printmgr file - Templeton

printmgr file - Templeton

printmgr file - Templeton

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

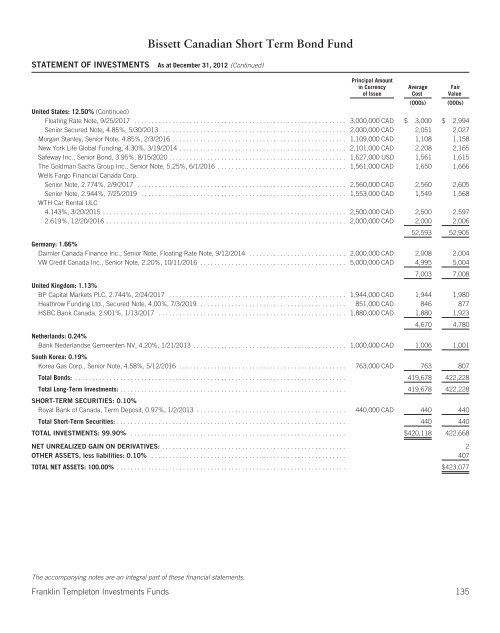

Bissett Canadian Short Term Bond Fund<br />

STATEMENT OF INVESTMENTS As at December 31, 2012 (Continued)<br />

Principal Amount<br />

in Currency<br />

of Issue<br />

(000s) (000s)<br />

United States: 12.50% (Continued)<br />

Floating Rate Note, 9/25/2017 ............................................................. 3,000,000 CAD $ 3,000 $ 2,994<br />

Senior Secured Note, 4.85%, 5/30/2013 ..................................................... 2,000,000 CAD 2,051 2,027<br />

Morgan Stanley, Senior Note, 4.85%, 2/3/2016 .................................................. 1,109,000 CAD 1,108 1,158<br />

New York Life Global Funding, 4.30%, 3/19/2014 ................................................ 2,101,000 CAD 2,208 2,165<br />

Safeway Inc., Senior Bond, 3.95%, 8/15/2020 ................................................... 1,627,000 USD 1,561 1,615<br />

The Goldman Sachs Group Inc., Senior Note, 5.25%, 6/1/2016 .....................................<br />

Wells Fargo Financial Canada Corp.<br />

1,561,000 CAD 1,650 1,666<br />

Senior Note, 2.774%, 2/9/2017 ............................................................ 2,560,000 CAD 2,560 2,605<br />

Senior Note, 2.944%, 7/25/2019 ...........................................................<br />

WTH Car Rental ULC<br />

1,553,000 CAD 1,549 1,568<br />

4.143%, 3/20/2015 ...................................................................... 2,500,000 CAD 2,500 2,597<br />

2.619%, 12/20/2016 ..................................................................... 2,000,000 CAD 2,000 2,006<br />

Average<br />

Cost<br />

Fair<br />

Value<br />

52,593 52,905<br />

Germany: 1.66%<br />

Daimler Canada Finance Inc., Senior Note, Floating Rate Note, 9/12/2014 ............................ 2,000,000 CAD 2,008 2,004<br />

VW Credit Canada Inc., Senior Note, 2.20%, 10/11/2016 .......................................... 5,000,000 CAD 4,995 5,004<br />

7,003 7,008<br />

United Kingdom: 1.13%<br />

BP Capital Markets PLC, 2.744%, 2/24/2017 ................................................... 1,944,000 CAD 1,944 1,980<br />

Heathrow Funding Ltd., Secured Note, 4.00%, 7/3/2019 .......................................... 851,000 CAD 846 877<br />

HSBC Bank Canada, 2.901%, 1/13/2017 ...................................................... 1,880,000 CAD 1,880 1,923<br />

4,670 4,780<br />

Netherlands: 0.24%<br />

Bank Nederlandse Gemeenten NV, 4.20%, 1/21/2013 ............................................ 1,000,000 CAD 1,006 1,001<br />

South Korea: 0.19%<br />

Korea Gas Corp., Senior Note, 4.58%, 5/12/2016 ................................................ 763,000 CAD 763 807<br />

Total Bonds: .............................................................................. 419,678 422,228<br />

Total Long-Term Investments: ................................................................. 419,678 422,228<br />

SHORT-TERM SECURITIES: 0.10%<br />

Royal Bank of Canada, Term Deposit, 0.97%, 1/2/2013 ........................................... 440,000 CAD 440 440<br />

Total Short-Term Securities: .................................................................. 440 440<br />

TOTAL INVESTMENTS: 99.90% .............................................................. $420,118 422,668<br />

NET UNREALIZED GAIN ON DERIVATIVES: ..................................................... 2<br />

OTHER ASSETS, less liabilities: 0.10% ........................................................ 407<br />

TOTAL NET ASSETS: 100.00% .................................................................. $423,077<br />

The accompanying notes are an integral part of these financial statements.<br />

Franklin <strong>Templeton</strong> Investments Funds 135