Internal War Loans Belligerent Countries

Internal War Loans Belligerent Countries

Internal War Loans Belligerent Countries

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

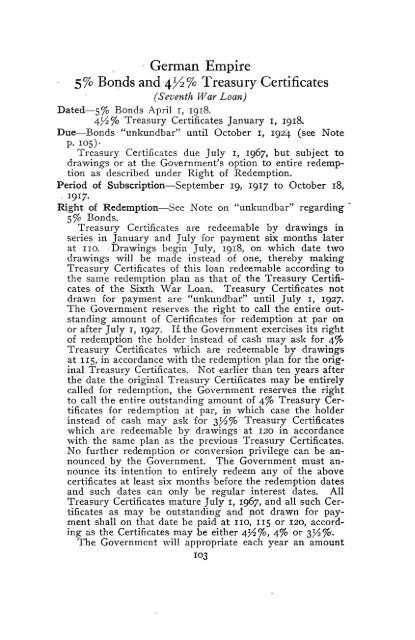

German Empire<br />

5% Bonds and 4^% Treasury Certificates<br />

(Seventh <strong>War</strong> Loan)<br />

Dated—5% Bonds April 1, 1918,<br />

4Y2% Treasury Certificates January 1, 1918.<br />

Due—Bonds "unkundbar" until October 1, 1924 (see Note<br />

P- IO 5)-<br />

Treasury Certificates due July 1, 1967, but subject to<br />

drawings or at the Government's option to entire redemption<br />

as described under Right of Redemption.<br />

Period of Subscription—September 19, 1917 to October 18,<br />

1917.<br />

Right of Redemption—See Note on "unkundbar" regarding<br />

5% Bonds.<br />

Treasury Certificates are redeemable by drawings in<br />

series in January and July for payment six months later<br />

at no. Drawings begin July, 1918, on which date two<br />

drawings will be made instead of one, thereby making<br />

Treasury Certificates of this loan redeemable according to<br />

the same redemption plan as that of the Treasury Certificates<br />

of the Sixth <strong>War</strong> Loan. Treasury Certificates not<br />

drawn for payment are "unkundbar" until July 1, 1927.<br />

The Government reserves the right to call the entire outstanding<br />

amount of Certificates for redemption at par on<br />

or after July 1, 1927. If the Government exercises its right<br />

of redemption the holder instead of cash may ask for 4%<br />

Treasury Certificates which are redeemable by drawings<br />

at 115, in accordance with the redemption plan for the original<br />

Treasury Certificates. Not earlier than ten years after<br />

the date the original Treasury Certificates may be entirely<br />

called for redemption, the Government reserves the right<br />

to call the entire outstanding amount of 4% Treasury Certificates<br />

for redemption at par, in which case the holder<br />

instead of cash may ask for 3j4% Treasury Certificates<br />

which are redeemable by drawings at 120 in accordance<br />

with the same plan as the previous Treasury Certificates.<br />

No further redemption or conversion privilege can be announced<br />

by the Government. The Government must announce<br />

its intention to entirely redeem any of the above<br />

certificates at least six months before the redemption dates<br />

and such dates can only be regular interest dates. All<br />

Treasury Certificates mature July I, 1967, and all such Certificates<br />

as may be outstanding and not drawn for payment<br />

shall on that date be paid at no, 115 or 120, according<br />

as the Certificates may be either 4^/2%, 4% or 3^%'.<br />

The Government will appropriate each year an amount<br />

103