2006 Annual Report

2006 Annual Report

2006 Annual Report

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3 Luxury Lodging, which includes The Ritz-Carlton and<br />

Bulgari Hotels & Resorts brands worldwide;<br />

3 Timeshare, which includes the development, marketing,<br />

operation and sale of timeshare, fractional and whole<br />

ownership properties under the Marriott Vacation Club,<br />

The Ritz-Carlton Club, Grand Residences by Marriott and<br />

Horizons by Marriott Vacation Club brands worldwide; and<br />

3 Synthetic Fuel, which includes our interest in the operation<br />

of coal-based synthetic fuel production facilities.<br />

In addition to the segments above, in 2002 we announced<br />

our intent to sell, and subsequently did sell, our Senior Living<br />

Services business segment and exited our Distribution Services<br />

business segment.<br />

In <strong>2006</strong>, the company analyzed its internal reporting process<br />

and implemented changes in the fourth quarter that were<br />

designed to improve efficiency. As part of this process, we evaluated<br />

the impact on segment reporting and made certain<br />

changes that were in accordance with U.S. generally accepted<br />

accounting principles. These reporting changes are in conformity<br />

with the requirements of FAS No. 131,“Disclosures about<br />

Segments of an Enterprise and Related Information,” and will<br />

better enable investors to view the Company the way management<br />

views it. Accordingly, we now report six operating segments<br />

as compared to five before the change and indirect<br />

administrative expenses are no longer allocated to our segments.<br />

Senior management now allocates resources and<br />

assesses performance based on the six operating segments. The<br />

revised segment reporting is reflected throughout this report for<br />

all periods presented. Historical figures are presented in a manner<br />

that is consistent with the revised segment reporting.<br />

We evaluate the performance of our segments based primarily<br />

on the results of the segment without allocating corporate<br />

expenses, interest expense or indirect general, administrative<br />

and other expenses. With the exception of the Synthetic Fuel<br />

segment, we do not allocate income taxes or interest income to<br />

our segments. As note sales are an integral part of the Timeshare<br />

segment, we include note sale gains in our Timeshare segment<br />

results, and we allocate other gains and losses as well as equity<br />

earnings or losses from our joint ventures and divisional general,<br />

administrative and other expenses to each of our segments.<br />

“Other unallocated corporate” represents that portion of our revenues,<br />

general, administrative and other expenses, equity in<br />

earnings or losses, and other gains or losses that are not allocable<br />

to our segments.<br />

We have aggregated the brands presented within our<br />

North American Full-Service, North American Limited-Service,<br />

International and Luxury segments considering their similar economic<br />

characteristics, types of customers, distribution channels,<br />

the regulatory business environment of the brands and operations<br />

within each segment and our organizational structure and<br />

management reporting structure.<br />

60 | MARRIOTT INTERNATIONAL, INC. <strong>2006</strong><br />

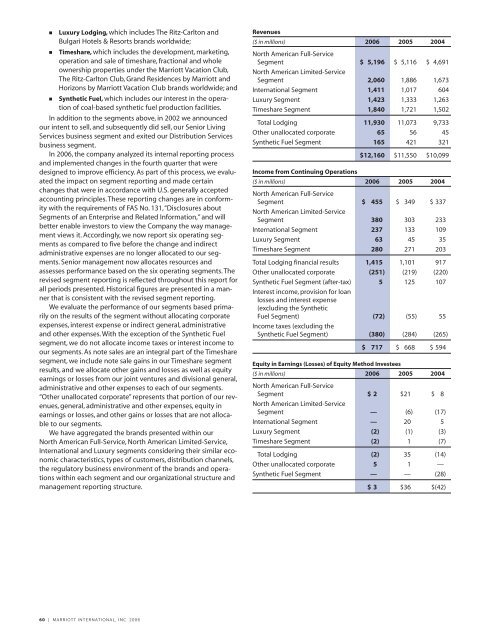

Revenues<br />

($ in millions) <strong>2006</strong> 2005 2004<br />

North American Full-Service<br />

Segment<br />

North American Limited-Service<br />

$ 5,196 $ 5,116 $ 4,691<br />

Segment 2,060 1,886 1,673<br />

International Segment 1,411 1,017 604<br />

Luxury Segment 1,423 1,333 1,263<br />

Timeshare Segment 1,840 1,721 1,502<br />

Total Lodging 11,930 11,073 9,733<br />

Other unallocated corporate 65 56 45<br />

Synthetic Fuel Segment 165 421 321<br />

Income from Continuing Operations<br />

$12,160 $11,550 $10,099<br />

($ in millions) <strong>2006</strong> 2005 2004<br />

North American Full-Service<br />

Segment<br />

North American Limited-Service<br />

$ 455 $ 349 $ 337<br />

Segment 380 303 233<br />

International Segment 237 133 109<br />

Luxury Segment 63 45 35<br />

Timeshare Segment 280 271 203<br />

Total Lodging financial results 1,415 1,101 917<br />

Other unallocated corporate (251) (219) (220)<br />

Synthetic Fuel Segment (after-tax)<br />

Interest income, provision for loan<br />

losses and interest expense<br />

(excluding the Synthetic<br />

5 125 107<br />

Fuel Segment)<br />

Income taxes (excluding the<br />

(72) (55) 55<br />

Synthetic Fuel Segment) (380) (284) (265)<br />

Equity in Earnings (Losses) of Equity Method Investees<br />

$ 717 $ 668 $ 594<br />

($ in millions) <strong>2006</strong> 2005 2004<br />

North American Full-Service<br />

Segment<br />

North American Limited-Service<br />

$2 $21 $ 8<br />

Segment — (6) (17)<br />

International Segment — 20 5<br />

Luxury Segment (2) (1) (3)<br />

Timeshare Segment (2) 1 (7)<br />

Total Lodging (2) 35 (14)<br />

Other unallocated corporate 5 1 —<br />

Synthetic Fuel Segment — — (28)<br />

$3 $36 $(42)