Internal War Loans Belligerent Countries

Internal War Loans Belligerent Countries

Internal War Loans Belligerent Countries

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

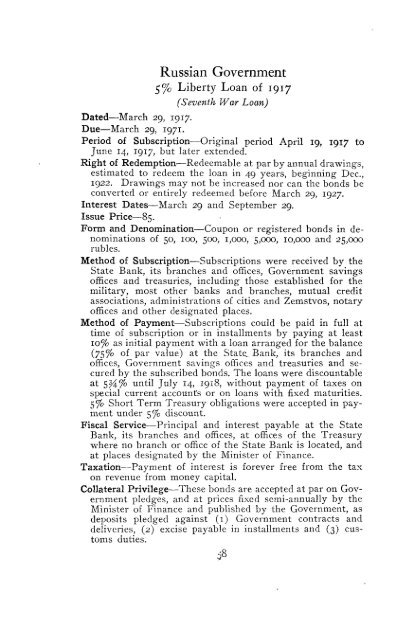

Russian Government<br />

5% Liberty Loan of 1917<br />

(Seventh <strong>War</strong> Loan)<br />

Dated—March 29, 1917.<br />

Due—March 29, 1971.<br />

Period of Subscription—Original period April 19, 1917 to<br />

June 14, 1917, but later extended.<br />

Right of Redemption—Redeemable at par by annual drawings,<br />

estimated to redeem the loan in 49 years, beginning Dec.,<br />

1922. Drawings may not be increased nor can the bonds be<br />

converted or entirely redeemed before March 29, 1927.<br />

Interest Dates—March 29 and September 29.<br />

Issue Price—85.<br />

Form and Denomination—Coupon or registered bonds in denominations<br />

of 50, 100, 500, 1,000, 5,000, 10,000 and 25,000<br />

rubles.<br />

Method of Subscription—Subscriptions were received by the<br />

State Bank, its branches and offices, Government savings<br />

offices and treasuries, including those established for the<br />

military, most other banks and branches, mutual credit<br />

associations, administrations of cities and Zemstvos, notary<br />

offices and other designated places.<br />

Method of Payment—Subscriptions could be paid in full at<br />

time of subscription or in installments by paying at least<br />

10% as initial payment with a loan arranged for the balance<br />

(75% OI P ar value) at the State_ Bank, its branches and<br />

offices, Government savings offices and treasuries and secured<br />

by the subscribed bonds. The loans were discountable<br />

at sH% until July 14, 1918, without payment of taxes on<br />

special current accounts or on loans with fixed maturities.<br />

5% Short Term Treasury obligations were accepted in payment<br />

under 5% discount.<br />

Fiscal Service—Principal and interest payable at the State<br />

Bank, its branches and offices, at offices of the Treasury<br />

where no branch or office of the State Bank is located, and<br />

at places designated by the Minister of Finance.<br />

Taxation—Payment of interest is forever free from the tax<br />

on revenue from money capital.<br />

Collateral Privilege—These bonds are accepted at par on Government<br />

pledges, and at prices fixed semi-annually by the<br />

Minister of Finance and published by the Government, as<br />

deposits pledged against (1) Government contracts and<br />

deliveries, (2) excise payable in installments and (3) customs<br />

duties.<br />

$