To e Cai ni Legislatu Regula S in 2009-10 - Streetsblog San Francisco

To e Cai ni Legislatu Regula S in 2009-10 - Streetsblog San Francisco

To e Cai ni Legislatu Regula S in 2009-10 - Streetsblog San Francisco

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

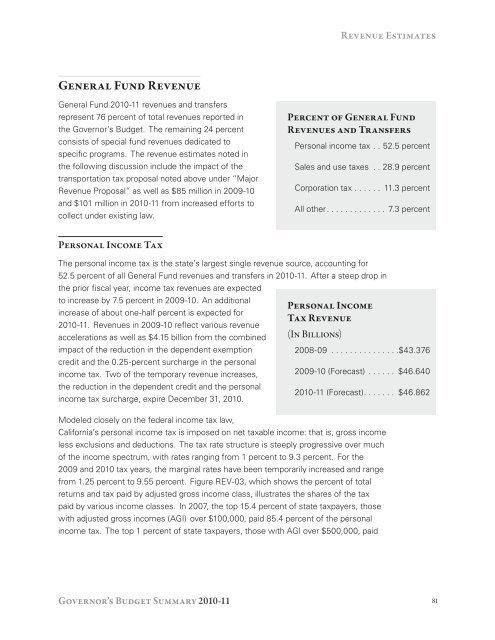

General Fund Revenue<br />

General Fund 20<strong>10</strong>-11 revenues and transfers<br />

represent 76 percent of total revenues reported <strong>in</strong><br />

the Governor’s Budget. The remai<strong>ni</strong>ng 24 percent<br />

consists of special fund revenues dedicated to<br />

specific programs. The revenue estimates noted <strong>in</strong><br />

the follow<strong>in</strong>g discussion <strong>in</strong>clude the impact of the<br />

transportation tax proposal noted above under “Major<br />

Revenue Proposal” as well as $85 million <strong>in</strong> <strong>2009</strong>-<strong>10</strong><br />

and $<strong>10</strong>1 million <strong>in</strong> 20<strong>10</strong>-11 from <strong>in</strong>creased efforts to<br />

collect under exist<strong>in</strong>g law.<br />

Personal Income Tax<br />

The personal <strong>in</strong>come tax is the state’s largest s<strong>in</strong>gle revenue source, account<strong>in</strong>g for<br />

52.5 percent of all General Fund revenues and transfers <strong>in</strong> 20<strong>10</strong>-11. After a steep drop <strong>in</strong><br />

the prior fiscal year, <strong>in</strong>come tax revenues are expected<br />

to <strong>in</strong>crease by 7.5 percent <strong>in</strong> <strong>2009</strong>-<strong>10</strong>. An additional<br />

<strong>in</strong>crease of about one-half percent is expected for<br />

20<strong>10</strong>-11. Revenues <strong>in</strong> <strong>2009</strong>-<strong>10</strong> reflect various revenue<br />

accelerations as well as $4.15 billion from the comb<strong>in</strong>ed<br />

impact of the reduction <strong>in</strong> the dependent exemption<br />

credit and the 0.25-percent surcharge <strong>in</strong> the personal<br />

<strong>in</strong>come tax. Two of the temporary revenue <strong>in</strong>creases,<br />

the reduction <strong>in</strong> the dependent credit and the personal<br />

<strong>in</strong>come tax surcharge, expire December 31, 20<strong>10</strong>.<br />

Modeled closely on the federal <strong>in</strong>come tax law,<br />

Governor’s Budget Summary 20<strong>10</strong>-11<br />

Revenue Estimates<br />

Percent of General Fund<br />

Revenues and Transfers<br />

Personal <strong>in</strong>come tax . . 52.5 percent<br />

Sales and use taxes . . 28.9 percent<br />

Corporation tax . . . . . . 11.3 percent<br />

All other. ............ 7.3 percent<br />

Personal Income<br />

Tax Revenue<br />

(In Billions)<br />

2008-09 . . . . . . . . . . . . . . .$43.376<br />

<strong>2009</strong>-<strong>10</strong> (Forecast) . . . . . . $46.640<br />

20<strong>10</strong>-11 (Forecast). ...... $46.862<br />

Califor<strong>ni</strong>a’s personal <strong>in</strong>come tax is imposed on net taxable <strong>in</strong>come: that is, gross <strong>in</strong>come<br />

less exclusions and deductions. The tax rate structure is steeply progressive over much<br />

of the <strong>in</strong>come spectrum, with rates rang<strong>in</strong>g from 1 percent to 9.3 percent. For the<br />

<strong>2009</strong> and 20<strong>10</strong> tax years, the marg<strong>in</strong>al rates have been temporarily <strong>in</strong>creased and range<br />

from 1.25 percent to 9.55 percent. Figure REV-03, which shows the percent of total<br />

returns and tax paid by adjusted gross <strong>in</strong>come class, illustrates the shares of the tax<br />

paid by various <strong>in</strong>come classes. In 2007, the top 15.4 percent of state taxpayers, those<br />

with adjusted gross <strong>in</strong>comes (AGI) over $<strong>10</strong>0,000, paid 85.4 percent of the personal<br />

<strong>in</strong>come tax. The top 1 percent of state taxpayers, those with AGI over $500,000, paid<br />

81