Student Handbook - School of Business and Economics - Maastricht ...

Student Handbook - School of Business and Economics - Maastricht ...

Student Handbook - School of Business and Economics - Maastricht ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Student</strong> <strong>H<strong>and</strong>book</strong> • Practical Guide<br />

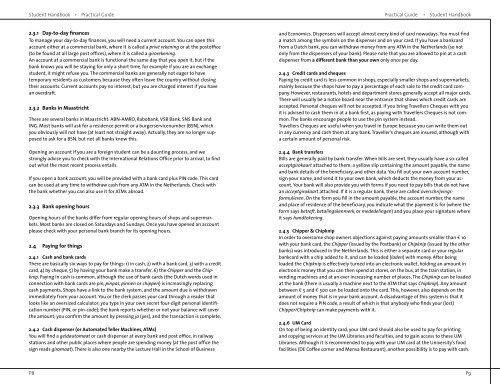

2.3.1 Day-to-day finances<br />

To manage your day-to-day finances, you will need a current account. You can open this<br />

account either at a commercial bank, where it is called a privé rekening or at the post<strong>of</strong>fice<br />

(to be found at all large post <strong>of</strong>fices), where it is called a girorekening.<br />

An account at a commercial bank is functional the same day that you open it, but if the<br />

bank knows you will be staying for only a short time, for example if you are an exchange<br />

student, it might refuse you. The commercial banks are generally not eager to have<br />

temporary residents as customers because they <strong>of</strong>ten leave the country without closing<br />

their accounts. Current accounts pay no interest, but you are charged interest if you have<br />

an overdraft.<br />

2.3.2 Banks in <strong>Maastricht</strong><br />

There are several banks in <strong>Maastricht</strong>: ABN-AMRO, Rabobank, VSB Bank, SNS Bank <strong>and</strong><br />

ING. Most banks will ask for a residence permit or a burgerservicenumber (BSN), which<br />

you obviously will not have (at least not straight away). Actually, they are no longer supposed<br />

to ask for a BSN, but not all banks know this.<br />

Opening an account if you are a foreign student can be a daunting process, <strong>and</strong> we<br />

strongly advise you to check with the International Relations Office prior to arrival, to find<br />

out what the most recent process entails.<br />

If you open a bank account, you will be provided with a bank card plus PIN code. This card<br />

can be used at any time to withdraw cash from any ATM in the Netherl<strong>and</strong>s. Check with<br />

the bank whether you can also use it for ATMs abroad.<br />

2.3.3 Bank opening hours<br />

Opening hours <strong>of</strong> the banks differ from regular opening hours <strong>of</strong> shops <strong>and</strong> supermarkets.<br />

Most banks are closed on Saturdays <strong>and</strong> Sundays. Once you have opened an account<br />

please check with your personal bank branch for its opening hours.<br />

2.4 Paying for things<br />

2.4.1 Cash <strong>and</strong> bank cards<br />

There are basically six ways to pay for things: 1) in cash, 2) with a bank card, 3) with a credit<br />

card, 4) by cheque, 5) by having your bank make a transfer, 6) the Chipper <strong>and</strong> the Chipknip.<br />

Paying in cash is common, although the use <strong>of</strong> bank cards (the Dutch words used in<br />

connection with bank cards are pin, pinpas, pinnen or chippen) is increasingly replacing<br />

cash payments. Shops have a link to the bank system, <strong>and</strong> the amount due is withdrawn<br />

immediately from your account. You or the clerk passes your card through a reader that<br />

looks like an oversized calculator; you type in your own secret four-digit personal identification<br />

number (PIN, or pin-code); the bank reports whether or not your balance will cover<br />

the amount; you confirm the amount by pressing ja (yes), <strong>and</strong> the transaction is complete.<br />

2.4.2 Cash dispenser (or Automated Teller Machines, ATMs)<br />

You will find a geldautomaat or cash dispenser at every bank <strong>and</strong> post <strong>of</strong>fice, in railway<br />

stations <strong>and</strong> other public places where people are spending money (at the post <strong>of</strong>fice the<br />

sign reads giromaat). There is also one nearby the Lecture Hall in the <strong>School</strong> <strong>of</strong> <strong>Business</strong><br />

Practical Guide • <strong>Student</strong> <strong>H<strong>and</strong>book</strong><br />

<strong>and</strong> <strong>Economics</strong>. Dispensers will accept almost every kind <strong>of</strong> card nowadays. You must find<br />

a match among the symbols on the dispenser <strong>and</strong> on your card. If you have a bankcard<br />

from a Dutch bank, you can withdraw money from any ATM in the Netherl<strong>and</strong>s (so not<br />

only from the dispensers <strong>of</strong> your bank). Please note that you are allowed to pin at a cash<br />

dispenser from a different bank than your own only once per day.<br />

2.4.3 Credit cards <strong>and</strong> cheques<br />

Paying by credit card is less common in shops, especially smaller shops <strong>and</strong> supermarkets,<br />

mainly because the shops have to pay a percentage <strong>of</strong> each sale to the credit card company.<br />

However, restaurants, hotels <strong>and</strong> department stores generally accept all major cards.<br />

There will usually be a notice board near the entrance that shows which credit cards are<br />

accepted. Personal cheques will not be accepted. If you bring Travellers Cheques with you<br />

it is advised to cash them in at a bank first, as paying with Travellers Cheques is not common.<br />

The banks encourage people to use the pin system instead.<br />

Travellers Cheques are useful when you travel in Europe because you can write them out<br />

in any currency <strong>and</strong> cash them at any bank. Traveller’s cheques are insured, although with<br />

a certain amount <strong>of</strong> personal risk.<br />

2.4.4 Bank transfers<br />

Bills are generally paid by bank transfer. When bills are sent, they usually have a so-called<br />

acceptgirokaart attached to them: a yellow slip containing the amount payable, the name<br />

<strong>and</strong> bank details <strong>of</strong> the beneficiary, <strong>and</strong> other data. You fill out your own account number,<br />

sign your name, <strong>and</strong> send it to your own bank, which deducts the money from your account.<br />

Your bank will also provide you with forms if you need to pay bills that do not have<br />

an acceptgirokaart attached. If it is a regular bank, these are called overschrijvings-<br />

formulieren. On the form you fill in the amount payable, the account number, the name<br />

<strong>and</strong> place <strong>of</strong> residence <strong>of</strong> the beneficiary, you indicate what the payment is for (where the<br />

form says betreft, betalingskenmerk, or mededelingen) <strong>and</strong> you place your signature where<br />

it says h<strong>and</strong>tekening.<br />

2.4.5 Chipper & Chipknip<br />

In order to overcome shop owners objections against paying amounts smaller than € 10<br />

with your bank card, the Chipper (issued by the Postbank) or Chipknip (issued by the other<br />

banks) was introduced in the Netherl<strong>and</strong>s. This is either a separate card or your regular<br />

bankcard with a chip added to it, <strong>and</strong> can be loaded (laden) with money. After being<br />

loaded the Chipknip is effectively turned into an electronic wallet, holding an amount in<br />

electronic money that you can then spend at stores, on the bus, at the train station, in<br />

vending machines <strong>and</strong> at an ever increasing number <strong>of</strong> places. The Chipknip can be loaded<br />

at the bank (there is usually a machine next to the ATM that says Chipknip). Any amount<br />

between € 5 <strong>and</strong> € 500 can be loaded onto the card. This, however, also depends on the<br />

amount <strong>of</strong> money that is in your bank account. A disadvantage <strong>of</strong> this system is that it<br />

does not require a PIN code, a result <strong>of</strong> which is that anybody who finds your (lost)<br />

Chipper/Chipknip can make payments with it.<br />

2.4.6 UM Card<br />

On top <strong>of</strong> being an identity card, your UM card should also be used to pay for printing<br />

<strong>and</strong> copying services at the UM Libraries <strong>and</strong> faculties, <strong>and</strong> to gain access to these UM<br />

Libraries. Although it is recommended to pay with your UM card at the University’s food<br />

facilities (DE C<strong>of</strong>fee corner <strong>and</strong> Mensa Restaurant), another possibility is to pay with cash.<br />

P8 P9