Internal War Loans Belligerent Countries

Internal War Loans Belligerent Countries

Internal War Loans Belligerent Countries

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

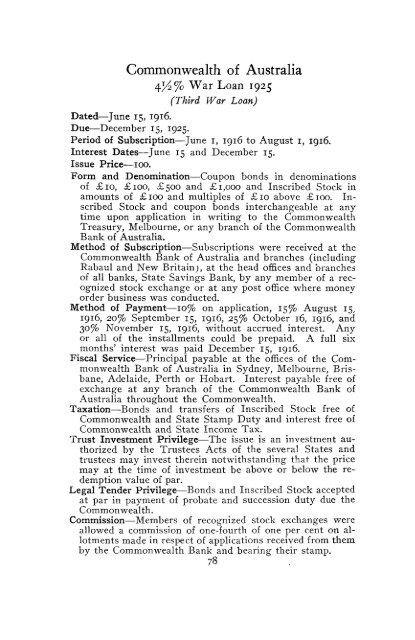

Commonwealth of Australia<br />

4^2% <strong>War</strong> Loan 1925<br />

(Third <strong>War</strong> Loan)<br />

Dated—June 15, 1916.<br />

Due—December 15, 1925.<br />

Period of Subscription—June 1, 1916 to August 1, 1916.<br />

Interest Dates—June 15 and December 15.<br />

Issue Price—100.<br />

Form and Denomination—Coupon bonds in denominations<br />

of £10, £100, £500 and £1,000 and Inscribed Stock in<br />

amounts of £100 and multiples of £10 above £100. Inscribed<br />

Stock and coupon bonds interchangeable at anytime<br />

upon application in writing to the Commonwealth<br />

Treasury, Melbourne, or any branch of the Commonwealth<br />

Bank of Australia.<br />

Method of Subscription—Subscriptions were received at the<br />

Commonwealth Bank of Australia and branches (including<br />

Rabaul and New Britain;, at the head offices and branches<br />

of all banks, State Savings Bank, by any member of a recognized<br />

stock exchange or at any post office where money<br />

order business was conducted.<br />

Method of Payment—10% on application, 15% August 15,<br />

1916, 20% September 15, 1916, 25% October 16, 1916, and<br />

30% November 15, 1916, without accrued interest. Any<br />

or all of the installments could be prepaid. A full six<br />

months' interest was paid December 15, 1916.<br />

Fiscal Service—Principal payable at the offices of the Commonwealth<br />

Bank of Australia in Sydney, Melbourne, Brisbane,<br />

Adelaide, Perth or Hobart. Interest payable free of<br />

exchange at any branch of the Commonwealth Bank of<br />

Australia throughout the Commonwealth.<br />

Taxation—Bonds and transfers of Inscribed Stock free of<br />

Commonwealth and State Stamp Duty and interest free of<br />

Commonwealth and State Income Tax.<br />

Trust Investment Privilege—The issue is an investment authorized<br />

by the Trustees Acts of the several States and<br />

trustees may invest therein notwithstanding that the price<br />

may at the time of investment be above or below the redemption<br />

value of par.<br />

Legal Tender Privilege—Bonds and Inscribed Stock accepted<br />

at par in payment of probate and succession duty due the<br />

Commonwealth.<br />

Commission—Members of recognized stock exchanges were<br />

allowed a commission of one-fourth of one per cent on allotments<br />

made in respect of applications received from them<br />

by the Commonwealth Bank and bearing their stamp.<br />

78