2006 Annual Report

2006 Annual Report

2006 Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

production, our synthetic fuel production facilities will not be<br />

able to generate credits in future years. As a result, our future<br />

effective tax rate is likely to increase significantly, thereby<br />

reducing our after-tax profits.<br />

DISCONTINUED OPERATIONS<br />

Distribution Services<br />

In 2005 and 2004, we had income, net of tax of $1 million and<br />

$2 million, respectively, associated with the distribution services<br />

business that we exited in 2002.<br />

LIQUIDITY AND CAPITAL RESOURCES<br />

Cash Requirements and Our Credit Facilities<br />

We are party to a $2.0 billion multicurrency revolving credit agreement<br />

that supports our commercial paper program and letters of<br />

credit. Effective June 6, <strong>2006</strong>, we executed an amendment extending<br />

the maturity date for $1.955 billion of commitments under<br />

this agreement by one year to June 6, 2011.The remaining $45 million<br />

commitment still matures on June 6, 2010. Borrowings under<br />

this facility bear interest at the London Interbank Offered Rate<br />

plus a spread based on our public debt rating. Additionally, we<br />

pay annual fees on the facility at a rate also based on our public<br />

debt rating. We do not anticipate that fluctuations in the availability<br />

of the commercial paper market will affect our liquidity<br />

because of the flexibility provided by our credit facility. We classify<br />

commercial paper as long-term debt based on our ability and<br />

intent to refinance it on a long-term basis.<br />

At year-end <strong>2006</strong> our available borrowing capacity amounted<br />

to $1.770 billion and reflected borrowing capacity at $2.0 billion<br />

under the credit facility plus our cash balance of $193 million<br />

less the letters of credit outstanding under the facility of $108 million<br />

and $315 million of outstanding commercial paper supported<br />

by the facility. We consider these resources, together with<br />

cash we expect to generate from operations, adequate to meet<br />

our short-term and long-term liquidity requirements, finance our<br />

long-term growth plans, meet debt service and fulfill other cash<br />

requirements. We periodically evaluate opportunities to sell<br />

additional debt or equity securities, obtain credit facilities from<br />

lenders or repurchase, refinance, or otherwise restructure our<br />

long-term debt for strategic reasons or to further strengthen our<br />

financial position.<br />

We issue short-term commercial paper in Europe and in the<br />

United States. Our commercial paper issuances are subject to<br />

the availability of the commercial paper in each of these markets,<br />

as we have no commitments from buyers to purchase our<br />

commercial paper. We reserve unused capacity under our credit<br />

facility to repay outstanding commercial paper borrowings in<br />

the event that the commercial paper market is not available to<br />

us for any reason when outstanding borrowings mature.<br />

We monitor the status of the capital markets and regularly<br />

evaluate the effect that changes in capital market conditions<br />

may have on our ability to execute our announced growth plans.<br />

We expect that part of our financing and liquidity needs will<br />

continue to be met through commercial paper borrowings and<br />

access to long-term committed credit facilities. If conditions in<br />

the lodging industry deteriorate, or if disruptions in the commercial<br />

paper market take place as they did in the immediate<br />

aftermath of September 11, 2001, we may be unable to place<br />

some or all of our commercial paper on a temporary or<br />

extended basis, and may have to rely more on borrowings under<br />

the credit facility, which may carry a higher cost than commercial<br />

paper.<br />

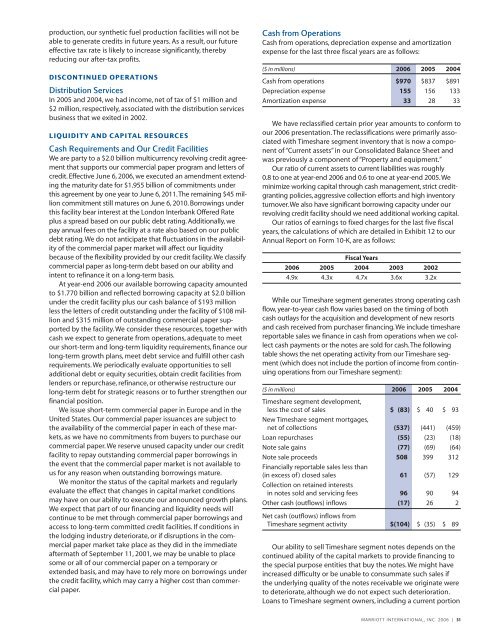

Cash from Operations<br />

Cash from operations, depreciation expense and amortization<br />

expense for the last three fiscal years are as follows:<br />

($ in millions) <strong>2006</strong> 2005 2004<br />

Cash from operations $970 $837 $891<br />

Depreciation expense 155 156 133<br />

Amortization expense 33 28 33<br />

We have reclassified certain prior year amounts to conform to<br />

our <strong>2006</strong> presentation. The reclassifications were primarily associated<br />

with Timeshare segment inventory that is now a component<br />

of “Current assets” in our Consolidated Balance Sheet and<br />

was previously a component of “Property and equipment.”<br />

Our ratio of current assets to current liabilities was roughly<br />

0.8 to one at year-end <strong>2006</strong> and 0.6 to one at year-end 2005.We<br />

minimize working capital through cash management, strict creditgranting<br />

policies, aggressive collection efforts and high inventory<br />

turnover.We also have significant borrowing capacity under our<br />

revolving credit facility should we need additional working capital.<br />

Our ratios of earnings to fixed charges for the last five fiscal<br />

years, the calculations of which are detailed in Exhibit 12 to our<br />

<strong>Annual</strong> <strong>Report</strong> on Form 10-K, are as follows:<br />

<strong>2006</strong> 2005<br />

Fiscal Years<br />

2004 2003 2002<br />

4.9x 4.3x 4.7x 3.6x 3.2x<br />

While our Timeshare segment generates strong operating cash<br />

flow, year-to-year cash flow varies based on the timing of both<br />

cash outlays for the acquisition and development of new resorts<br />

and cash received from purchaser financing. We include timeshare<br />

reportable sales we finance in cash from operations when we collect<br />

cash payments or the notes are sold for cash.The following<br />

table shows the net operating activity from our Timeshare segment<br />

(which does not include the portion of income from continuing<br />

operations from our Timeshare segment):<br />

($ in millions) <strong>2006</strong> 2005 2004<br />

Timeshare segment development,<br />

less the cost of sales<br />

New Timeshare segment mortgages,<br />

$ (83) $ 40 $ 93<br />

net of collections (537) (441) (459)<br />

Loan repurchases (55) (23) (18)<br />

Note sale gains (77) (69) (64)<br />

Note sale proceeds<br />

Financially reportable sales less than<br />

508 399 312<br />

(in excess of ) closed sales<br />

Collection on retained interests<br />

61 (57) 129<br />

in notes sold and servicing fees 96 90 94<br />

Other cash (outflows) inflows<br />

Net cash (outflows) inflows from<br />

(17) 26 2<br />

Timeshare segment activity $(104) $ (35) $ 89<br />

Our ability to sell Timeshare segment notes depends on the<br />

continued ability of the capital markets to provide financing to<br />

the special purpose entities that buy the notes. We might have<br />

increased difficulty or be unable to consummate such sales if<br />

the underlying quality of the notes receivable we originate were<br />

to deteriorate, although we do not expect such deterioration.<br />

Loans to Timeshare segment owners, including a current portion<br />

MARRIOTT INTERNATIONAL, INC. <strong>2006</strong> | 31