To e Cai ni Legislatu Regula S in 2009-10 - Streetsblog San Francisco

To e Cai ni Legislatu Regula S in 2009-10 - Streetsblog San Francisco

To e Cai ni Legislatu Regula S in 2009-10 - Streetsblog San Francisco

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Corporation Tax<br />

Corporation tax revenues are expected to contribute 11.3 percent of all General Fund<br />

revenues and transfers <strong>in</strong> 20<strong>10</strong>-11. Corporation tax revenues are expected to drop<br />

about 1.4 percent from 2008-09 to <strong>2009</strong>-<strong>10</strong> but<br />

then recover <strong>in</strong> 20<strong>10</strong>-11. Revenues from this<br />

source are expected to grow by 6.9 percent for<br />

the budget year. Corporation tax revenues are<br />

driven by corporate profits, which generally track<br />

the overall bus<strong>in</strong>ess cycle. In the budget year,<br />

revenues will <strong>in</strong>crease as a result of higher penalties<br />

on large corporations that under-report <strong>in</strong>come<br />

and underpay taxes. Revenues will decrease as<br />

a result of the impacts of budget actions taken <strong>in</strong><br />

earlier years. These factors <strong>in</strong>clude an end to the temporary suspension of net operat<strong>in</strong>g<br />

Governor’s Budget Summary 20<strong>10</strong>-11<br />

Revenue Estimates<br />

loss claims, <strong>in</strong>creased ability to claim various credits among members of a u<strong>ni</strong>tary groups<br />

and adoption of s<strong>in</strong>gle sales factor <strong>in</strong>come apportionment.<br />

Corporation tax revenues are derived from the follow<strong>in</strong>g sources:<br />

•<br />

•<br />

•<br />

•<br />

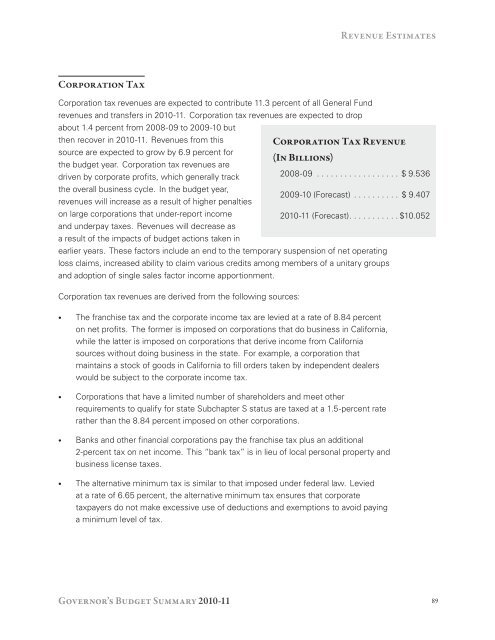

Corporation Tax Revenue<br />

(In Billions)<br />

2008-09 . . . . . . . . . . . . . . . . . . $ 9.536<br />

<strong>2009</strong>-<strong>10</strong> (Forecast) . . . . . . . . . . $ 9.407<br />

20<strong>10</strong>-11 (Forecast). ..........$<strong>10</strong>.052<br />

The franchise tax and the corporate <strong>in</strong>come tax are levied at a rate of 8.84 percent<br />

on net profits. The former is imposed on corporations that do bus<strong>in</strong>ess <strong>in</strong> Califor<strong>ni</strong>a,<br />

while the latter is imposed on corporations that derive <strong>in</strong>come from Califor<strong>ni</strong>a<br />

sources without do<strong>in</strong>g bus<strong>in</strong>ess <strong>in</strong> the state. For example, a corporation that<br />

ma<strong>in</strong>ta<strong>in</strong>s a stock of goods <strong>in</strong> Califor<strong>ni</strong>a to fill orders taken by <strong>in</strong>dependent dealers<br />

would be subject to the corporate <strong>in</strong>come tax.<br />

Corporations that have a limited number of shareholders and meet other<br />

requirements to qualify for state Subchapter S status are taxed at a 1.5-percent rate<br />

rather than the 8.84 percent imposed on other corporations.<br />

Banks and other f<strong>in</strong>ancial corporations pay the franchise tax plus an additional<br />

2-percent tax on net <strong>in</strong>come. This “bank tax” is <strong>in</strong> lieu of local personal property and<br />

bus<strong>in</strong>ess license taxes.<br />

The alternative mi<strong>ni</strong>mum tax is similar to that imposed under federal law. Levied<br />

at a rate of 6.65 percent, the alternative mi<strong>ni</strong>mum tax ensures that corporate<br />

taxpayers do not make excessive use of deductions and exemptions to avoid pay<strong>in</strong>g<br />

a mi<strong>ni</strong>mum level of tax.<br />

89