(ip) hub master plan - Ministry of Law

(ip) hub master plan - Ministry of Law

(ip) hub master plan - Ministry of Law

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

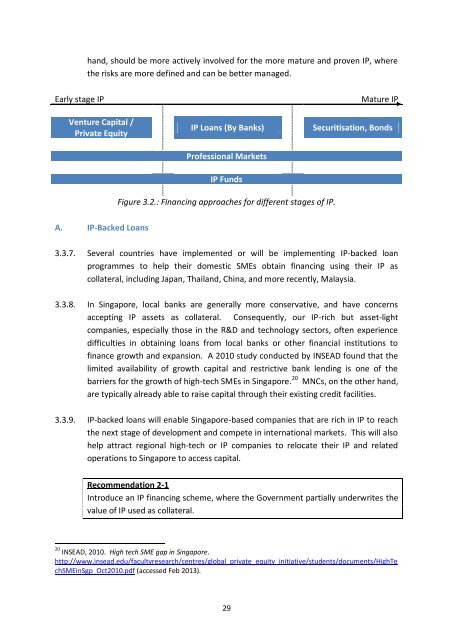

hand, should be more actively involved for the more mature and proven IP, where<br />

the risks are more defined and can be better managed.<br />

Early stage IP Mature IP<br />

Venture Capital /<br />

Private Equity<br />

A. IP-Backed Loans<br />

IP Loans (By Banks)<br />

Pr<strong>of</strong>essional Markets<br />

IP Funds<br />

Figure 3.2.: Financing approaches for different stages <strong>of</strong> IP.<br />

29<br />

Securitisation, Bonds<br />

3.3.7. Several countries have implemented or will be implementing IP-backed loan<br />

programmes to help their domestic SMEs obtain financing using their IP as<br />

collateral, including Japan, Thailand, China, and more recently, Malaysia.<br />

3.3.8. In Singapore, local banks are generally more conservative, and have concerns<br />

accepting IP assets as collateral. Consequently, our IP-rich but asset-light<br />

companies, especially those in the R&D and technology sectors, <strong>of</strong>ten experience<br />

difficulties in obtaining loans from local banks or other financial institutions to<br />

finance growth and expansion. A 2010 study conducted by INSEAD found that the<br />

limited availability <strong>of</strong> growth capital and restrictive bank lending is one <strong>of</strong> the<br />

barriers for the growth <strong>of</strong> high-tech SMEs in Singapore. 20 MNCs, on the other hand,<br />

are typically already able to raise capital through their existing credit facilities.<br />

3.3.9. IP-backed loans will enable Singapore-based companies that are rich in IP to reach<br />

the next stage <strong>of</strong> development and compete in international markets. This will also<br />

help attract regional high-tech or IP companies to relocate their IP and related<br />

operations to Singapore to access capital.<br />

Recommendation 2-1<br />

Introduce an IP financing scheme, where the Government partially underwrites the<br />

value <strong>of</strong> IP used as collateral.<br />

20 INSEAD, 2010. High tech SME gap in Singapore.<br />

http://www.insead.edu/facultyresearch/centres/global_private_equity_initiative/students/documents/HighTe<br />

chSMEinSgp_Oct2010.pdf (accessed Feb 2013).