Internal War Loans Belligerent Countries

Internal War Loans Belligerent Countries

Internal War Loans Belligerent Countries

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

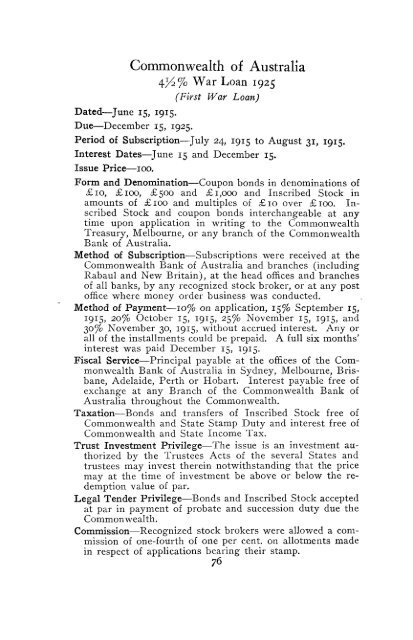

Commonwealth of Australia<br />

4>4% <strong>War</strong> Loan 1925<br />

(First <strong>War</strong> Loan)<br />

Dated—June 15, 1915.<br />

Due—December 15, 1925.<br />

Period of Subscription—July 24, 1915 to August 31, 1915.<br />

Interest Dates—June 15 and December 15.<br />

Issue Price—100.<br />

Form and Denomination—Coupon bonds in denominations of<br />

£10, £100, £500 and £1,000 and Inscribed Stock in<br />

amounts of £100 and multiples of £10 over £100. Inscribed<br />

Stock and coupon bonds interchangeable at anytime<br />

upon application in writing to the Commonwealth<br />

Treasury, Melbourne, or any branch of the Commonwealth<br />

Bank of Australia.<br />

Method of Subscription—Subscriptions were received at the<br />

Commonwealth Bank of Australia and branches (including<br />

Rabaul and New Britain), at the head offices and branches<br />

of all banks, by any recognized stock broker, or at any post<br />

office where money order business was conducted.<br />

Method of Payment—10% on application, 15% September 15,<br />

1915, 20% October 15, 1915, 25% November 15, 1915, and<br />

30% November 30, 1915, without accrued interest. Any or<br />

all of the installments could be prepaid. A full six months'<br />

interest was paid December 15, 1915.<br />

Fiscal Service—Principal payable at the offices of the Commonwealth<br />

Bank of Australia in Sydney, Melbourne, Brisbane,<br />

Adelaide, Perth or Hobart. Interest payable free of<br />

exchange at any Branch of the Commonwealth Bank of<br />

Australia throughout the Commonwealth.<br />

Taxation—Bonds and transfers of Inscribed Stock free of<br />

Commonwealth and State Stamp Duty and interest free of<br />

Commonwealth and State Income Tax.<br />

Trust Investment Privilege—The issue is an investment authorized<br />

by the Trustees Acts of the several States and<br />

trustees may invest therein notwithstanding that the price<br />

may at the time of investment be above or below the redemption<br />

value of par.<br />

Legal Tender Privilege—Bonds and Inscribed Stock accepted<br />

at par in payment of probate and succession duty due the<br />

Commonwealth.<br />

Commission—Recognized stock brokers were allowed a commission<br />

of one-fourth of one per cent, on allotments made<br />

in respect of applications bearing their stamp.<br />

76