Capital Budgeting Techniques: Certainty and Risk

Capital Budgeting Techniques: Certainty and Risk

Capital Budgeting Techniques: Certainty and Risk

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

PROBLEMS<br />

LG1<br />

LG1<br />

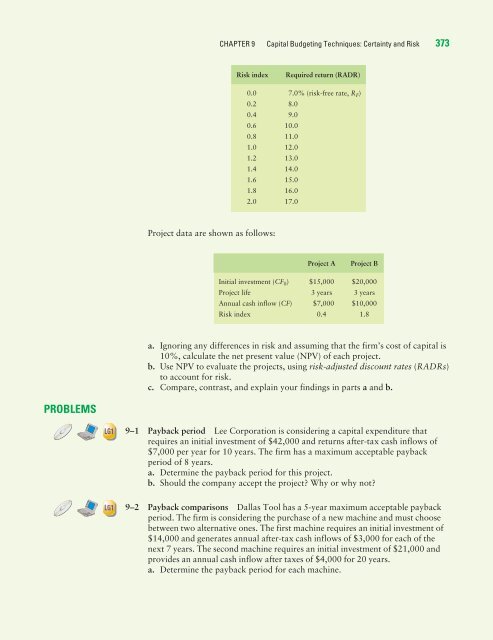

Project data are shown as follows:<br />

CHAPTER 9 <strong>Capital</strong> <strong>Budgeting</strong> <strong>Techniques</strong>: <strong>Certainty</strong> <strong>and</strong> <strong>Risk</strong> 373<br />

<strong>Risk</strong> index Required return (RADR)<br />

0.0 7.0% (risk-free rate, RF) 0.2 8.0<br />

0.4 9.0<br />

0.6 10.0<br />

0.8 11.0<br />

1.0 12.0<br />

1.2 13.0<br />

1.4 14.0<br />

1.6 15.0<br />

1.8 16.0<br />

2.0 17.0<br />

Project A Project B<br />

Initial investment (CF0) $15,000 $20,000<br />

Project life 3 years 3 years<br />

Annual cash inflow (CF) $7,000 $10,000<br />

<strong>Risk</strong> index 0.4 1.8<br />

a. Ignoring any differences in risk <strong>and</strong> assuming that the firm’s cost of capital is<br />

10%, calculate the net present value (NPV) of each project.<br />

b. Use NPV to evaluate the projects, using risk-adjusted discount rates (RADRs)<br />

to account for risk.<br />

c. Compare, contrast, <strong>and</strong> explain your findings in parts a <strong>and</strong> b.<br />

9–1 Payback period Lee Corporation is considering a capital expenditure that<br />

requires an initial investment of $42,000 <strong>and</strong> returns after-tax cash inflows of<br />

$7,000 per year for 10 years. The firm has a maximum acceptable payback<br />

period of 8 years.<br />

a. Determine the payback period for this project.<br />

b. Should the company accept the project? Why or why not?<br />

9–2 Payback comparisons Dallas Tool has a 5-year maximum acceptable payback<br />

period. The firm is considering the purchase of a new machine <strong>and</strong> must choose<br />

between two alternative ones. The first machine requires an initial investment of<br />

$14,000 <strong>and</strong> generates annual after-tax cash inflows of $3,000 for each of the<br />

next 7 years. The second machine requires an initial investment of $21,000 <strong>and</strong><br />

provides an annual cash inflow after taxes of $4,000 for 20 years.<br />

a. Determine the payback period for each machine.