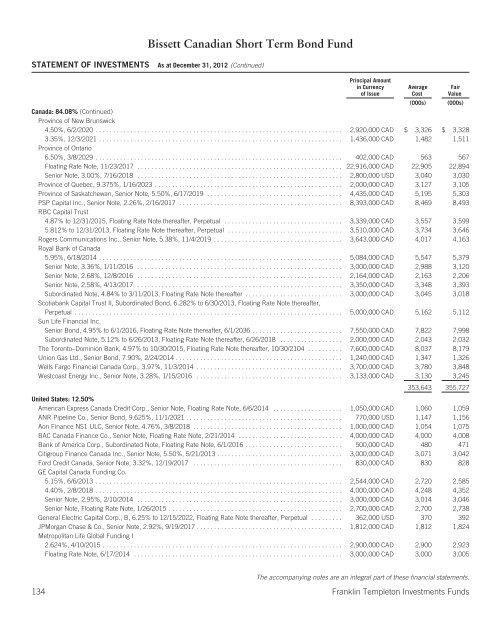

Bissett Canadian Short Term Bond Fund<br />

STATEMENT OF INVESTMENTS As at December 31, 2012 (Continued)<br />

Principal Amount<br />

in Currency<br />

of Issue<br />

(000s) (000s)<br />

Canada: 84.08% (Continued)<br />

Province of New Brunswick<br />

4.50%, 6/2/2020 ....................................................................... 2,920,000 CAD $ 3,326 $ 3,328<br />

3.35%, 12/3/2021 ......................................................................<br />

Province of Ontario<br />

1,436,000 CAD 1,482 1,511<br />

6.50%, 3/8/2029 ....................................................................... 402,000 CAD 563 567<br />

Floating Rate Note, 11/23/2017 ........................................................... 22,916,000 CAD 22,905 22,894<br />

Senior Note, 3.00%, 7/16/2018 ........................................................... 2,800,000 USD 3,040 3,030<br />

Province of Quebec, 9.375%, 1/16/2023 ...................................................... 2,000,000 CAD 3,127 3,105<br />

Province of Saskatchewan, Senior Note, 5.50%, 6/17/2019 ....................................... 4,435,000 CAD 5,195 5,303<br />

PSP Capital Inc., Senior Note, 2.26%, 2/16/2017 ...............................................<br />

RBC Capital Trust<br />

8,393,000 CAD 8,469 8,493<br />

4.87% to 12/31/2015, Floating Rate Note thereafter, Perpetual .................................. 3,339,000 CAD 3,557 3,599<br />

5.812% to 12/31/2013, Floating Rate Note thereafter, Perpetual ................................. 3,510,000 CAD 3,734 3,646<br />

Rogers Communications Inc., Senior Note, 5.38%, 11/4/2019 .....................................<br />

Royal Bank of Canada<br />

3,643,000 CAD 4,017 4,163<br />

5.95%, 6/18/2014 ...................................................................... 5,084,000 CAD 5,547 5,379<br />

Senior Note, 3.36%, 1/11/2016 ........................................................... 3,000,000 CAD 2,988 3,120<br />

Senior Note, 2.68%, 12/8/2016 ........................................................... 2,164,000 CAD 2,163 2,206<br />

Senior Note, 2.58%, 4/13/2017 ........................................................... 3,350,000 CAD 3,348 3,393<br />

Subordinated Note, 4.84% to 3/11/2013, Floating Rate Note thereafter ............................<br />

Scotiabank Capital Trust II, Subordinated Bond, 6.282% to 6/30/2013, Floating Rate Note thereafter,<br />

3,000,000 CAD 3,045 3,018<br />

Perpetual .............................................................................<br />

Sun Life Financial Inc.<br />

5,000,000 CAD 5,162 5,112<br />

Senior Bond, 4.95% to 6/1/2016, Floating Rate Note thereafter, 6/1/2036 .......................... 7,550,000 CAD 7,822 7,998<br />

Subordinated Note, 5.12% to 6/26/2013, Floating Rate Note thereafter, 6/26/2018 .................. 2,000,000 CAD 2,043 2,032<br />

The Toronto–Dominion Bank, 4.97% to 10/30/2015, Floating Rate Note thereafter, 10/30/2104 .......... 7,600,000 CAD 8,037 8,179<br />

Union Gas Ltd., Senior Bond, 7.90%, 2/24/2014 ................................................ 1,240,000 CAD 1,347 1,326<br />

Wells Fargo Financial Canada Corp., 3.97%, 11/3/2014 .......................................... 3,700,000 CAD 3,780 3,848<br />

Westcoast Energy Inc., Senior Note, 3.28%, 1/15/2016 .......................................... 3,133,000 CAD 3,130 3,245<br />

Average<br />

Cost<br />

Fair<br />

Value<br />

353,643 355,727<br />

United States: 12.50%<br />

American Express Canada Credit Corp., Senior Note, Floating Rate Note, 6/6/2014 .................... 1,050,000 CAD 1,060 1,059<br />

ANR Pipeline Co., Senior Bond, 9.625%, 11/1/2021 ............................................. 770,000 USD 1,147 1,156<br />

Aon Finance NS1 ULC, Senior Note, 4.76%, 3/8/2018 ........................................... 1,000,000 CAD 1,054 1,075<br />

BAC Canada Finance Co., Senior Note, Floating Rate Note, 2/21/2014 .............................. 4,000,000 CAD 4,000 4,008<br />

Bank of America Corp., Subordinated Note, Floating Rate Note, 6/1/2016 ............................ 500,000 CAD 480 471<br />

Citigroup Finance Canada Inc., Senior Note, 5.50%, 5/21/2013 .................................... 3,000,000 CAD 3,071 3,042<br />

Ford Credit Canada, Senior Note, 3.32%, 12/19/2017 ........................................... 830,000 CAD 830 828<br />

GE Capital Canada Funding Co.<br />

5.15%, 6/6/2013 ....................................................................... 2,544,000 CAD 2,720 2,585<br />

4.40%, 2/8/2018 ....................................................................... 4,000,000 CAD 4,248 4,352<br />

Senior Note, 2.95%, 2/10/2014 ........................................................... 3,000,000 CAD 3,014 3,046<br />

Senior Note, Floating Rate Note, 1/26/2015 .................................................. 2,700,000 CAD 2,700 2,738<br />

General Electric Capital Corp., B, 6.25% to 12/15/2022, Floating Rate Note thereafter, Perpetual ......... 362,000 USD 370 392<br />

JPMorgan Chase & Co., Senior Note, 2.92%, 9/19/2017 .......................................... 1,812,000 CAD 1,812 1,824<br />

Metropolitan Life Global Funding I<br />

2.624%, 4/10/2015 ..................................................................... 2,900,000 CAD 2,900 2,923<br />

Floating Rate Note, 6/17/2014 ............................................................ 3,000,000 CAD 3,000 3,005<br />

The accompanying notes are an integral part of these financial statements.<br />

134 Franklin <strong>Templeton</strong> Investments Funds