Internal War Loans Belligerent Countries

Internal War Loans Belligerent Countries

Internal War Loans Belligerent Countries

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

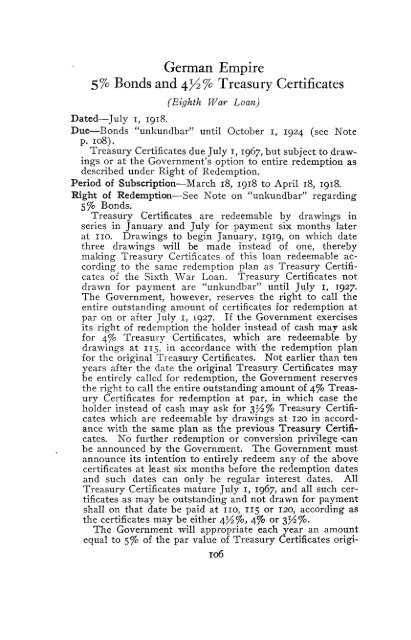

German Empire<br />

5% Bonds and 4^2% Treasury Certificates<br />

(Eighth <strong>War</strong> Loan)<br />

Dated—July i, 1918.<br />

Due—Bonds "unkundbar" until October 1, 1924 (see Note<br />

p. 108).<br />

Treasury Certificates due July 1, 1967, but subject to drawings<br />

or at the Government's option to entire redemption as<br />

described under Right of Redemption.<br />

Period of Subscription—March 18, 1918 to April 18, 1918.<br />

Right of Redemption—See Note on "unkundbar" regarding<br />

5% Bonds.<br />

Treasury Certificates are redeemable by drawings in<br />

series in January and July for payment six months later<br />

at no. Drawings to begin January, 1919, on which date<br />

three drawings will be made instead of one, thereby<br />

making Treasury Certificates of this loan redeemable according<br />

to the same redemption plan as Treasury Certificates<br />

of the Sixth <strong>War</strong> Loan. Treasury Certificates not<br />

drawn for payment are "unkundbar" until July 1, 1927.<br />

The Government, however, reserves the right to call the<br />

entire outstanding amount of certificates for redemption at<br />

par on or after July 1, 1927. If the Government exercises<br />

its right of redemption the holder instead of cash may ask<br />

for 4% Treasury Certificates, which are redeemable by<br />

drawings at 115, in accordance with' the redemption plan<br />

for the original Treasury Certificates. Not earlier than ten<br />

years after the date the original Treasury Certificates may<br />

be entirely called for redemption, the Government reserves<br />

the right to call the entire outstanding amount of 4% Treasury<br />

Certificates for redemption at par, in which case the<br />

holder instead of cash may ask for 3/4% Treasury Certificates<br />

which are redeemable by drawings at 120 in accordance<br />

with the same plan as the previous Treasury Certificates.<br />

No further redemption or conversion privilege -can<br />

be announced by the Government. The Government must<br />

announce its intention to entirely redeem any of the above<br />

certificates at least six months before the redemption dates<br />

and such dates can only be regular interest dates. All<br />

Treasury Certificates mature July I, 1967, and all such certificates<br />

as may be outstanding and not drawn for payment<br />

shall on that date be paid at no, 115 or 120, according as<br />

the certificates may be either 4 1 /i c fo, 4% or 3j4%.<br />

The Government will appropriate each year an amount<br />

equal to $% of the par value of Treasury Certificates origi-<br />

106