2006 Annual Report

2006 Annual Report

2006 Annual Report

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Audit of Employee Stock Ownership Plan Transaction<br />

The IRS is currently auditing the Company’s federal tax returns<br />

for the 2000, 2001 and 2002 fiscal years. As part of that audit, the<br />

IRS is reviewing a leveraged employee stock ownership plan<br />

(“ESOP”) feature of the Company’s Employees’ Profit Sharing,<br />

Retirement and Savings Plan and Trust (the “Plan”) that was<br />

implemented in a transaction (the “ESOP Transaction”) on June<br />

13, 2000. Principal and interest on the debt related to the transaction<br />

was forgiven over a 26-month period as a mechanism for<br />

funding Company contributions of elective deferrals and matching<br />

contributions to the Plan. The Company claimed federal<br />

income tax deductions for the forgiven principal on the debt in<br />

the amount of $1 billion over that period, along with forgiven<br />

interest on the debt. The benefit related to the tax deductions<br />

was reflected in equity and did not flow through the provision<br />

for income taxes.<br />

Based on discussions with the IRS during the course of the<br />

audit, the IRS may seek to disallow some or all of the deductions<br />

related to the ESOP Transaction, and may seek to impose other<br />

taxes, penalties, and interest, including excise taxes for prohibited<br />

transactions under Section 4975 of the Internal Revenue<br />

Code of 1986, as amended. In a January 19, 2007, letter to the<br />

Company, the U.S. Department of Labor confirmed that it is<br />

reviewing the ESOP Transaction. The Company has retained<br />

counsel to assist with the audit process and to respond to any<br />

claims or assessments the IRS or Department of Labor issues.<br />

Although we are early in the process of closing this audit, we do<br />

not expect the result of the audit to have a material impact on<br />

either equity for any lost deductions or earnings for interest or<br />

penalties, if any, related to the ESOP Transaction.<br />

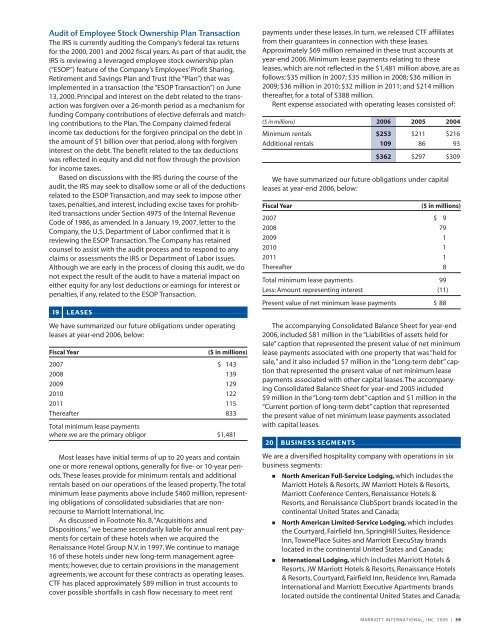

19 | LEASES<br />

We have summarized our future obligations under operating<br />

leases at year-end <strong>2006</strong>, below:<br />

Fiscal Year ($ in millions)<br />

2007 $ 143<br />

2008 139<br />

2009 129<br />

2010 122<br />

2011 115<br />

Thereafter<br />

Total minimum lease payments<br />

833<br />

where we are the primary obligor $1,481<br />

Most leases have initial terms of up to 20 years and contain<br />

one or more renewal options, generally for five- or 10-year periods.<br />

These leases provide for minimum rentals and additional<br />

rentals based on our operations of the leased property. The total<br />

minimum lease payments above include $460 million, representing<br />

obligations of consolidated subsidiaries that are nonrecourse<br />

to Marriott International, Inc.<br />

As discussed in Footnote No. 8,“Acquisitions and<br />

Dispositions,” we became secondarily liable for annual rent payments<br />

for certain of these hotels when we acquired the<br />

Renaissance Hotel Group N.V. in 1997. We continue to manage<br />

16 of these hotels under new long-term management agreements;<br />

however, due to certain provisions in the management<br />

agreements, we account for these contracts as operating leases.<br />

CTF has placed approximately $89 million in trust accounts to<br />

cover possible shortfalls in cash flow necessary to meet rent<br />

payments under these leases. In turn, we released CTF affiliates<br />

from their guarantees in connection with these leases.<br />

Approximately $69 million remained in these trust accounts at<br />

year-end <strong>2006</strong>. Minimum lease payments relating to these<br />

leases, which are not reflected in the $1,481 million above, are as<br />

follows: $35 million in 2007; $35 million in 2008; $36 million in<br />

2009; $36 million in 2010; $32 million in 2011; and $214 million<br />

thereafter, for a total of $388 million.<br />

Rent expense associated with operating leases consisted of:<br />

($ in millions) <strong>2006</strong> 2005 2004<br />

Minimum rentals $253 $211 $216<br />

Additional rentals 109 86 93<br />

$362 $297 $309<br />

We have summarized our future obligations under capital<br />

leases at year-end <strong>2006</strong>, below:<br />

Fiscal Year ($ in millions)<br />

2007 $ 9<br />

2008 79<br />

2009 1<br />

2010 1<br />

2011 1<br />

Thereafter 8<br />

Total minimum lease payments 99<br />

Less: Amount representing interest (11)<br />

Present value of net minimum lease payments $ 88<br />

The accompanying Consolidated Balance Sheet for year-end<br />

<strong>2006</strong>, included $81 million in the “Liabilities of assets held for<br />

sale” caption that represented the present value of net minimum<br />

lease payments associated with one property that was “held for<br />

sale,” and it also included $7 million in the “Long-term debt” caption<br />

that represented the present value of net minimum lease<br />

payments associated with other capital leases. The accompanying<br />

Consolidated Balance Sheet for year-end 2005 included<br />

$9 million in the “Long-term debt” caption and $1 million in the<br />

“Current portion of long-term debt” caption that represented<br />

the present value of net minimum lease payments associated<br />

with capital leases.<br />

20 | BUSINESS SEGMENTS<br />

We are a diversified hospitality company with operations in six<br />

business segments:<br />

3 North American Full-Service Lodging, which includes the<br />

Marriott Hotels & Resorts, JW Marriott Hotels & Resorts,<br />

Marriott Conference Centers, Renaissance Hotels &<br />

Resorts, and Renaissance ClubSport brands located in the<br />

continental United States and Canada;<br />

3 North American Limited-Service Lodging, which includes<br />

the Courtyard, Fairfield Inn, SpringHill Suites, Residence<br />

Inn, TownePlace Suites and Marriott ExecuStay brands<br />

located in the continental United States and Canada;<br />

3 International Lodging, which includes Marriott Hotels &<br />

Resorts, JW Marriott Hotels & Resorts, Renaissance Hotels<br />

& Resorts, Courtyard, Fairfield Inn, Residence Inn, Ramada<br />

International and Marriott Executive Apartments brands<br />

located outside the continental United States and Canada;<br />

MARRIOTT INTERNATIONAL, INC. <strong>2006</strong> | 59