printmgr file - Templeton

printmgr file - Templeton

printmgr file - Templeton

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

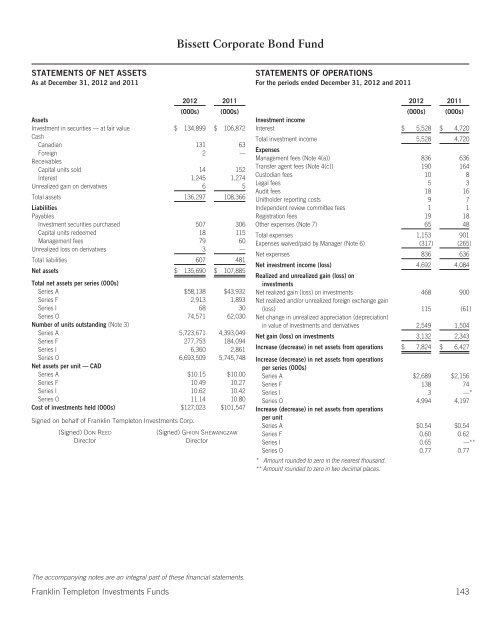

STATEMENTS OF NET ASSETS<br />

As at December 31, 2012 and 2011<br />

2012 2011<br />

(000s) (000s)<br />

Assets<br />

Investment in securities — at fair value<br />

Cash<br />

$ 134,899 $ 106,872<br />

Canadian 131 63<br />

Foreign<br />

Receivables<br />

2 —<br />

Capital units sold 14 152<br />

Interest 1,245 1,274<br />

Unrealized gain on derivatives 6 5<br />

Total assets<br />

Liabilities<br />

Payables<br />

136,297 108,366<br />

Investment securities purchased 507 306<br />

Capital units redeemed 18 115<br />

Management fees 79 60<br />

Unrealized loss on derivatives 3 —<br />

Total liabilities 607 481<br />

Net assets $ 135,690 $ 107,885<br />

Total net assets per series (000s)<br />

Series A $58,138 $43,932<br />

Series F 2,913 1,893<br />

Series I 68 30<br />

Series O 74,571 62,030<br />

Number of units outstanding (Note 3)<br />

Series A 5,723,671 4,393,049<br />

Series F 277,753 184,094<br />

Series I 6,360 2,861<br />

Series O 6,693,509 5,745,748<br />

Net assets per unit — CAD<br />

Series A $10.15 $10.00<br />

Series F 10.49 10.27<br />

Series I 10.62 10.42<br />

Series O 11.14 10.80<br />

Cost of investments held (000s) $127,023 $101,547<br />

Signed on behalf of Franklin <strong>Templeton</strong> Investments Corp.<br />

(Signed) DON REED<br />

Director<br />

Bissett Corporate Bond Fund<br />

(Signed) GHION SHEWANGZAW<br />

Director<br />

The accompanying notes are an integral part of these financial statements.<br />

STATEMENTS OF OPERATIONS<br />

For the periods ended December 31, 2012 and 2011<br />

2012 2011<br />

(000s) (000s)<br />

Investment income<br />

Interest $ 5,528 $ 4,720<br />

Total investment income<br />

Expenses<br />

5,528 4,720<br />

Management fees (Note 4(a)) 836 636<br />

Transfer agent fees (Note 4(c)) 190 164<br />

Custodian fees 10 8<br />

Legal fees 5 3<br />

Audit fees 18 16<br />

Unitholder reporting costs 9 7<br />

Independent review committee fees 1 1<br />

Registration fees 19 18<br />

Other expenses (Note 7) 65 48<br />

Total expenses 1,153 901<br />

Expenses waived/paid by Manager (Note 6) (317) (265)<br />

Net expenses 836 636<br />

Net investment income (loss) 4,692 4,084<br />

Realized and unrealized gain (loss) on<br />

investments<br />

Net realized gain (loss) on investments<br />

Net realized and/or unrealized foreign exchange gain<br />

468 900<br />

(loss)<br />

Net change in unrealized appreciation (depreciation)<br />

115 (61)<br />

in value of investments and derivatives 2,549 1,504<br />

Net gain (loss) on investments 3,132 2,343<br />

Increase (decrease) in net assets from operations $ 7,824 $ 6,427<br />

Increase (decrease) in net assets from operations<br />

per series (000s)<br />

Series A $2,689 $2,156<br />

Series F 138 74<br />

Series I 3 —*<br />

Series O<br />

Increase (decrease) in net assets from operations<br />

per unit<br />

4,994 4,197<br />

Series A $0.54 $0.54<br />

Series F 0.60 0.62<br />

Series I 0.65 —**<br />

Series O 0.77 0.77<br />

* Amount rounded to zero in the nearest thousand.<br />

** Amount rounded to zero in two decimal places.<br />

Franklin <strong>Templeton</strong> Investments Funds 143