printmgr file - Templeton

printmgr file - Templeton

printmgr file - Templeton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

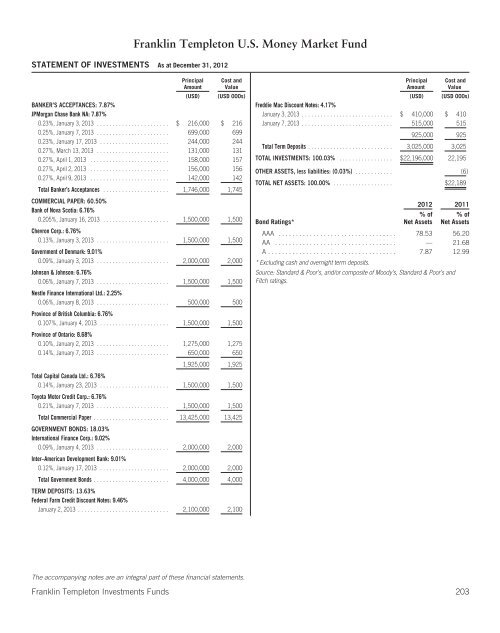

STATEMENT OF INVESTMENTS As at December 31, 2012<br />

Franklin <strong>Templeton</strong> U.S. Money Market Fund<br />

Principal<br />

Amount<br />

Cost and<br />

Value<br />

(USD) (USD 000s)<br />

BANKER’S ACCEPTANCES: 7.87%<br />

JPMorgan Chase Bank NA: 7.87%<br />

0.23%, January 3, 2013 ....................... $ 216,000 $ 216<br />

0.25%, January 7, 2013 ....................... 699,000 699<br />

0.23%, January 17, 2013 . ..................... 244,000 244<br />

0.27%, March 13, 2013 ....................... 131,000 131<br />

0.27%, April 1, 2013 . ........................ 158,000 157<br />

0.27%, April 2, 2013 . ........................ 156,000 156<br />

0.27%, April 9, 2013 . ........................ 142,000 142<br />

Total Banker’s Acceptances ..................... 1,746,000 1,745<br />

COMMERCIAL PAPER: 60.50%<br />

Bank of Nova Scotia: 6.76%<br />

0.205%, January 16, 2013 ..................... 1,500,000 1,500<br />

Chevron Corp.: 6.76%<br />

0.13%, January 3, 2013 ....................... 1,500,000 1,500<br />

Government of Denmark: 9.01%<br />

0.09%, January 3, 2013 ....................... 2,000,000 2,000<br />

Johnson & Johnson: 6.76%<br />

0.06%, January 7, 2013 ....................... 1,500,000 1,500<br />

Nestle Finance International Ltd.: 2.25%<br />

0.06%, January 8, 2013 ....................... 500,000 500<br />

Province of British Columbia: 6.76%<br />

0.107%, January 4, 2013 . ..................... 1,500,000 1,500<br />

Province of Ontario: 8.68%<br />

0.10%, January 2, 2013 ....................... 1,275,000 1,275<br />

0.14%, January 7, 2013 ....................... 650,000 650<br />

1,925,000 1,925<br />

Total Capital Canada Ltd.: 6.76%<br />

0.14%, January 23, 2013 . ..................... 1,500,000 1,500<br />

Toyota Motor Credit Corp.: 6.76%<br />

0.21%, January 7, 2013 ....................... 1,500,000 1,500<br />

Total Commercial Paper ........................ 13,425,000 13,425<br />

GOVERNMENT BONDS: 18.03%<br />

International Finance Corp.: 9.02%<br />

0.09%, January 4, 2013 ....................... 2,000,000 2,000<br />

Inter–American Development Bank: 9.01%<br />

0.12%, January 17, 2013 . ..................... 2,000,000 2,000<br />

Total Government Bonds ........................ 4,000,000 4,000<br />

TERM DEPOSITS: 13.63%<br />

Federal Farm Credit Discount Notes: 9.46%<br />

January 2, 2013 ............................. 2,100,000 2,100<br />

The accompanying notes are an integral part of these financial statements.<br />

Principal<br />

Amount<br />

Cost and<br />

Value<br />

(USD) (USD 000s)<br />

Freddie Mac Discount Notes: 4.17%<br />

January 3, 2013 ............................. $ 410,000 $ 410<br />

January 7, 2013 ............................. 515,000 515<br />

925,000 925<br />

Total Term Deposits ........................... 3,025,000 3,025<br />

TOTAL INVESTMENTS: 100.03% ................. $22,196,000 22,195<br />

OTHER ASSETS, less liabilities: (0.03%) ............ (6)<br />

TOTAL NET ASSETS: 100.00% ................... $22,189<br />

Bond Ratings*<br />

2012 2011<br />

%of<br />

Net Assets<br />

%of<br />

Net Assets<br />

AAA .................................. 78.53 56.20<br />

AA ................................... — 21.68<br />

A..................................... 7.87 12.99<br />

* Excluding cash and overnight term deposits.<br />

Source: Standard & Poor’s, and/or composite of Moody’s, Standard & Poor’s and<br />

Fitch ratings.<br />

Franklin <strong>Templeton</strong> Investments Funds 203